PRRN14A: Revised preliminary proxy statement filed by non-management

Published on January 31, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 2 )

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| x | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

| BARRETT BUSINESS SERVICES, INC. | ||||

| (Name of registrant as specified in its charter) | ||||

| Charles M. Gillman Kimberly J. Jacobsen Sherertz Estate of William W. Sherertz Keith L. Barnes Michael L. Boguski Lawrence D. Firestone Daniel C. Molhoek W. Scott Rombach Mark D. Stolper |

||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

|

|||

|

|

||||

| (2) | Aggregate number of securities to which transaction applies:

|

|||

|

|

||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

|

|

||||

| (4) | Proposed maximum aggregate value of transaction:

|

|||

|

|

||||

| (5) | Total fee paid: | |||

|

|

||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

|

|||

|

|

||||

| (2) | Form, Schedule or Registration Statement No.:

|

|||

|

|

||||

| (3) | Filing Party:

|

|||

|

|

||||

| (4) | Date Filed:

|

|||

|

|

||||

PRELIMINARY COPY SUBJECT TO COMPLETION

Stockholders for BBSI Value

[January] [30], 2012

Dear Fellow Stockholders:

For the reasons set forth in the enclosed Proxy Statement, the participants in this solicitation (collectively, Stockholders for BBSI Value or we or us) do not believe that five (5) of the six (6) current directors, specifically Messrs. Thomas Carley, James Hicks, Roger Johnson, Jon Justesen, and Anthony Meeker of Barrett Business Services, Inc. (BBSI or the Company) (the Five Directors) are capable of acting in the best interests of the Companys stockholders. We also believe that the Five Directors do not collectively possess the backgrounds and experience necessary to maximize stockholder value.

As permitted under Sections 1.2 and 2.10 of the Companys Bylaws, Article III of its Charter, and the Maryland General Corporation Law, we seek to remove the Five Directors from the current board of directors and elect our seven (7) proposed nominees to the board of directors in order to allow all BBSI stockholders to realize the fullest potential of their investments in the Company. We do not seek to replace or remove current director Mr. Michael Elich nor are we nominating or including Mr. Elich as one of our seven (7) proposed nominees. If the Five Directors are removed and our seven (7) nominees elected, our Nominees will, if necessary, increase the Board in size from six (6) to eight (8), which is permitted under Section 2.2 of the Bylaws so long as a majority of the directors vote to increase the size of the Board. For the reasons discussed in the enclosed Proxy Statement, we do not believe that the Five Directors are acting or will in the future act in the best interests of the Companys stockholders.

We submitted written requests to the Company that the Company call a special meeting of the stockholders on February 21, 2012, pursuant to Section 1.2 of the Companys Bylaws. The Company, through its attorney, informed us by letters of January 13 and January 20, 2012 that it viewed the requests for a special meeting as legally inadequate on the grounds that the Estate of William W. Sherertz (the Estate) and Kimberly J. Jacobsen Sherertz were not stockholders entitled to cast 25 percent of all votes entitled to be cast under Maryland law. We disagree with the Boards choice not to call the special meeting of stockholders as requested by letter of December 21, 2011, as amended by letter of December 29, 2011, and as reiterated in letters of January 11 and January 19, 2012. [On January , 2012, without prejudice to the initial special meeting request, as amended, and our objection to the Companys position, and at significant additional expense, we caused the record holder of the Estates and Ms. Sherertzs shares, Cede & Co, which is the nominee of The Depository Trust Company, to make a new special meeting request for the same purposes previously requested in our letter of December 29, 2011. We also caused Cede & Co. to request, pursuant to section 2-513 of the Maryland General Corporation Law, the Company make its books, records and stockholder lists available for copying and inspection. Through Cede & Co., the Estate and Ms. Sheretz have requested that a special meeting of the stockholders be held on [March 13, 2012], 2012 at [11:00] [a.m.] Pacific Time at [The Heathman Lodge], [7801 NE Greenwood Drive], [Vancouver, Washington], [98662], (including any adjournments, postponements or continuations thereof, the Special Meeting), as permitted under the Companys Bylaws.]

We seek your support at the Special Meeting to take the following actions:

| 1) | to remove the Five Directors from the Board of the Company; |

| 2) | to elect the seven (7) nominees proposed by us (our Nominees); and |

| 3) | to vote in our discretion on such other matters as may properly come before the Special Meeting and that are not known within a reasonable time before the date of this Proxy Statement. |

We think you will agree that the Five Directors are not acting in the best interests of the BBSI stockholders. The time has come to move forward by electing our Nominees to the Board. We believe that our Nominees possess the skill, experience and motivation that will enable them to represent the best interests of the Companys stockholders.

We are seeking your support at the Special Meeting. Please read the enclosed Proxy Statement carefully for more detailed information about our Nominees.

On behalf of Stockholders for BBSI Value,

Kimberly J. Jacobsen Sherertz

IF YOU HAVE ANY QUESTIONS, REQUIRE ASSISTANCE IN VOTING YOUR GREEN PROXY CARD, OR

NEED ADDITIONAL COPIES OF OUR PROXY MATERIALS, PLEASE CALL OUR PROXY SOLICITOR

OKAPI PARTNERS LLC AT THE PHONE NUMBERS LISTED BELOW.

Okapi Partners LLC

437 Madison Avenue, 28th Floor

New York, New York 10022

(212) 297-0720

Stockholders Call Toll-Free: (877) 869-0171

Email: info@okapipartners.com

PRELIMINARY COPY SUBJECT TO COMPLETION

SPECIAL MEETING OF THE STOCKHOLDERS

OF

BARRETT BUSINESS SERVICES, INC.

PROXY STATEMENT

OF

KIMBERLY J. JACOBSEN SHERERTZ AND OTHER PARTICIPANTS

The participants in this solicitation (collectively, Stockholders for BBSI Value or we or us) are concerned about five (5) of the six (6) directors currently on the board of directors of the Company, specifically Messrs. Thomas Carley, James Hicks, Roger Johnson, Jon Justesen, and Anthony Meeker (the Five Directors) of Barrett Business Services, Inc. (BBSI or the Company). Without former Chairman, CEO and President William Bill W. Sherertz, who served as CEO since 1980 until his unexpected passing on January 20, 2011, at the helm of the Company we believe that the Five Directors membership has resulted in an ineffective board of directors (the Existing Board). We have expressed our support for current President, Chief Executive Officer and member of the Board Mr. Michael Elich in public filings with the Securities and Exchange Commission (the SEC or Commission) and are not seeking to remove or replace Mr. Elich. Mr. Elich is not one of our Nominees (as defined below). We believe changes to the composition of the Existing Board are imperative to ensure that the Company is managed in a manner consistent with the best interests of all its stockholders.

We believe an engaged and proactive Board is vital to serve the best interests of the BBSI stockholders. We are therefore seeking your support at the special meeting of stockholders requested on [January __, 2012] by Cede & Co., the nominee of The Depository Trust Company, on behalf of Kimberly J. Jacobsen Sherertz, individually and as sole representative of the Estate of William W. Sherertz (the Estate), be held on [March 13, 2012] at [11:00] [a.m.] Pacific Time at [The Heathman Lodge], [7801 NE Greenwood Drive], [Vancouver, Washington], [98662] (including any adjournments, postponements or continuations thereof, the Special Meeting), to remove the Five Directors and elect our slate of seven director nominees to the Board.

