DEF 14A: Definitive proxy statements

Published on April 18, 2006

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT

PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the registrant [X]

Filed by a party other than the registrant [ ]

Check the appropriate box:

[ ] Preliminary proxy statement.

[ ] Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)).

[X] Definitive proxy statement.

[ ] Definitive additional materials.

[ ] Soliciting material under Rule 14a-12.

BARRETT BUSINESS SERVICES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of filing fee (check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

BARRETT BUSINESS SERVICES, INC.

April 18, 2006

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Barrett Business Services, Inc., to be held at 2:00 p.m., Pacific Time, on Thursday, May 18, 2006, at the Multnomah Athletic Club located at 1849 S.W. Salmon Street, Portland, Oregon 97207.

Matters to be presented for action at the meeting include the election of directors and such other business as may properly come before the meeting or any adjournment thereof.

We look forward to conversing with those of you who are able to attend the meeting in person. Whether or not you can attend, it is important that you sign, date, and return your proxy as soon as possible. If you do attend the meeting and wish to vote in person, you may withdraw your proxy and vote personally.

| Sincerely, | |

/s/ William W. Sherertz |

|

| William W. Sherertz President and Chief Executive Officer |

BARRETT BUSINESS SERVICES, INC.

_________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 18, 2006

_________________

You are invited to attend the annual meeting of stockholders of Barrett Business Services, Inc., to be held at the Multnomah Athletic Club located at 1849 S.W. Salmon Street, Portland, Oregon 97207, on Thursday, May 18, 2006, at 2:00 p.m., Pacific Time.

Only stockholders of record at the close of business on March 24, 2006, will be entitled to vote at the meeting.

The meeting is being held to consider and act upon the following matters:

1. Election of directors.

2. Such other business as may properly come before the meeting or any adjournments thereof.

Please sign and date the accompanying proxy, and return it promptly in the enclosed postage-paid envelope to avoid the expense of further solicitation. If you attend the meeting, you may withdraw your proxy and vote your shares in person.

| By Order of the Board of Directors | |

/s/ Michael D. Mulholland |

|

| Michael D. Mulholland Secretary |

Vancouver, Washington

April

18, 2006

BARRETT BUSINESS

SERVICES, INC.

8100 N.E. Parkway

Drive, Suite 200

Vancouver, Washington

98662

(360) 828-0700

_________________

PROXY STATEMENT

2006 ANNUAL MEETING OF

STOCKHOLDERS

_________________

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the Board) of Barrett Business Services, Inc. (the Company), to be voted at the annual meeting of stockholders to be held on May 18, 2006, and any adjournments thereof. The proxy statement and accompanying form of proxy were first mailed to stockholders on approximately April 18, 2006.

VOTING, REVOCATION, AND SOLICITATION OF PROXIES

When a proxy in the accompanying form is properly executed and returned, the shares represented will be voted at the meeting in accordance with the instructions specified in the spaces provided in the proxy. If no instructions are specified, the shares will be voted FOR Item 1 in the accompanying Notice of Annual Meeting of Stockholders.

Any proxy given pursuant to this solicitation may be revoked by the person giving the proxy at any time prior to its exercise by written notice to the Secretary of the Company of such revocation, by a later-dated proxy received by the Company, or by attending the meeting and voting in person. The mailing address of the Companys principal executive offices is 8100 N.E. Parkway Drive, Suite 200, Vancouver, Washington 98662.

The solicitation of proxies will be made primarily by mail, but proxies may also be solicited personally or by telephone or facsimile by directors and officers of the Company without additional compensation for such services. Brokers and other persons holding shares in their names, or in the names of nominees, will be reimbursed for their reasonable expenses in forwarding soliciting materials to their principals and in obtaining authorization for the execution of proxies. All costs of solicitation of proxies will be borne by the Company.

OUTSTANDING VOTING SECURITIES

The close of business on March 24, 2006, has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting. On the record date, the Company had outstanding 11,109,957 shares of Common Stock, $.01 par value (Common Stock), each share of which is entitled to one vote at the meeting. Common Stock is the only outstanding voting security of the Company. The presence, in person or by proxy, of stockholders entitled to cast a majority of all votes entitled to be cast at the meeting is required to constitute a quorum.

- 1 -

ITEM 1 ELECTION OF DIRECTORS

The directors of the Company are elected at the annual meeting of stockholders in May to serve until the next annual meeting and until their successors are elected and qualified. The Companys Bylaws authorize the Board to set the number of positions on the Board within a range of three and nine. Following the resignation of Nancy B. Sherertz as a director effective February 23, 2006, the Board reduced the number of positions to five. Vacancies on the Board, including vacancies resulting from an increase in the number of positions, may be filled by the Board for a term ending with the next annual meeting of stockholders.

All of the nominees for election as directors are members of the present Board.

A nominee will be elected if the nominee receives a plurality of the votes cast by the shares entitled to vote in the election, provided that a quorum is present at the meeting. A duly executed proxy will be voted FOR the election of the nominees named below, unless authority to vote for a director is withheld or a proxy of a broker or other nominee is expressly not voted on this item (a broker non-vote). Shares not voted for the election of directors, because authority to vote is withheld, or due to a broker non-vote or failure to return a proxy, will not count in determining the total number of votes for each nominee.

If for some unforeseen reason a nominee should become unavailable for election, the number of directors constituting the Board may be reduced prior to the annual meeting or the proxy may be voted for the election of such substitute nominee as may be designated by the Board.

The following table sets forth information with respect to each person nominated for election as a director, including their ages as of February 28, 2006, business experience during the past five years, and directorships in other corporations.

| Name | Principal Occupation(1) | Age | Director Since |

|---|---|---|---|

Thomas J. Carley |

Private investor |

47 |

2000 |

James B. Hicks, Ph.D. |

Director of the Women's Cancer Genomics Initiative at Cold Spring Harbor Laboratory, a nonprofit research institution in New York |

59 |

2001 |

Jon L. Justesen |

Co-owner and Chief Executive Officer of Justesen Ranches located in eastern Oregon |

54 |

2004 |

Anthony Meeker |

Retired Managing Director of Victory Capital Management, Inc., Cleveland, Ohio, an investment management firm |

66 |

1993 |

William W. Sherertz |

President and Chief Executive Officer of the Company |

60 |

1980 |

- 2 -

| (1) | During the past five years, the principal occupation and other business experience of each nominee has been as follows: |

| (a) | Mr. Carley was President and Chief Financial Officer of Jensen Securities, a securities and investment banking firm in Portland, Oregon, for eight years until February 1998, when the company was sold to D.A. Davidson & Co. Thereafter, he was a research analyst covering technology companies and financial institutions at D.A. Davidson & Co. until December 1999. |

| (b) | Dr. Hicks is also a co-founder and director of Virogenomics, Inc., a biotechnology company located in the Portland metropolitan area, for which he has served as Chief Technology Officer. He has also been a director of AVI BioPharma, Inc., since 1997. From 1995 to 1999, he was co-founder and technical consultant for Sapient Health Network. He also continues to serve as President of Hedral Therapeutics, Inc., a biotechnology company, where he was Chief Executive Officer, Chief Scientist and a director from 1994 to 1998. |

| (c) | Mr. Justesen has managed Justesen Ranches in eastern Oregon since 1970. He also serves as President of Buck Hollow Ranch, Inc., and is a private investor. |

| (d) | Mr. Meeker retired in 2003 as a Managing Director of Victory Capital Management, Inc. (formerly known as Key Asset Management, Inc.) where he was employed for ten years. Mr. Meeker is Chairman of the Board of First Federal Savings and Loan Association of McMinnville and a director of Oregon Mutual Insurance Company. From 1987 to 1993, he was Treasurer of the State of Oregon. |

| (e) | Mr. Sherertz also serves as Chairman of the Board of Directors. |

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Board held seven meetings in 2005. During 2005, each director attended at least 75 percent of the total number of the meetings of the Board and the meetings held by each committee of the Board on which he or she served during his or her tenure on such committee or the Board.

The Company does not have a policy regarding directors attendance at the Companys annual meeting of stockholders. Five of the Companys six Board members in 2005 attended last years annual meeting.

The Board has determined that Messrs. Carley, Hicks, Justesen, and Meeker are independent directors as defined in Rule 4200(a)(15) of the listing standards applicable to companies quoted on The Nasdaq Stock Market.

- 3 -

Audit and Compliance Committee

The Audit and Compliance Committee (the Audit Committee) reviews and pre-approves audit and legally-permitted non-audit services provided by the Companys independent registered public accounting firm (the independent auditors), makes decisions concerning the engagement or discharge of the independent auditors, and reviews with management and the independent auditors the results of their audit, the adequacy of internal accounting controls, and the quality of financial reporting. The Audit Committee also develops and oversees the Companys corporate governance principles and the Companys Code of Business Conduct and Code of Ethics for Senior Financial Officers. The Audit Committee held six meetings in 2005.

The current members of the Audit Committee are Messrs. Carley (chair), Hicks, and Meeker. The Board has determined that Thomas J. Carley is qualified to be an audit committee financial expert as defined by the Securities and Exchange Commission (SEC) under the Securities Exchange Act of 1934 (the Exchange Act). The Board has also determined that each member of the Audit Committee, including Mr. Carley, meets the financial literacy and independence requirements for audit committee membership specified in applicable rules of the SEC under the Exchange Act and in listing standards applicable to companies quoted on The Nasdaq Stock Market. The Audit Committees activities are governed by a written charter, a copy of which is available on the Companys website at www.barrettbusiness.com.

Compensation Committee

The Compensation Committee reviews the compensation of executive officers of the Company and makes recommendations to the Board regarding salary levels and other forms of compensation to be paid to executive officers, including decisions as to grants of options and other stock-based awards. The current members of the Compensation Committee are Messrs. Meeker (chair), Hicks, and Justesen. The Compensation Committee held five meetings in 2005.

Compensation Committee Interlocks and Insider Participation

Messrs. Meeker and Hicks served on the Compensation Committee throughout 2005. Nancy B. Sherertz served on the Compensation Committee through March 18, 2005, but she did not participate in the Compensation Committees deliberations regarding stock options. Mr. Justesen was appointed as a member of the Compensation Committee on May 12, 2005.