On December 21, 2011 the Estate and Ms. Sherertz submitted a written request through its attorney to the Company that a special meeting of the stockholders be held on February 21, 2012, pursuant to Section 1.2 of the Companys Bylaws and that the Company make available for copying and inspection its stockholder lists. That request was subsequently amended by letter of December 29, 2011 to call for the removal of the Five Directors instead of the Existing Board. The Company, through its attorney, informed us by letters of January 13 and January 20, 2012 that it viewed the Estates and Ms. Sherertzs requests for a special meeting and stockholder lists as legally inadequate on the grounds that the Estate and Ms. Sherertz were not stockholders entitled to make those requests under Maryland law. We disagree with the Companys choice to not call the special meeting of stockholders or make the stockholder lists available for copying and inspection as requested by letter of December 21, 2011, as amended by letter of December 29, 2011, and as reiterated in letters of January 11 and January 20, 2012. [On January , 2012, without prejudice to the initial special meeting request, as amended, and our objection to the Companys position, and at significant additional expense, we caused the record holder of the Estates and Ms. Sherertzs shares, Cede & Co, which is the nominee of The Depository Trust Company, to make a new special meeting request for the same purposes previously requested in our letter of December 29, 2011. We also caused Cede & Co. to request, pursuant to section 2-513 of the Maryland General Corporation Law, the Company make its books, records and stockholder lists available for copying and inspection.]

This proxy statement (the Proxy Statement) and the enclosed GREEN proxy card are being furnished to the Companys stockholders by us in connection with the solicitation of proxies for the following:

| 1) | to remove the Five Directors from the Board of the Company; |

| 2) | to elect the seven (7) nominees proposed by us (our Nominees); and |

| 3) | to vote in our discretion on such other matters as may properly come before the Special Meeting and that are not known within a reasonable time before the date of this Proxy Statement. |

Charles M. Gillman, Kimberly J. Jacobsen Sherertz, the Estate of William W. Sherertz, Keith L. Barnes, Michael L. Boguski, Lawrence D. Firestone, Daniel C. Molhoek, W. Scott Rombach, and Mark D. Stolper are the participants comprising Stockholders for BBSI Value. As of the date of this Proxy Statement, the participants were collectively the beneficial owners of an aggregate of 2,541,278 shares of common stock of the Company,

which currently represents approximately 25.69% of the issued and outstanding common stock of the Company, all of which will be entitled to vote at the Special Meeting.1 The Company has set as the record date for determining stockholders entitled to notice of and to vote at the Special Meeting [ ], [ ] 2012 (the Record Date). According to the Company, as of the Record Date, there were [ ] shares of common stock of the Company, par value $0.01 per share (the Common Stock), outstanding and entitled to vote at the Special Meeting. The mailing address of the principal executive offices of the Company is 8100 N.E. Parkway Drive, Suite 200 Vancouver, Washington 98662.

THIS SOLICITATION IS BEING MADE BY THE PARTICIPANTS NOTED HEREIN AND NOT ON BEHALF OF THE COMPANY, EXISTING BOARD OF DIRECTORS, OR MANAGEMENT OF BBSI.

IMPORTANT

STOCKHOLDERS FOR BBSI VALUE URGE YOU TO CAREFULLY CONSIDER THE INFORMATION CONTAINED IN THE ENCLOSED PROXY STATEMENT AND THEN SUPPORT OUR EFFORTS BY USING THE GREEN PROXY CARD TO VOTE TO REMOVE THE FIVE DIRECTORS AND FOR THE ELECTION OF OUR NOMINEES.

OUR NOMINEES ARE COMMITTED TO ACTING IN THE BEST INTERESTS OF THE COMPANYS STOCKHOLDERS. WE BELIEVE THAT YOUR VOICE IN THE FUTURE OF BBSI CAN BEST BE EXPRESSED THROUGH THE ELECTION OF OUR NOMINEES. ACCORDINGLY, WE URGE YOU TO VOTE THE GREEN PROXY CARD TO REMOVE THE FIVE DIRECTORS AND FOR THE ELECTION OF OUR NOMINEES.

THIS SOLICITATION IS BEING MADE BY STOCKHOLDERS FOR BBSI VALUE AND NOT ON BEHALF OF THE COMPANY, EXISTING BOARD OF DIRECTORS, OR MANAGEMENT OF BBSI. OTHER THAN AS DISCLOSED IN THIS PROXY STATEMENT, WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE SPECIAL MEETING. SHOULD OTHER MATTERS OF WHICH WE ARE NOT AWARE BEFORE THE DATE OF THIS PROXY STATEMENT BE BROUGHT BEFORE THE SPECIAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GREEN PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

WE URGE YOU NOT TO SIGN ANY PROXY CARD SENT TO YOU BY THE COMPANY OR ANYONE ELSE OTHER THAN US. YOU MAY REVOKE YOUR BEFORE IT IS VOTED AT THE SPECIAL MEETING BY (1) SUBMITTING A REVOCATION LETTER WITH A LATER DATE THAN THAT ON YOUR PROXY CARD; (2) DELIVERING A SECOND SIGNED PROXY CARD DATED LATER THAN THE FIRST SIGNED PROXY CARD; OR (3) ATTENDING THE SPECIAL MEETING AND VOTING IN PROXY PERSON.

YOUR VOTE IS IMPORTANT, REGARDLESS OF HOW MANY SHARES YOU OWN. STOCKHOLDERS FOR BBSI VALUE URGE YOU TO SIGN, DATE AND RETURN THE ENCLOSED GREEN PROXY CARD TODAY TO VOTE FOR THE ELECTION OF OUR NOMINEES.

IF YOU HAVE ANY QUESTIONS OR REQUIRE ASSISTANCE IN

VOTING YOUR GREEN PROXY CARD, PLEASE CALL:

OKAPI PARTNERS LLC

437 Madison Avenue, 28th Floor

New York, NY 10022

(212) 297-0720

Stockholders Call Toll-Free at 877-869-0171

Email: info@okapipartners.com

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS

FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON

[March 13, 2012] at [11:00 a.m. Pacific Time]

This Proxy Statement and our GREEN proxy card are available at

http://www.[ ].com

| 1 | The percentage beneficially owned collectively by the participants of the issued and outstanding common stock of the Company was calculated using the number of shares of the Companys Common Stock outstanding as of October 28, 2011, which number was 9,892,396 according to the Form 10-Q for the quarter ended September 30, 2011 filed with the Commission by the Company on November 9, 2011. |