Nominating Committee

The Nominating Committee evaluates and recommends candidates for nomination by the Board in director elections and otherwise assists the Board in determining and evaluating the composition of the Board and its committees. The Nominating Committee also assists in identifying candidates for appointment as officers of the Corporation. The current members of the Nominating Committee are Messrs. Hicks (chair), Carley, Justesen, and Meeker. The Nominating Committee held one meeting in 2005.

The Board has determined that each current member of the Nominating Committee is an independent director as defined in Rule 4200(a)(15) of the listing standards applicable to companies quoted on The Nasdaq Stock Market. The Nominating Committee is governed by a written charter, which is available on the Companys website at www.barrettbusiness.com.

- 4 -

The Nominating Committee does not have any specific, minimum qualifications for director candidates. In evaluating potential director nominees, the Nominating Committee will consider:

| | The candidate's ability to commit sufficient time to the position; |

| | Professional and educational background that is relevant to the financial, regulatory, and business environment in which the Company operates; |

| | Demonstration of ethical behavior; |

| | Whether the candidate contributes to the goal of bringing diverse perspectives, business experience, and expertise to the Company's Board; and |

| | The need to satisfy independence and financial expertise requirements relating to Board composition. |

The Nominating Committee relies on its periodic evaluations of the Board in determining whether to recommend nomination of current directors for re-election. Whenever the Nominating Committee is required to identify new director candidates, because of a vacancy or a decision to expand the Board, the Nominating Committee will poll current directors for suggested candidates. The Nominating Committee has not hired a third-party search firm to date, but has the authority to do so if it deems such action to be appropriate.

Once potential candidates are identified, the Nominating Committee will conduct interviews with the candidates and perform such investigations into the candidates background as the Nominating Committee determines appropriate.

The Nominating Committee will consider director candidates suggested by stockholders for nomination by the Board. Stockholders wishing to suggest a candidate to the Nominating Committee should do so by sending the candidates name, biographical information, and qualifications to: Nominating Committee Chair c/o Michael D. Mulholland, Secretary, Barrett Business Services, Inc., 8100 N.E. Parkway Drive, Suite 200, Vancouver, Washington 98662. Candidates suggested by stockholders will be evaluated by the same criteria and process as candidates from other sources.

CODE OF ETHICS

The Company has adopted a Code of Ethics for Senior Financial Officers (Code of Ethics), which is applicable to the Companys Chief Executive Officer, principal financial officer, and principal accounting officer. The Code of Ethics focuses on honest and ethical conduct, the adequacy of disclosure in financial reports of the Company, and compliance with applicable laws and regulations. The Code of Ethics is included as part of the Companys Code of Business Conduct, which is generally applicable to all of the Companys directors, officers, and employees. The Code of Business Conduct and Code of Ethics for Senior Financial Officers is available on the Companys website at www.barrettbusiness.com.

- 5 -

STOCK OWNERSHIP BY

PRINCIPAL STOCKHOLDERS

AND MANAGEMENT

Beneficial Ownership Table

The following table gives information regarding the beneficial ownership of Common Stock as of March 24, 2006, by each director and executive officer and by all directors and executive officers of the Company as a group. In addition, it gives information about each other person or group known to the Company to own beneficially more than 5% of the outstanding shares of Common Stock. Information as to beneficial stock ownership is based on data furnished by the stockholder. Unless otherwise indicated, all shares listed as beneficially owned are held with sole voting and dispositive powers. All share amounts reflect a 3-for-2 stock split effected May 19, 2005.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(2) |

Percent of Class |

|

|---|---|---|---|

| 5 Percent Beneficial Owners |

|||

| Nancy B. Sherertz(1) | 1,462,530 | (3) | 13.2% |

| William W. Sherertz(1) | 3,068,582 | (4) | 26.6% |

| Directors and Executive Officers | |||

| Thomas J. Carley | 42,000 | * | |

| Michael L. Elich | 71,248 | * | |

| James B. Hicks, Ph.D | 18,250 | * | |

| Jon L. Justesen | 20,400 | * | |

| Anthony Meeker | 12,675 | * | |

| Michael D. Mulholland | 97,150 | * | |

| William W. Sherertz(1) | 3,068,582 | (4) | 26.6% |

| Gregory R. Vaughn | 138,188 | 1.2% | |

| All directors and executive officers as a group | |||

| (8 persons) | 3,468,492 | 29.2% | |

* Less than 1% of the outstanding shares of Common Stock.

| (1) | The addresses of persons owning beneficially more than 5% of the outstanding Common Stock are as follows: Nancy B. Sherertz, 27023 Rigby Lot Road, Easton, Maryland 21601; and William W. Sherertz, 8100 N.E. Parkway Drive, Suite 200, Vancouver, Washington 98662. Nancy B. Sherertz and William W. Sherertz are not related to each other. |

| (2) | Includes options to purchase Common Stock as follows: Ms. Sherertz, 3,938 shares; Mr. Carley, 12,000 shares; Mr. Elich, 68,248 shares; Dr. Hicks, 9,750 shares; Mr. Justesen, 3,750 shares; Mr. Meeker, 10,500 shares; Mr. Mulholland, 96,400 shares; Mr. Sherertz, 438,393 shares; Mr. Vaughn, 136,688 shares; and all directors and executive officers as a group, 775,728 shares. |

- 6 -

| (3) | Ms. Sherertz disclaims beneficial ownership of an additional 5,898 shares held by her children. |

| (4) | Includes 10,650 shares held by Mr. Sherertzs wife and 66,479 shares held by Mr. Sherertz for his children, as to which he shares voting and dispositive powers. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 of the Exchange Act (Section 16) requires that reports of beneficial ownership of Common Stock and changes in such ownership be filed with the SEC by Section 16 reporting persons, including directors, executive officers, and certain holders of more than 10% of the outstanding Common Stock. To the Companys knowledge, all Section 16 reporting requirements applicable to known reporting persons were complied with for transactions and stock holdings during 2005, except as follows: James B. Hicks, director, one late filing reporting one purchase.

SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Moss Adams LLP (Moss Adams) as the Companys independent registered public accounting firm to examine the financial statements of the Company for the fiscal year ending December 31, 2006.

Moss Adams was the Companys independent registered public accounting firm with respect to its audited financial statements for the year ended December 31, 2005. The Company expects representatives of Moss Adams to be present at the 2006 annual meeting of stockholders and to be available to respond to appropriate questions. They will have the opportunity to make a statement at the annual meeting if they desire to do so.

On June 2, 2005, the Company dismissed its previous independent registered public accounting firm, PricewaterhouseCoopers LLP (PwC), and engaged Moss Adams as its new principal independent registered public accounting firm to audit the Companys financial statements. The Audit Committee directed the review process and made the final decision to dismiss PwC and engage Moss Adams. The reports of PwC on the Companys financial statements for the fiscal years ended December 31, 2003 and 2004 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 31, 2003 and 2004, and the subsequent interim period through June 2, 2005, the Company had no disagreement with PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of PwC, would have caused PwC to make reference to the subject matter of the disagreement in connection with its report on the Companys financial statements for such fiscal years, other than a matter relating to the Companys financial statements for the fiscal year ended December 31, 2004. This issue related to the effect of an accounting principle on the reporting of assets and liabilities relating to workers compensation claims that are insured by the Companys prior excess workers compensation insurance carrier and was resolved to PwCs satisfaction by the Companys presentation of accrued liabilities for certain insured workers compensation claims on a gross basis on the Companys balance sheets, along with a corresponding receivable from the Companys insurer. The Audit Committee discussed this issue with the Companys management and with PwC.

- 7 -

During the period from January 1, 2003 through June 2, 2005, no reportable events occurred with respect to the Company, as described in Item 304(a)(1)(v) of Regulation S-K promulgated by the SEC.

The Company authorized PwC to respond fully to the inquiries of Moss Adams concerning the matters described above.

During the period from January 1, 2003 through June 2, 2005, the Company did not consult with Moss Adams regarding (1) the application of accounting principles to a specified transaction, whether completed or proposed, (2) the type of audit opinion that might be rendered with respect to the Companys financial statements or (3) any matter that was either the subject of a disagreement or a reportable event (as such terms are defined in Items 304(a)(1)(iv) and (v) of Regulation S-K).

MATTERS RELATING TO OUR

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Fees Paid to Principal Independent Registered Public Accounting Firm

The following fees were billed by Moss Adams for professional fees rendered to the Company in fiscal 2005:

| 2005 | |

|---|---|

| Audit Fees(1) | $192,000 |

| Audit Related Fees(2) | |

| Tax Fees | |

| All Other Fees(3) | 27,000 |

| (1) | Consists of fees for professional services rendered for the audit of the Companys annual financial statements for fiscal 2005 and for review of financial statements included in quarterly reports on Form 10-Q filed during 2005. |

| (2) | Refers to assurance and related services that are reasonably related to the audit or review of a companys financial statements and that are not included in audit fees. |

| (3) | Consists primarily of services related to the Companys registration of Common Stock for its follow-on offering in July 2005 and consultation regarding acceleration of vesting of stock options and internal control over financial reporting. |

- 8 -

Pre-Approval Policy

The Company has adopted a policy requiring pre-approval by the Audit Committee of all fees and services of the Companys independent registered public accounting firm (the independent auditors), including all audit, audit-related, tax, and other legally-permitted services. Under the policy, a detailed description of each proposed service is submitted to the Audit Committee jointly by the independent auditors and the Companys chief financial officer, together with a statement from the independent auditors that such services are consistent with the SECs rules on auditor independence. The policy permits the Audit Committee to pre-approve lists of audit, audit-related, tax, and other legally-permitted services. The maximum term of any preapproval is 12 months. Additional pre-approval is required for services not included in the pre-approved categories and for services exceeding pre-approved fee levels. The policy allows the Audit Committee to delegate its pre-approval authority to one or more of its members provided that a full report of any pre-approval decision is provided to the full Audit Committee at its next scheduled meeting. All audit and permissible non-audit services provided by Moss Adams in 2005 were pre-approved by the Audit Committee.

AUDIT COMMITTEE REPORT

In discharging its responsibilities, the Audit Committee and its individual members have met with management and with the Companys independent registered public accounting firm (the independent auditors), Moss Adams LLP, to review their audit process and the Companys accounting functions. The Committee discussed and reviewed with the Companys independent auditors all matters that the independent auditors were required to communicate and discuss with the Committee under applicable auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, regarding communications with audit committees. Committee members also discussed and reviewed the results of the independent auditors examination of the financial statements, the quality and adequacy of the Companys internal controls, and issues relating to the independent auditors independence. The Committee has obtained a formal written statement relating to independence consistent with Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and discussed with the independent auditors any relationships that may affect their objectivity and independence.