BACKGROUND FOR THE SOLICITATION

The following is a chronology of events leading up to this proxy solicitation:

| | On January 20, 2011 Mr. William W. Sherertz passed away. Mr. Sherertz was the Chairman of the Board, President and Chief Executive Officer of the Company at the time of his passing. |

| | On February 4, 2011, as a result of the passing of William W. Sherertz, the Estate of William W. Sherertz (the Estate) and Ms. Sherertz, in her capacity as the sole personal representative of the Estate, became the beneficial owners of 2,644,529 shares of Common Stock. On that same date, the Clerk of the Superior Court of the State of Washington for Clark County in Case No. 11-4-00087-8 recognized Kimberly J. Jacobsen Sherertz as the Personal Representative of the Estate and authorized Ms. Sherertz to execute the Will and First Codicil to Will of William W. Sherertz. |

| | On March 2, 2011 Ms. Sherertz and one of her financial advisors, Mr. Shawn Willard, met with then interim Chief Executive Officer of the Company Mr. Michael Elich and Chairman of the Board of the Company Mr. Anthony Meeker to discuss the Estate and the Company. The main purpose of the meeting was to provide an overview of the position of the Estate relative to its BBSI holdings, particularly that an aggressive selling campaign would be detrimental to the Estate and likely place pressure on the stock price, which would be detrimental to all stockholders. Ms. Sherertz and Mr. Willard then explained certain obligations of William W. Sherertzs Trust as to why that would be the case. Ms. Sherertz also requested in writing that the Company hire an investment banker to evaluate all strategic alternatives for the Company in the wake of the Companys former Chairman and CEO. No response was ever received by Ms. Sherertz regarding her request that the Company hire an investment banker. Approximately one week later, Mr. Meeker told Mr. Willard that unless Mr. Willard was formally advising Ms. Sherertz pursuant to a written agreement, Mr. Meeker would no longer be willing to speak with Mr. Willard. |

| | On April 28, 2011 Ms. Sherertz filed a Schedule 13D with the SEC, which stated that she had retained D.A. Davidson & Co., a broker dealer, as financial advisor to the Estate and herself individually to assist in monitoring and evaluating their investments in the Company. |

| | On May 16, 2011 Ms. Sherertz and one of her representatives met with the Board of the Company to discuss Ms. Sherertzs belief that the Company and its stockholders would benefit from the addition of individuals to the Board who had a substantial beneficial ownership interest in the Company and a wider variety of business experience. At the May 16 meeting, Ms. Sherertz proposed expanding the number of directors on the Board from six (6) to nine (9) members, with Ms. Sherertz filling one of the seats on the Board and the remaining two positions being filled by persons recommended by Ms. Sherertz. The Board offered Ms. Sherertz a seat on the board of directors of the Company but was otherwise silent. Ms. Sherertz is without knowledge of the bases for the Boards reaction to her requests. |

| | On July 21, 2011 Ms. Sherertz emailed a cover letter and her resume to Anthony Meeker per his July 20, 2011 email asking that she produce a cover letter and resume for the Board to review for the purpose of considering Ms. Sherertz for nomination to the Board. |

| | On September 8, 2011 Ms. Sherertz was invited by Anthony Meeker, Chairman of the Board, to interview with the entire Board. Ms. Sherertz received a memorandum from Company counsel, Miller Nash LLP, regarding Fiduciary Duties of Directors. Ms. Sherertz never heard from the Company or Miller Nash regarding the interview and is without knowledge why she was never contacted again regarding her interview. |

| | On October 5, 2011 Ms. Sherertz and Mr. Charles Gillman entered a Joint Filing Agreement and formed a group. Ms. Sherertz, as sole representative of the Estate and individually, and Mr. Gillman agreed to work together for the purpose of consulting with recognized experts on corporate governance and the proxy advisory process. |

| | On October 6, 2011 Ms. Sherertz and Mr. Gillman announced in a public filing with the SEC that they were alarmed by the low level of stock ownership of the Existing Board and that in their experience low levels of stock ownership by boards of companies was contrary to the long-term interests of stockholders of such companies. |

| | On November 22, 2011 Ms. Sherertz and Mr. Gillman announced they would assemble a slate of directors to nominate for the Board of the Company at the Companys next annual meeting of the stockholders and that such proposed slate of directors would be better suited to work with the Companys current Chief Executive Officer Michael Elich than the Existing Board. |

| | On November 22, 2011, Frederic Dorwart, Lawyers, the law firm retained by Ms. Sherertz and Mr. Gillman (our counsel), faxed and sent a letter by certified mail on behalf of the group to Mr. Elich notifying him that Mr. Gillman, a member of the group, would like to speak with him. |

| | On December 5, 2011 soliciting material pursuant to 17 C.F.R. § 240.14a-12 was published and which indicated that the group supported the Companys current Chief Executive Officer, management, and branch managers. |

| | On December 14, 2011 soliciting material pursuant to 17 C.F.R. § 240.14a-12 was published and which indicated that the group was of the opinion that the Companys Change in Control Agreements in place with executive management of the Company needed to be revised to conform with industry standards and best practices. |

| | On December 16, 2011, our counsel again faxed and sent a letter by certified mail to Mr. Elich asking him to contact Mr. Gillman. |

| | On December 21, 2011 our counsel sent a letter to the Company pursuant to the Companys Bylaws requesting that a special meeting of the stockholders be held on February 21, 2012 at 11:00 a.m. Pacific Time at The Heathman Lodge, 7801 NE Greenwood Drive, Vancouver, Washington 98662, for the purpose of removing all of the current directors from the Companys Board and consideration by the stockholders of the groups Nominees to serve on the Board of the Company. The December 21, 2011 letter also requested that, pursuant to Section 2-513 of the Maryland General Corporation Law, the Company make available for inspection and copying a list of the Companys stockholders. |

| | On December 23, 2011 our counsel received by email a PDF of a letter from the law firm Miller Nash LLP requesting that certain types of future communications by our counsel relating to the Company be directed to Mary Ann Frantz at Miller Nash LLP. |

| | On December 29, 2011 our counsel sent another letter to the Company amending its request for a special meeting of the stockholders to be called by the Secretary of the Company. Specifically, the amendment stated that the purpose of the special meeting was the removal of the Five Directors and consideration by the stockholders of the groups Nominees to serve on the Board of the Company. |

| | On January 9, 2012, our counsel called the Companys attorney at Miller Nash LLP to inquire when the stockholder list requested would be ready for inspection and copying and whether Mr. Elich or any members of the Existing Board would be willing to speak with some of the participants regarding bringing the Companys current Change in Control Agreements in line with industry standards. We have never received a response from or had any meetings with Mr. Elich despite having requested to speak with him three times. |

| | On January 10, 2012, our counsel received a letter from Miller Nash stating that while the Company had obtained a copy of the list of stockholders verified by the Companys stock transfer agent, the list would not be provided to Ms. Sherertz until evidence was presented that she was in fact a stockholder of record of at least 5 percent of the outstanding Common Stock of the Company and had been so for at least six months. |

| | On January 11, 2012, our counsel and Ms. Sherertz sent letters to Miller Nash objecting to the Companys position in denying Ms. Sherertzs request to inspect and copy the stockholder list of the Company. Both letters also demanded that the Company respond to Ms. Sherertzs requests made in December 2011 that a special meeting of the stockholders be called pursuant to the Companys Bylaws for the purpose stated in the letter of December 29, 2011 amending the original December 21, 2011 request. |

| | On January 13, 2012, the participants issued a press release that was filed with the Commission that same day on Schedule 14A, which noted the participants efforts to reach out to current CEO Michael Elich, their dissatisfaction with the Companys Change in Control Agreements and the Boards lack of response to Ms. Sherertzs request that a special meeting of the stockholders be held on February 21, 2012. |

| | Also on January 13, 2012, our counsel received a letter from Miller Nash setting forth the reason why the Company chose not to call the special meeting of the stockholders as requested by Ms. Sherertz. The Board took the position that only stockholders of record entitled to cast at least 25 percent of all the votes entitled to be cast a special meeting of stockholders of BBSI may request that a special meeting of the stockholders of BBSI be called by the Secretary of BBSI.2 |