Based on its review and discussions with management and the Companys independent auditors, the Audit Committee recommended to the Board that the audited financial statements for the fiscal year ended December 31, 2005, be included in the Companys Annual Report on Form 10-K for filing with the SEC.

| AUDIT COMMITTEE | |

| Thomas J. Carley, Chair | |

| James B. Hicks, Ph.D. | |

| Anthony Meeker |

- 9 -

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth compensation for the years indicated to the Companys chief executive officer and the Companys other executive officers.

SUMMARY COMPENSATION TABLE

|

Annual Compensation |

Long-Term Compensation Awards |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Other Annual Compensation ($) (1) |

Securities Underlying Options (#) (2) |

||||||

| William W. Sherertz | 2005 | $250,000 | $81,825 | $154,104 | 98,697 | ||||||

| President and | 2004 | 241,667 | 59,236 | 151,567 | 27,660 | ||||||

| Chief Executive Officer | 2003 | 200,000 | 14,752 | 50,684 | 94,536 | ||||||

Michael D. Mulholland |

2005 | $200,000 | $65,469 | | 43,073 | ||||||

| Vice President-Finance | 2004 | 197,500 | 48,410 | | 12,072 | ||||||

| Treasurer, and Secretary | 2003 | 185,000 | 13,646 | | 22,500 | ||||||

Gregory R. Vaughn |

2005 |

$165,000 | $54,012 | | 26,908 | ||||||

| Vice President | 2004 | 165,000 | 40,444 | | 7,541 | ||||||

| 2003 | 150,000 | 11,064 | | 22,500 | |||||||

Michael L. Elich |

2005 |

$162,500 | $53,193 | | 25,000 | ||||||

| Vice President and Chief | |||||||||||

| Operating Officer(3) | |||||||||||

| (1) | Amounts shown for Mr. Sherertz include $77,121, $77,120, and $21,663 for 2005, 2004, and 2003, respectively, for reimbursement of the payment of life insurance premiums and $61,265, $62,447, and $17,021, respectively, for reimbursement of Mr. Sherertzs personal income tax obligations with respect to the foregoing amounts. Amounts for Mr. Sherertz also include an annual car allowance of $12,000 and $3,718 for personal use of the corporate aircraft. |

| (2) | Share amounts reflect a 3-for-2 stock split effected May 19, 2005. |

| (3) | Mr. Elich became an executive officer of the Company upon promotion to the position of Vice President and Chief Operating Officer in July 2005. The amounts shown represent his compensation throughout 2005. |

- 10 -

Stock Option Data for Executive Officers

The following table provides information as to options to purchase Common Stock granted under the Companys 2003 Stock Incentive Plan to the named executive officers during 2005.

OPTION GRANTS IN LAST

FISCAL YEAR

INDIVIDUAL GRANTS

|

Name |

Number of Securities Underlying Options Granted(1) (#) |

% of Total Options Granted to Employees in Fiscal Year |

Exercise Price ($/Share) |

Expiration Date |

Grant Date Present Value ($)(2) |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

William W. Sherertz |

98,697 | 46.0 | % | $15.20 | 7/01/2015 | $801,765 | |||||

Michael D. Mulholland |

43,073 | 20.1 | 15.20 | 7/01/2015 | 349,903 | ||||||

Gregory R. Vaughn |

26,908 | 12.5 | 15.20 | 7/01/2015 | 218,587 | ||||||

Michael L. Elich |

25,000 | 11.7 | 15.20 | 7/01/2015 | 203,088 | ||||||

| (1) | Options shown above were fully exercisable on the date of grant. No SARs were granted by the Company during 2005. |

| (2) | The values shown have been calculated based on the Black-Scholes option pricing model and do not reflect the effect of restrictions on transferability. The values were calculated based on the following assumptions: (i) expectations regarding volatility of 59% were based on monthly stock price data for the Company; (ii) the risk-free rate of return (4.18%) was assumed to be the Treasury Bond rate whose maturity corresponds to the expected term (4.8 years) of the option granted; and (iii) no dividends on the Common Stock will be paid during the option term. The values which may ultimately be realized will depend on the market value of the Common Stock during the periods during which the options are exercisable, which may vary significantly from the assumptions underlying the Black-Scholes model. |

- 11 -

Information concerning exercises of stock options during 2005 and the value of unexercised options held by the named executive officers at December 31, 2005, is summarized in the table below.