| | On January 18, 2012 the Company issued a press release that was filed with the Commission on Schedule 14A finally responding to some of the issues previously raised by us in our public filings with the Commission. |

| | On January 19, 2012, our counsel sent a letter to the Companys attorney disputing the Companys view of the Estates and Ms. Sherertzs ability to call a special meeting of the stockholders and request the stockholder list be made available for inspection and copying. The letter also reiterated Ms. Sherertzs and the Estates demand that the Company provide to Ms. Sherertz and the Estate the costs of the notice of the special meeting so that the Ms. Sherertz and the Estate could pay such costs, as required by the Companys Bylaws. Also on January 19, Cede & Co. gave notice to the Company of Ms. Sherertzs intent to bring nominations of persons for election to the Board at the Companys next Annual Meeting and that she intended to nominate the seven nominees named in this Proxy Statement, in accordance with the Companys Bylaws. |

| | On January 20, 2012, the Companys attorney informed us by letter that the Company would continue to deny calling a special meeting of the stockholders as requested by the Estate and Ms. Sherertz in December 2011. The Existing Board noted that its decision not to call the requested special meeting had not changed and such decision was reached after consulting with Maryland counsel. |

| | On January 30, 2012, Ms. Sherertz, individually and as sole representative of the Estate, and Mr. Gillman disclosed that Ms. Sherertz, individually, through one of her brokers caused Cede & Co. to give notice to the Company on January 19, 2012 of Ms. Sherertzs intent to bring nominations of persons for election to the Board at the Companys next Annual Meeting. That public filing also disclosed that the Estate had recently sold 50,000 shares of Common Stock in the open market in a series of transactions. |

| | [On January , 2012], the Estate and Ms. Sherertz, through their brokers, caused Cede & Co, the record holder of their shares and nominee of The Depository Trust Company, to request that a special meeting of the stockholders be held on [March 13, 2012], 2012 at [11:00] [a.m.] Pacific Time at [The Heathman Lodge], [7801 NE Greenwood Drive], [Vancouver, Washington], [98662] for the purpose of removing the Five Directors and consideration of our seven proposed Nominees. The [January , 2012] Cede & Co. letter also requested that, pursuant to Section 2-513 of the Maryland General Corporation Law, the Company make available for inspection and copying a list of the Companys stockholders and other Company books and records to which the Estate and Ms. Sherertz are entitled under the Maryland General Corporation Law as owners of at least 5% of the Companys Common Stock for at least six months. |

| 2 | The participants have neither requested nor received consent from Miller Nash nor the Company to quote the letter received by our counsel from Miller Nash via email on January 13, 2011 in this Proxy Statement. |

REASONS FOR THE SOLICITATION

Stockholders for BBSI Value believes the primary responsibilities of directors are to create stockholder value and be responsive to stockholder concerns. In light of our interactions with the Existing Board, and lack thereof, we have determined that a new slate of directors would be better able to create stockholder value and respond to stockholder concerns than the Existing Board.

| 1. | CHANGE IN CONTROL AGREEMENTS |

Several of the participants in this solicitation have previously expressed their concern over a lack of appropriate corporate governance at the board level within the Company. One example of this deficiency is the Existing Boards unwillingness to follow industry standards and best practices in the area of executive change in control agreements. Stockholders for BBSI Value are concerned that the Existing Board caused the Company, in the wake of Mr. Sherertzs sudden passing in January 2011, to enter into change in control agreements with key executives that are contrary to the best interests of BBSI stockholders. According to the Companys definitive proxy statement filed on Schedule 14A with the Commission on April 18, 2011, the Company executed change in control agreements with Messrs. Elich, Vaughn and Miller in April 2011(the CIC Agreements).3 We believe there are two (2) areas in the CIC Agreements that are cause for concern:

Definition of Good Reason.

Good Reason exists under Mr. Elichs agreement where he is required to report to a successor Board of which fewer than half of the members were directors of the Company prior to the Change in Control.

Messrs. Vaughn and Millers change in control agreements contain the same change in Board composition provision as Mr. Elichs agreement, which applies if Messrs. Vaugh or Miller is required to report directly to the Board. Alternatively, if either of them is required to report directly to Mr. Elich, and Mr. Elich ceases to be President and CEO of the Company, then Good Reason also exists.

We believe that change in control agreements executed by the Companys peers are reflective of industry standards. The two definitions of Good Reason are not found in change in control agreements in place at Manpower, Inc., General Employment Enterprises, Inc., On Assignment, Inc., and True Blue, Inc. according to filings made by each of those companies with the Commission.4

Separation Payment Multiple.

Upon either an involuntary termination other than for Cause, death or Disability due to the independent exercise of the unilateral authority of the Company or a voluntary separation from the Company by the Executive for Good Reason, the Company owes the Executive three times the sum of his Annual Base Salary and his Target Bonus, both amounts determined as of the date of the Change in Control.

| 3 | The CIC Agreements are available on the SECs website as Exhibits 10.4, 10.5 and 10.6, respectively, to the Companys Form 10-Q filed on May 9, 2011 for the quarter ended March 31, 2011. |

| 4 | General Employment Enterprises, Inc. information may be found in Exhibit 10.3 of the Form 8-K filed by General Employment Enterprises with the Commission on September 7, 2011. On Assignment, Inc. information may be found in Exhibits 10.21 of the Form 10-Ks filed by On Assignment with the Commission on March 16, 2009 and March 16, 2010, and Exhibit 10.1 of the Form 10-Q filed by On Assignment with the Commission on November 14, 2003. We are unaware of any updates to, replacements or terminations of the agreements filed by General Employment Enterprises and On Assignment and referenced by us. The participants have neither requested nor received consent from General Employment Enterprises or On Assignment to quote or cite to its filings with the Commission, including exhibits thereto, in this Proxy Statement. |

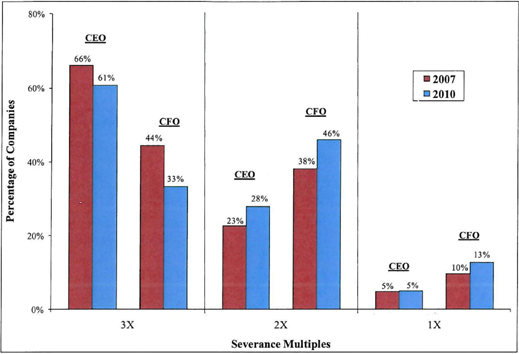

Manpower, Inc. provides a multiplier of two (2) to the sum of the annual salary and target bonus in its change in control agreements and TrueBlue provides a multiplier of two (2) for executives other than its CEO.5 General Employment Enterprises does not include a payment multiplier in its compensation formula. On Assignment does provide its CEO with a payment multiplier of three (3), but provides a multiple of less than three (3) for other executives. And, among large cap companies, [s]everance multiples have trended down from 3X to 2X for both CEOs and CFOs.6 The following graph, which represents separation payment multiplier trends among 100 large cap companies, also supports our belief that the Companys separation payment multipliers are not in line with industry standard. The Companys CIC Agreement separation payment multipliers are not in line with both the Companys peers and a strong trend among large cap companies.7

If some or all of our Nominees are elected to the Board such that a change in the majority of the composition of the Board as existed immediately prior to the election of our Nominees, a Change in Control will occur and Good Reason would exist under the CIC Agreements. A Change in Control and Good Reason must both exist under the CIC Agreements before the executive may voluntarily quit and receive a separation payment. Thus, any or all of Messrs. Elich, Vaughn or Miller would be entitled to a separation payment upon their voluntary termination of employment with the Company if we are successful in our proposals. Messrs. Elich, Vaughn and Millers salaries for 2011, as disclosed in the CIC Agreements, were $300,000, $250,000 and $225,000, respectively. We are unaware of what their Target Bonuses would be at the time of a Change in Control, which would occur if some or all of our Nominees are elected to the Board such that a change in the majority of the composition of the Board as existed immediately prior to the election of our Nominees. The potential obligations of the Company are difficult to quantify due to unknown factors such as Target Bonus amounts, whether Messrs. Elich, Vaughn or Miller will exercise their rights under the CIC Agreements, and whether such payments, if owed, would be reduced under Internal Revenue Code Section 4999. We also believe that a Change in Control occurring upon our success will fully vest options granted to Messrs. Elich, Vaughn and Miller (and any other persons who are parties to the Award Agreements attached as Exhibits 10.1, 10.2 and 10.3 to the Companys Form 10-Q filed on May 9, 2011 for the quarter ended March 31, 2011).8

| 5 | Manpower, Inc. information may be found in Exhibit 10.2 of the Form S-4 filed by Manpower, Inc. with the Commission on December 19, 2003. TrueBlue, Inc. information may be found in Exhibit 10.8 of the Form 10-Q filed by TrueBlue, Inc. with the Commission on May 4, 2007. We are unaware of any updates to, replacements or terminations of the agreements filed by Manpower and True Blue and referenced by us. The participants have neither requested nor received consent from Manpower, Inc. or TrueBlue, Inc. to quote or cite to its filings with the Commission, including exhibits thereto, in this Proxy Statement. |

| 6 | Frederic W. Cook & Co., Inc., Evolution of Change-in-Control Practices: 2007 vs. 2010 (Aug. 20, 2010) available at http://fwcook.com/alert_letters/08-20-10_Evolution_of_CIC_Practices_2007_vs_2010.pdf. The participants have neither requested nor received consent from Frederic W. Cook & Co., Inc., to quote its publications in this Proxy Statement. |

| 7 | The average market capitalization of the 100 companies used in the Frederic W. Cook & Co. research sample, as of June 30, 2010, was approximately $64,681,000,000. |

| 8 | The Companys definitive proxy statement filed with the Commission on April 18, 2011 confirms such vesting. |

To the best of our knowledge there is no agreement requiring Mr. Elich to resign from the Board if he voluntarily terminates his employment as President and CEO and receives the separation payment under his change in control agreement. As disclosed above, we reached out to Mr. Elich several times to discuss making changes to the CIC Agreements but have not had any meetings or communications with Mr. Elich and our counsel was directed by the Companys attorney to discontinue sending requests for meetings to discuss the CIC Agreements to Mr. Elich. If elected, our Nominees intend to renegotiate the CIC Agreements to bring them in line with what we believe to be industry standards.

| 2. | WORKERS COMPENSATION INSURANCE EXPERTISE |

According to the Companys Form 10-K for the year ended December 31, 2010 filed with the Commission on April 1, 2011, the Companys platform of outsourced human resource management services is built upon [its] expertise in . . . workers compensation coverage.9 Stockholders for BBSI Value believe that the Five Directors lack the expertise and experience our Nominees will bring to the Board in the area of workers compensation insurance. We believe our Nominees legal and workers compensation expertise and experience will help the Company avoid making acquisitions in states in which the workers compensation insurance litigation environment or laws make it impossible to earn a profit from offering workers compensation insurance. One of our Nominees, Mr. Boguski, has 15 years of workers compensation insurance experience at the management and board level with Eastern Insurance Holdings, Inc., a company specializing in workers compensation insurance underwriting. We believe that Mr. Boguskis and Mr. Molhoeks experience and expertise will help protect the Company and stockholder value from the potential pitfalls of navigating each states unique workers compensation laws and regulations, which necessarily affect the Companys ability to operate profitably in states where the Company currently operates and those it may consider for expanded or new operations.

| 3. | BROADER EXPERTISE |

The board slate proposed in this Proxy Statement includes Nominees with particular experience in the areas of management, sales, marketing, technology, finance, and corporate governance. As a result of this expertise, our Nominees are better qualified to support the Companys Branch Managers than the Existing Board. After a full strategic technical review of the Company, our Nominees will develop and execute a technology strategy that leverages technology as a competitive advantage. Several of our Nominees have experience in salesforce automation and human capital management technology solutions. One form of salesforce automation software has been shown to increase sales by 29%, sales productivity by 34% and forecast accuracy by 42%.10 While specific technology plans cannot be finalized until after a full technical review of the Company has been completed, the types of solutions that will be considered for use by our Nominees have been proven to increase sales, productivity and provide increased accuracy in forecasting.

| 4. | LOW LEVEL OF STOCK OWNERSHIP BY EXISTING BOARD |

We believe that the Existing Boards minimal beneficial ownership of Common Stock compromises the Existing Boards ability to properly evaluate and create stockholder value. As of April 4, 2011, the Existing Board beneficially owned an aggregate of just 167,468 shares of Common Stock according to the Companys definitive proxy statement filed on Schedule 14A with the Commission on April 18, 2011. This amounts to just 1.7% of the

| 9 | The quoted language may be found in Part I, Item 1 of the Form 10-K referenced in the text. |

| 10 | Please see the Salesforce.com website at the following link for more information, available at https://www.salesforce.com/form/sem/sales_manage_sales.jsp?d=70130000000FPOi&DCMP=KNC-Google&mkwid=cKIQa2jE&pcrid=8199430619&type=Exact&gclid=CN6nm5WM360CFQdjhwodP3f7CA. The participants have neither requested nor received consent from Salesforce.com, Inc. or any of its affiliates to cite to or include a link to its website in this Proxy Statement. |

outstanding Common Stock of the Company.11 Our research has led us to believe that board members are more sensitive and responsive to stockholders and their concerns when those board members own significant shares in the company. When board members have their own wealth dependent upon the companys success, like non-director stockholders, board members are properly incentivized to act in the long-term interest of the Company and all its stockholders.12

In contrast, we are the beneficial owners, on a cumulative basis, of an aggregate of 2,541,278 shares of Common Stock, or approximately 25.69% of the outstanding shares of Common Stock. While all shares are owned by the Estate and Ms. Sherertz, the Nominees may be deemed the beneficial owners of such shares but expressly disclaim such ownership. Our Nominees are committed to purchasing the Companys Common Stock if elected. While our Nominees cannot predict or promise they will acquire a certain number of shares, they are committed to properly aligning themselves with the stockholders of the Company by becoming stockholders.

| 5. | CONCLUSION |

We would like to reaffirm our support of the Companys current Branch Managers and management team, including Chief Executive Officer Michael Elich. We selected Nominees that we are confident can work effectively and closely with Mr. Elich to grow revenues and profitability over the short, medium, and long term. While we have publicly supported Mr. Elich in filings with the Commission and reached out to Mr. Elich to discuss the Companys future, we have not had any discussions with Mr. Elich. It is unknown to us whether Mr. Elich supports our Nominees. We continue to support Mr. Elich as evidenced by our proposals, which do not call for his removal from the Board.