AGGREGATED OPTION

EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END

OPTION VALUES(1)

|

Name |

Shares Acquired on Exercise (#) |

Value Realized ($) |

Number of Securities Underlying Unexercised Options at Fiscal Year-End (#) (Exercisable/Unexercisable) |

Value of Unexercised In-the-Money Options at Fiscal Year-End(2) (Exercisable/Unexercisable) |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| William W. Sherertz |

| | 438,393 | / | 0 | $8,366,012 | / | 0 | |||||||||

Michael D. |

77,400 | $1,406,454 | 96,400 | / | 0 | $1,560,010 | / | 0 | |||||||||

| Mulholland | |||||||||||||||||

Gregory R. Vaughn |

| | 136,688 | / | 0 | $2,727,218 | / | 0 | |||||||||

Michael L. Elich |

13,125 | 170,572 | 68,248 | / | 0 | $1,200,321 | / | 0 | |||||||||

____________

| (1) | The named executive officers did not hold any SARs at December 31, 2005. |

| (2) | The values shown have been calculated based on the last reported sale price, $24.99, of the Common Stock reported on the National Market tier of The Nasdaq Stock Market on December 30, 2005, and the per share exercise price of unexercised in-the-money options. |

Additional Equity Compensation Plan Information

The following table summarizes information regarding shares of the Companys Common Stock that may be issued upon exercise of options, warrants, and rights under the Companys existing equity compensation plans and arrangements as of December 31, 2005. The only plan or arrangement under which equity compensation could be awarded at December 31, 2005, was the Companys 2003 Stock Incentive Plan, including a related plan for California residents, which was approved by stockholders in May 2003. Prior to 2003, grants of stock options were made under the Companys 1993 Stock Incentive Plan, which had been approved by stockholders. The information includes the number of shares covered by, and the weighted average exercise price of, outstanding options, warrants, and other rights under both plans, and the number of shares remaining available for future grants excluding the shares to be issued upon exercise of outstanding options.

- 12 -

| Plan Category | A. Number of securities to be issued upon exercise of outstanding options, warrants, and rights |

B. Weighted- average exercise price of outstanding options, warrants, and rights |

C. Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column A) |

||||

|---|---|---|---|---|---|---|---|

| Equity compensation plans | |||||||

| approved by stockholders | |||||||

| 925,354 | $ 6.20 | 93,877 | |||||

| Equity compensation plans or arrangements not approved by stockholders |

0 | N/A | 0 | ||||

| Total | 925,354 | $ 6.20 | 93,877 | ||||

Acceleration of Stock Option Vesting

In December 2005, the Compensation Committee approved the acceleration of vesting of all options to purchase Common Stock which were then outstanding and unvested. The acceleration affected options covering a total of 322,613 shares granted under the Companys 2003 Stock Incentive Plan and 1993 Stock Incentive Plan, including options held by executive officers as follows: Mr. Sherertz, 148,245 shares; Mr. Mulholland, 50,304 shares; Mr. Vaughn, 33,781 shares; and Mr. Elich, 17,905 shares.

In reaching the decision to accelerate vesting of options, the Compensation Committee considered the Companys overall compensation philosophy and the impact of the decision on the Companys financial results, as well as similar actions by other companies. The primary purpose of accelerating vesting was to eliminate future compensation expense the Company would otherwise have recognized in its future income statements with respect to the options under Statement of Financial Accounting Standards No. 123 Share Based Payment (revised 2004), which the Company was required to adopt effective January 1, 2006.

Directors Compensation

Directors (other than directors who are full-time employees of the Company, who do not receive directors fees) are entitled to receive an annual retainer of $12,000 payable in cash in monthly installments of $1,000.

On July 1, 2005, each then non-employee director received an option for 3,750 shares of Common Stock at an exercise price of $15.20 per share, the fair market value on the date of grant. The options were fully exercisable on the date of grant and have a term of ten years. Payment of the exercise price of the options may be in cash or in previously-acquired shares of Common Stock.

- 13 -

In December 2005, vesting was accelerated for stock options covering 3,938 shares for each non-employee director other than Mr. Justesen, who held no unvested options. See Acceleration of Stock Option Vesting above.

Employment Agreement

Effective January 26, 1999, the Company entered into an employment agreement with Michael D. Mulholland, Vice President-Finance, Treasurer, and Secretary of the Company. The agreement provides for a term of not less than two years as of each anniversary date of the agreement and is subject to automatic extension for an additional year annually unless either party notifies the other of an election to terminate the agreement by December 27 of the prior year. In the event of a change in control of the Company, the agreement will be renewed automatically for a two-year period beginning with the day immediately preceding the change in control. The employment agreement provides for an annual salary of not less than $155,000, subject to annual review by the Board, together with other compensation and benefits provided for in the Companys compensation policy for executive officers adopted in 1995.

Pursuant to the employment agreement, if Mr. Mulhollands employment is terminated by the Company following a change in control of the Company other than by reason of death or disability or for cause, or by Mr. Mulholland within 90 days following a change in duties related to a change in control of the Company, he will be entitled to receive a lump sum payment of an amount equal to two times his then-current annual base salary, subject to reduction to the extent that such amount would be subject to the excise tax imposed on benefits that constitute excess parachute payments under Section 280G of the Internal Revenue Code of 1986, as amended.

A change in control of the Company for purposes of the employment agreement includes (i) any occurrence which would be required to be reported as such by the proxy disclosure rules of the SEC, (ii) the acquisition by a person or group (other than the Company or one of its employee benefit plans) of 30% or more of the combined voting power of its voting securities, (iii) with certain exceptions, the existing directors ceasing to constitute a majority of the Board, (iv) certain transactions involving the merger, sale, or transfer of a majority of the assets of the Company, or (v) approval by the stockholders of a plan of liquidation or dissolution of the Company. A change in control does not, however, include a business combination transaction in which the Company becomes a privately-held company and William W. Sherertz continues as President and Chief Executive Officer. A change in duties includes a significant change in the nature or scope of Mr. Mulhollands position, responsibilities, authorities or duties, a significant diminution in his eligibility to participate in compensation plans or benefits, a change in the location of his employment by more than 30 miles, or a significant violation of the Companys obligations under the agreement.