We have disclosed these plans and our intentions to file this Proxy Statement in filings with the SEC (Schedule 13D Amendments filed with the SEC on October 6, November 22, 2011, December 22, 2011, December 30, 2011, January 12, 2012 and January 30, 2012, and Schedule 14As filed on December 5, December 14, 2011 and January 13, 2012). We urge you to vote to REMOVE the Five Directors and FOR our Nominees named on the enclosed GREEN proxy card.

If we are unable to elect our Nominees to the Board at the Special Meeting, Kimberly J. Jacobsen Sherertz, individually, intends to re-nominate for election the Nominees at the Companys Annual Meeting of stockholders. On January 19, 2012, Ms. Sherertz caused the record holder of some of the shares she beneficially owns in her individual capacity Cede & Co., the nominee of The Depository Trust Company, to provide notice to the Company pursuant to Section 1.10 of the Bylaws that she intends to bring for election the Nominees at the Annual Meeting of the stockholders, which is to be held during the third week of May under Section 1.1 of the Bylaws.

| 11 | The percentage of ownership of the Existing Board was calculated using the number of shares outstanding according to the Form 10-Q for the quarter ended September 30, 2011 filed with the Commission on November 9, 2011. |

| 12 | For an article on why this is particularly true in small-cap companies, see Rex Moores October 2, 2009 article, Why This Stock is a Winner at The Motley Fool, available at http://www.fool.com/investing/small-cap/2009/10/02/why-this-stock-is-a-winner.aspx. The participants have neither requested nor received consent from Mr. Moore nor The Motley Fool to quote its publication in this Proxy Statement. |

PROPOSAL NO. 1

REMOVAL OF THE FIVE DIRECTORS FROM THE EXISTING BOARD

The Maryland General Corporation Law and Section 2.10 of the Companys Bylaws authorize the removal of directors by stockholders. In order for a director to be removed from the Board, a majority of all the votes entitled to be cast for the election of directors is required. You may vote to remove the Five Directors or any director(s) you choose. We strongly urge you to vote to REMOVE the Five Directors for the reasons set forth in this Proxy Statement.

We have included the names, principal occupations, ages and tenure on the Board of the Five Directors as disclosed by the Company in its definitive proxy statement filed on Schedule 14A with the Commission on April 18, 2011. We have not updated or altered the information, other than the manner of presentation of such information, that was obtained from the Companys definitive proxy statement referenced above. According to that definitive proxy statement filed by the Company, Roger L. Johnson and Jon L. Justesen are first cousins.

| Name |

Age | Principal Occupation |

Director Since | |||||||

| Thomas Carley |

52 | Co-founder, Portal Capital, an investment management company | 2000 | |||||||

| James B. Hicks, Ph.D. |

64 | Research Professor, Cold Spring Harbor Laboratory, a nonprofit research institution in New York | 2001 | |||||||

| Roger L. Johnson |

67 | Founder and Managing Partner of Summa Global Advisors, LLC, an investment advisory firm | 2006 | |||||||

| Jon L. Justesen |

59 | Co-owner and Chief Executive Officer of Justesen Ranches located in eastern Oregon | 2004 | |||||||

| Anthony Meeker |

71 | Retired Managing Director of Victory Capital Management, Inc., Cleveland, Ohio, an investment management firm | 1993 | |||||||

WE STRONGLY RECOMMEND THAT YOU VOTE TO REMOVE

THE FIVE DIRECTORS FROM THE EXISTING BOARD.

PROPOSAL NO. 2

ELECTION OF THE NOMINEES TO THE BOARD

According to BBSIs public filings, the Board is currently composed of six (6) directors. We do not know whether the Board has established six (6) as the number of directors. Stockholders for BBSI Value have nominated seven (7) highly qualified Nominees who, if elected, would constitute seven (7) of the eight (8) directors of BBSI. Section 2.2 of the Companys Bylaws authorizes the Board from time to time by resolution to set the number of seats on the Board within a range of three (3) to nine (9). If elected and if the number of directors has been fixed at less than eight (8), our Nominees have agreed to increase the number of Board seats to ensure all seven (7) Nominees are seated on the Board by Messrs. Barnes, Boguski, Firestone, Gillman, and Rombach being seated on the Board and Mr. Molhoek and Mr. Stolper filling the two (2) new seats should such Board action be required.

Pursuant to the Companys Charter and Bylaws, only the Board may adopt, alter or repeal the Bylaws.

Our Nominees and Mr. Elich will hold office until the expiration of their respective terms and until their successors have been elected and qualified.

Our Nominees are committed to acting in the best interest of BBSIs stockholders and will pursue their efforts diligently and promptly.

Background on the Nominees

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for at least the past five years of each of the Nominees, as well as discussing the specific experience, qualifications, attributes or skills that led us to the conclusion that the person should serve as a Director. Each of our Nominees has consented to serve as a director of the Company and be named in this Proxy Statement as a Nominee. None of the entities referenced below is a parent or subsidiary of the Company.

| Name |

Age |

Present Principal Occupation and Five Year Employment History |

||

| Keith L. Barnes

Address: 4844 NW Barnes Road Portland, Oregon 97210 |

60 | Mr. Barnes served as CEO of Verigy Ltd., a semiconductor equipment company focused on lab and manufacturing test solutions for companies in the communications, consumer electronics, computers and memory industries, from 2006 until his retirement at the end of 2010, and is also the former Chairman of the Board of Directors of Verigy Ltd. Verigy was acquired by Advantest in July, 2011. Mr. Barnes also served as division president of the Agilent Technologies test business which was spun out to become Verigy. Previously, Mr. Barnes served in executive positions with Electroglas, IMS, Cadence and Kontron. Mr. Barnes serves on the board of directors of JDSU and Spansion, both NASDAQ-listed companies, and is a member of the audit and corporate development committees at JDSU and the compensation committee at Spansion. He is also a director of Classic Wines Auction and the San Jose State University Tower Foundation, both non-profit organizations. Until December 2010, Mr. Barnes was a director of NASDAQ-listed Cascade Microtech for seven (7) years, and a member of its audit and nominating & governance committees. Mr. Barnes completed professional director training at Stanford University and received a B.S. from San Jose State University in 1976. Mr. Barnes brings to the Board public company expertise, gained from both his employment history and directorships. |

| Michael L. Boguski

Business Address: 25 Race Avenue Lancaster, PA 17608 |

48 | Mr. Boguski is a director and the President and Chief Executive Officer of Eastern Insurance Holdings, Inc., and its operating subsidiaries. He has been with Eastern since the inception of the workers compensation insurance operation in 1997, and has served on the Board of Directors of the company operating subsidiaries since 2001. Mr. Boguski has 25 years of insurance industry experience, including previous positions as Underwriting Manager at Aetna Property & Casualty Company and Alternative Markets Underwriting Manager at the PMA Group. He is a member of the Young Presidents Organization (YPO) and currently serves as the Finance Officer for the YPO Keystone Chapter. He has been recognized for various awards, including: 2004 - Junior Achievement Laureate Award; 2003 - Finalist, Ernst & Young, LLP, Entrepreneur of the Year, Central PA; 2001 - Lancaster MS Leadership Class; 2000 - Central Penn Business Journal, Forty Under Forty. Mr. Boguski brings to the Board his significant management and leadership perspectives, and extensive expertise and experience in the area of workers compensation insurance. He graduated from Bloomsburg University with a B.S. degree in Business Management. | ||||