The Company entered into an employment agreement with Michael L. Elich effective October 1, 2001, which provides for his continued employment until terminated by either party upon notice to the other party. The agreement provides for a minimum annual salary of $120,000. Mr. Elich will be entitled to a lump-sum payment in an amount equal to 100% of his then annual base salary following his termination by the Company other than for cause or by Mr. Elich within 90 days following a change in duties (as described in the preceding paragraph), in each case only upon the occurrence of circumstances resulting in the relinquishment by William W. Sherertz of his position as President and Chief Executive Officer of the Company.

- 14 -

REPORT OF THE

COMPENSATION COMMITTEE

ON EXECUTIVE

COMPENSATION

The Compensation Committees goal in recommending levels of executive compensation is to serve the interests of the Companys stockholders by enabling the Company to attract, motivate, and retain the caliber of management expertise necessary for successful implementation of the Companys strategic goals.

Towards this goal, the Compensation Committee has adopted a philosophy that combines goal-driven annual cash compensation packages with equity incentives designed to build stock ownership among key employees. These two key principles serve to align executives effectively with stockholder interests by focusing management on financial goals necessary to enhance stockholder value, as well as long-term growth, by strongly encouraging significant ownership in the Companys stock.

Salaries. Base salaries for the Companys executive officers are initially determined by evaluating the responsibilities of the position and the experience of the individual, and by reference to the competitive marketplace for management talent. Annual salary adjustments are determined by evaluating the competitive marketplace, the performance of the Company, the performance of the executive, particularly with respect to the individuals specific contribution to the Companys success, and any increased responsibilities assumed by the executive. The Compensation Committee accepted managements recommendation that salary levels for the Companys executive officers remain unchanged during 2005, except for Mr. Elich, who received a 16.7% increase to $175,000 effective July 1, 2005, in connection with his appointment as Vice President and Chief Operating Officer.

Annual Cash Incentive Bonuses. The Compensation Committee has implemented a policy of providing annual cash incentive bonuses to the executive officers of the Company. It is the Compensation Committees belief that the stewardship provided by the executive officers is best measured by the Companys return on equity. Accordingly, target amounts for annual awards of cash incentive bonuses for 2005 were based upon a formula with reference to the Companys return on stockholders equity for the year ended December 31, 2005, and each executives total salary for the year. Based on the Companys return on equity of 32.23% for 2005, each executive officer, including the chief executive officer, was awarded an annual cash incentive bonus in an amount equal to 32.73% of his actual salary paid in 2005.

- 15 -

Long-Term Incentive Compensation. The Company strives to align executive officer financial interests with long-term stockholder value through stock option grants. See Option Grants in Last Fiscal Year above for details of options granted to the named executive officers in 2005. In December 2005, the Compensation Committee accelerated vesting of outstanding unvested options. For a discussion of the decision to accelerate vesting, see Acceleration of Stock Option Vesting above.

| COMPENSATION COMMITTEE | |

| Anthony Meeker, Chair | |

| James B. Hicks, Ph.D. | |

| Jon L. Justesen |

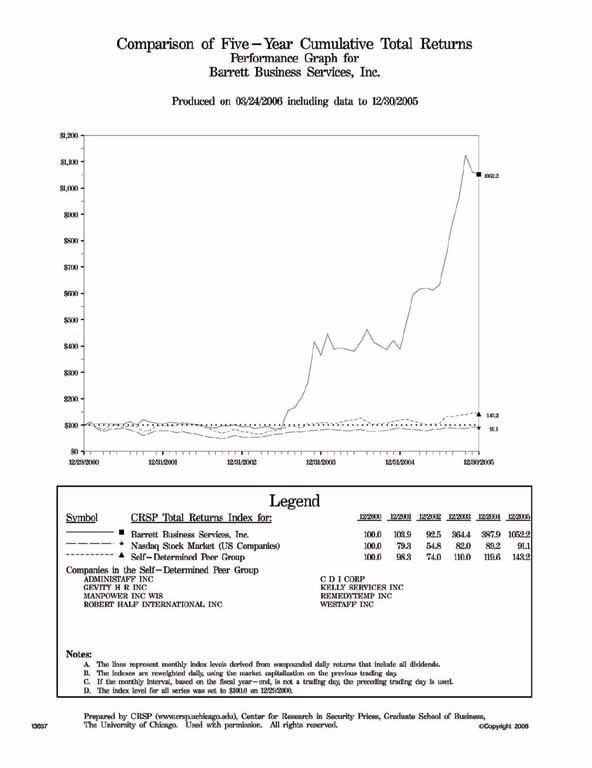

STOCK PERFORMANCE GRAPH

The graph on the following page shows the cumulative total return at the dates indicated for the period from December 31, 2000, until December 31, 2005, for the Common Stock, The Nasdaq Stock Market, and a group of the Companys current peers in the staffing industry (the 2006 Peer Group). The 2006 Peer Group is comprised of the same eight companies included in the peer group used to prepare the performance graph set forth in the Companys proxy statement for its annual meeting in May 2005. The graph was prepared using The Nasdaq Stock Market index rather than the Standard & Poors 500 Stock Index used in prior years because the latter index was not available through the Center for Research in Security Prices at the University of Chicago Graduate School of Business.

The stock performance graph has been prepared assuming that $100 was invested on December 31, 2000, in the Common Stock, The Nasdaq Stock Market, and the 2006 Peer Group, and that dividends are reinvested. In accordance with the SECs proxy rules, the stockholder return for each company in the 2006 Peer Group indices has been weighted on the basis of market capitalization as of the beginning of each annual period shown. The stock price performance reflected in the graph may not be indicative of future price performance.

- 16 -

- 17 -

TRANSACTIONS WITH MANAGEMENT

Beginning in October 2001, the Company rented Mr. Sherertzs personal residence in La Quinta, California, for marketing, customer relations, and business meeting purposes. The seasonal rental rates were established by a local real estate broker who handles similar properties in the La Quinta area. The Company made payments to Mr. Sherertz in the aggregate amount of $95,000 in 2005 for rental of the property.

Effective December 12, 2005, the Company purchased the La Quinta property from Mr. Sherertz for $1,150,000 based upon the average of two independent appraisals. The purchase was approved by a majority of the independent directors of the Company.

OTHER MATTERS

Management knows of no matters to be brought before the annual meeting other than the election of directors. However, if any other business properly comes before the meeting, the persons named in the accompanying form of proxy will vote or refrain from voting on the matter in accordance with their judgment pursuant to the discretionary authority given in the proxy.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD

Communications by stockholders to the Board should be submitted by e-mail to bod@bbsihq.com. All directors have access to this e-mail address. Communications to individual directors or committees should be sent to the attention of the intended recipient. The chair of the Audit Committee will be primarily responsible for monitoring e-mails to the Board (or its members or committees) and for forwarding messages as appropriate.

Stockholder communications sent by regular mail to the attention of the Board of Directors (or to individual directors or committees) will be forwarded as the chair of the Audit Committee deems appropriate. Communications will not be forwarded if they do not appear to be within the scope of the Boards (or such other intended recipients) responsibilities or are otherwise inappropriate or frivolous.

- 18 -

STOCKHOLDER PROPOSALS FOR ANNUAL MEETING IN 2007

Stockholder proposals submitted for inclusion in the proxy materials for the annual meeting of stockholders to be held in 2007 must be received by the Company by December 19, 2006. Any such proposal should comply with the SECs rules governing stockholder proposals submitted for inclusion in proxy materials. Proposals should be addressed to Michael D. Mulholland, Secretary, Barrett Business Services, Inc., 8100 N.E. Parkway Drive, Suite 200, Vancouver, Washington 98662.

For any proposal that is not submitted for inclusion in next years proxy materials, but instead is sought to be presented directly at the 2007 annual meeting of stockholders, management will be able to vote proxies in its discretion if the Company: (1) receives notice of the proposal before the close of business on March 4, 2007, and advises stockholders in the 2007 proxy materials about the nature of the matter and how management intends to vote on such matter; or (2) has not received notice of the proposal by the close of business on March 4, 2007. Notices of intention to present proposals at the 2007 annual meeting should be forwarded to the address listed above.

| April 18, 2006 | BARRETT BUSINESS SERVICES, INC. |

- 19 -

PROXY

BARRETT BUSINESS SERVICES, INC.

Annual Meeting of StockholdersMay 18, 2006

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints William W. Sherertz and Anthony Meeker, and each of them, with power to act without the other and with power of substitution, as proxies and attorneys-in-fact and hereby authorizes them to represent and vote, as provided on the reverse side, all the shares of Common Stock of Barrett Business Services, Inc., which the undersigned is entitled to vote, and, in their discretion, to vote upon such other business as may properly come before the Annual Meeting of Stockholders of the company to be held on Thursday, May 18, 2006, at 2:00 p.m., or at any adjournment or postponement thereof, with all powers which the undersigned would possess if present at the Meeting.

(Continued and to be marked, dated and signed on the reverse side)

Address Change/Comments (Mark the corresponding box on the reverse side)

/FOLD AND DETACH HERE/

THIS PROXY WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS INDICATED, WILL BE VOTED FOR THE ELECTION OF DIRECTORS.

| Please Mark Here for Address Change or Comments  |

|||

| 1. To elect five directors to a one-year term. |

FOR | WITHHELD FOR ALL |

SEE REVERSE SIDE |

| Nominees: |  |

|

|

| 01 Thomas J. Carley | |||

| 02 James B. Hicks, Ph.D. | |||

| 03 Jon L. Justesen | |||

| 04 Anthony Meeker | |||

| 05 William W. Sherertz |

Withheld for the nominees you list

below:

(Write that nominees name in the space provided below.)

_________________________________________________________________

2. To vote in accordance with their best judgment upon such other matters as may properly come before the meeting or any adjournments thereof.

The undersigned acknowledges receipt of the 2006 Notice of Annual Meeting and accompanying Proxy Statement and revokes all prior proxies for said meeting.

Dated: ________________________________, 2006

________________________________

Signature

________________________________

(Signature of stockholders)

NOTE: Please sign exactly as your name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such.

/ FOLD AND DETACH HERE /