| Lawrence D. Firestone

Business Address: 9950 Federal Drive, Suite 100 Colorado Springs, CO 80921 |

53 | Mr. Firestone is the Chief Financial Officer of Xiotech Corporation, a manufacturer of leading edge enterprise storage equipment, where he began his tenure in 2011. From 2006 to 2010, he was Executive Vice President and Chief Financial Officer of Advanced Energy Industries, Inc., a NASDAQ-listed $500 million global leader in innovative power conversion and instrumentation solutions for emerging, alternative-energy and IT markets with approximately 1,700 employees worldwide. Mr. Firestone was responsible for the General and Administrative organizations, including Finance and Control, Tax, Information Technology and Facilities, Internal Audit, Corporate Legal, Human Resources and Investor Relations. Previously, he held senior finance positions at Applied Films Corporation a NASDAQ-listed manufacturer of thin film deposition equipment for the LCD television industry, Avalanche Industries, Inc., and Woolson Spice & Coffee Company, Inc. Mr. Firestone is on the board of directors of Qualstar Corporation, where he is a member of the audit committee; and was Amtech Systems, Inc., where he was chairman of the audit & governance committee and a member of the compensation committee and the nominating committee, and Hyperspace Communications, Inc., where he was chairman of the audit & governance committee. Mr. Firestone brings to the Board 30 years of enterprise, operations and financial management experience in global public companies, and experience as a board member who has served as the financial expert and audit committee chairman/member on several public company boards. Mr. Firestone received a B.S.B.A. in Accounting from Slippery Rock State College. | ||||

| Charles M. Gillman

Business address: 15 East 5th Street, 32nd Floor Tulsa, OK |

41 | Since 2001, Mr. Gillman has provided portfolio management services for Nadel and Gussman, LLC, a management company that employs personnel for business entities related to family members of Herbert Gussman, in Tulsa, Oklahoma. In 2002, Mr. Gillman founded Value Fund Advisors, LLC (VFA) as an investment advisor to various Gussman family interests, including Boston Avenue Capital, LLC. Mr. Gillman now serves as a Portfolio Manager of Boston Avenue and other Gussman family entities. Prior to joining Nadel and Gussman, Mr. Gillman held a number of positions in the investment industry and developed an expertise in the analysis of companies going through changes in their capital allocation strategies. From 1992 to 1994, Mr. Gillman was a strategic management consultant in the New York office of McKinsey & Company, a management consulting firm. While at McKinsey, Mr. Gillman worked to develop strategic plans for business units of companies located both inside the United States and abroad. Mr. Gillman serves on the board of directors of MRV Communications, a telecom services company; Littlefield Corporation, a charitable gaming company; and CompuMed Inc., a development stage telemedicine company. Mr. Gillman brings to the Board a dedicated expertise in the creation of shareholder value at companies in transition. Mr. Gillman received a bachelor of science, summa cum laude, from the Wharton School of the University of Pennsylvania and serves on the Board of the Penn Club of New York. | ||

| Daniel C. Molhoek

Business Address: 333 Bridge Street NW Grand Rapids, MI 49504 |

70 | Mr. Molhoek is Of Counsel at the law firm of Varnum, LLP where was a partner until December 31, 2011. Mr. Molhoek began working at Varnum in May 1967. He has been listed in The Best Lawyers in America® since 1993 and has also been listed in the Michigan Super Lawyers. Mr. Molhoek has previously served as secretary to the board of two publicly held companies, and is a board member of several private companies. He currently sits on the board of a local chapter of Habitat for Humanity and was formerly the board chair. Mr. Molhoek brings to the Board experience advising and providing legal guidance to boards of directors and officers. Mr. Molhoek received a B.S.E. in Industrial Engineering from the University of Michigan, and a J.D., magna cum laude, from the University of Michigan. | ||

| W. Scott Rombach

Business Address: 2309 Vista Drive Manhattan Beach, CA 90266 |

41 | Mr. Rombach is the Chief Executive Officer of Rombach Capital, which he formed in May 2011. From 2005 until he formed Rombach Capital, Mr. Rombach was an independent private investor. Previously, from March 1998 to January 2005 as a sales executive with PeopleSoft, Inc., Mr. Rombach managed large sales teams during numerous multimillion-dollar sales cycles. Prior to its acquisition by Oracle, PeopleSoft was the global leader in providing human resources and payroll software solutions. Mr. Rombach was responsible for the development of executive relationships, sales execution, and contract negotiations. He also regularly utilized global consulting partners, PeopleSoft Consulting, and boutique staffing firms to staff PeopleSoft projects. In addition, he worked closely with PeopleSoft clients in the staffing industry. Mr. Rombach previously worked for Armstrong Laing, where he drove the sales and marketing that enabled this UK start-up to become one of the market leaders in Activity Based Management (ABM) software solutions, which helped secure venture capital to expand U.S. operations. Mr. Rombach serves on the Board of Directors of CompuMed, Inc., a development stage telemedicine company. Mr. Rombach brings to the | ||

| Board sales and marketing expertise, particularly as it relates to payroll, human resources and benefits administration solutions. Mr. Rombach has an M.B.A. from Georgia State University and a B.A. in Marketing from Michigan State University. | ||||||

| Mark D. Stolper

Business Address: 1510 Cotner Ave. Los Angeles, CA 90025 |

40 | Mr. Stolper has served since 2004 as Executive Vice President and Chief Financial Officer of RadNet, Inc., a NASDAQ-listed healthcare company that is the largest owner and operator of outpatient medical diagnostic imaging centers in the United States. At RadNet, among other duties, Mr. Stolper is responsible for all accounting, corporate finance, investor relations, treasury and related financial functions. Previously, Mr. Stolper has had diverse experiences in investment banking, private equity, venture capital investing, and operations, at Broadstream Capital Partners (a Los Angeles-based investment banking firm he co-founded); West Coast Capital, Eastman Kodak; Archon Capital Partners; and Dillon, Read and Co., Inc. Mr. Stolper is currently a member of the Board of Directors of publicly traded Metropolitan Health Networks, TIX Corporation and CompuMed, Inc. Mr. Stolper brings to the Board extensive leadership experience in financial and corporate governance practices, especially with respect to publicly traded companies. In particular, Mr. Stolper has extensive experience reviewing, preparing, auditing or analyzing financial statements that must be included in reports filed under the Securities Exchange Act of 1934. Mr. Stolper is designated by the Audit Committees of CompuMed, Inc. and Metropolitan Health Networks, Inc. as a financial expert. Mr. Stolper has a liberal arts degree from the University of Pennsylvania, a finance degree from the Wharton School, and a postgraduate Award in Accounting from UCLA. | ||||

Other Information About our Nominees

The only arrangements or understandings between any of the Nominees and any other person or persons pursuant to which he was or is to be selected as a director or nominee is the consent of such Nominee to be included in the slate to be proposed at the special meeting being called herein, and to serve as a director of BBSI if elected as such. In addition, Ms. Sherertz has asked Mr. Barnes to serve as chairman of the BBSI board if elected, and has agreed to indemnify the Nominees for claims relating to their agreement to participate in the slate that arise during the proxy solicitation process. Except as set forth herein, there is no arrangement or understanding between any Nominee and any other person pursuant to which he was or is to be selected as a Nominee or director. None of the Nominees or participants in the solicitation is a party adverse to BBSI or any of its subsidiaries or has a material interest adverse to BBSI or any of its subsidiaries in any material pending legal proceedings. None of the Nominees currently holds any employment position or office with BBSI, nor are there any family relationships between any Nominees. None of the Nominees has been involved in legal proceedings as described in Item 401 of Regulation S-K during the past ten years.

We do not expect that the Nominees will be unable to stand for election, but in the event that any Nominee is unable to serve or, for good cause, will not serve, the shares represented by the enclosed GREEN proxy card will be voted for substitute nominee(s) to the extent this is not prohibited under the Bylaws of the Company and applicable law, including the Maryland General Corporation Law. We reserve the right to nominate substitute persons if the Company makes or announces any changes to its Bylaws or Charter, or takes or announces any other action that has, or if consummated, would have, the effect of disqualifying any of our Nominees, to the extent this is not prohibited under the Bylaws, Charter and applicable law. In any such case, shares represented by the enclosed GREEN proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s) to the extent this is not prohibited under the Bylaws, Charter and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting of the stockholders. Additional nominations made by us pursuant to the immediately preceding sentence are without prejudice to the position of Stockholders for BBSI Value that any attempt to increase the size of the Existing Board constitutes an unlawful manipulation of the Companys corporate machinery.

In a case where we are permitted or required to substitute a nominee or nominate additional persons, we will file and deliver supplemental proxy materials, including a revised proxy card, disclosing the information relating to any substitute nominee that is required to be disclosed in solicitations for proxies for election of directors pursuant to Section 1.10 of the Companys Bylaws and Section 14 under the Securities Exchange Act of 1934, as amended (the Exchange Act). Only in such case will the shares of Common Stock represented by the enclosed GREEN proxy card be voted for substitute or additional nominees. In addition, we reserve the right to challenge any action by BBSI that has, or if consummated would have, the effect of disqualifying the Nominees.

Other than as disclosed in this Proxy Statement, none of the Nominees are, or were within the past year, a party to any contract, arrangement or understanding with any person with respect to any securities of BBSI, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies.

Our Nominees understand that, if elected as directors of BBSI, each of them will have an obligation under Maryland law to discharge his duties as a director in good faith, consistent with his fiduciary duties to BBSI and its stockholders.

There can be no assurance or guarantee that the actions our Nominees intend to take as described above will be implemented if they are elected or that the election of our Nominees will improve the Companys business or otherwise enhance stockholder value.

Director Nominee Independence

The Nominees are independent of BBSI in accordance with the SEC and Nasdaq Stock Market rules on board independence and all are citizens of the United States of America. The Nominees meet the definition of independence set out in Rule 5605(a)(2) of the Nasdaq Stock Market rules as:

| 1) | The Nominees are not, and have not been at any time during the past three years, employed by BBSI. |

| 2) | None of the Nominees or their Family Members (as such term is defined by Nasdaq Stock Market Rule 5605(a)(2)) have accepted any payments from BBSI in excess of $120,000 during any period of twelve (12) consecutive months within the past three (3) years. |

| 3) | None of the Nominees or their Family Members are, or have been, at any time in the past three years, employed by BBSI as an executive officer. |

| 4) | None of the Nominees or their Family Members are or have been a partner in, or a controlling stockholder or an executive officer of, any organization to which BBSI made, or from which BBSI received, payments for property or services in the current or any of the past three (3) fiscal years that exceed 5% of the recipients consolidated gross revenues for that year, or $200,000, whichever is greater. |

| 5) | None of the Nominees or their Family Members are, or have been, employed as executive officers of any entity where at any time during the past three years any of the executive officers of BBSI have served on the compensation committee of such entity. |

| 6) | None of the Nominees or their Family Members are, or have been, partners or employees of BBSIs outside auditor who worked on BBSIs audit at any time during the past three (3) years. |

With respect to the eligibility of the Nominees to serve as members of the audit committee of the Board, Section 10A of the Exchange Act specifies that each member of the audit committee shall be a member of the Board and shall otherwise be independent. In order to be considered independent for serving on the audit committee of the Board for purposes of Section 10A, the members of the audit committee may not, other than in their capacity as a member of the audit committee, the Board or any other committee of the Board, (i) accept any consulting, advisory or other compensatory fee from BBSI or (ii) be an affiliated person of BBSI or any subsidiary thereof. Accordingly, for the reasons stated above, we believe that the Nominees, if they are elected to the Board and nominated to the audit committee, will satisfy the audit committee independence standards under Section 10A of the Exchange Act following their election to the Board.

WE STRONGLY RECOMMEND THAT YOU VOTE FOR

THE ELECTION OF OUR NOMINEES TO THE BOARD.

OTHER MATTERS

We are not aware of any other proposals to be brought before the Special Meeting. However, we would bring before the Special Meeting such business as may be appropriate, including, without limitation, nominating additional persons for directorships, or making other proposals as may be appropriate to address any action of the Board not publicly disclosed prior to the date of this Proxy Statement. Should other proposals be brought before the Special Meeting, the persons named as proxies in the enclosed GREEN proxy card will vote on such matters in their discretion.

SOLICITATION OF PROXIES

Voting and Proxy Procedures

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Special Meeting. Each share of Common Stock is entitled to one vote. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Stockholders of record on the Record Date will retain their voting rights in connection with the Special Meeting even if they sell such shares after the Record Date. Based on publicly available information, we believe that the Common Stock is the only outstanding class of securities of BBSI entitled to vote at the Special Meeting.

Shares represented by properly executed GREEN proxy cards will be voted at the Special Meeting as marked and, in the absence of specific instructions, will be voted to REMOVE the Five Directors and FOR the election of our Nominees to the Board and, except as discussed below, in the discretion of the persons named as proxies, on all other matters as may properly come before the Special Meeting, including any matters incidental to the conduct of the Special Meeting, which are not known within a reasonable time before the date of this Proxy Statement.

We are asking you to remove the Five Directors and elect our Nominees to the Board. The participants who hold shares of Common Stock intend to vote all of those shares to remove the Five Directors and elect all the Nominees.

Quorum; Discretionary Voting; Votes Required for Approval

In order to conduct any business at the Special Meeting, a quorum must be present. Under Section 1.5 of the Companys Bylaws, a quorum is present if the stockholders entitled to cast a majority of all the votes entitled to be cast at the Special Meeting are present in person or by proxy. Under Section 1.5 of the Companys Bylaws, if a quorum is present a majority of all the votes cast at the meeting is sufficient to approve any matter which properly comes before the meeting unless the vote of a greater proportion of all the votes cast or voting by classes is required by the Maryland General Corporation Law or the Companys charter. Other than the removal of directors, we are unaware of any matters to be brought before the Special Meeting requiring a greater proportion of votes than is provided for in Section 1.5 of the Companys Bylaws.

A nominee will be elected if the nominee receives a plurality of the votes cast by the shares entitled to vote in the election pursuant to section 2-404 of the Maryland General Corporation Law, provided that a quorum is present. A duly executed proxy will be voted to REMOVE the Five Directors and FOR the election of all the Nominees, unless authority to remove certain directors or vote for a Nominee is withheld or a proxy of a broker or other nominee is expressly not voted on this item (a broker non-vote). Under Maryland law, broker non-votes will be counted for purposes of determining a quorum and will count as votes against our first proposal to remove the Five Directors since removal of directors requires a majority of all votes entitled to be cast. Broker non-votes will have no effect on the election of directors since only a plurality of the votes cast at a meeting is required to elect a director and broker non-votes are not considered part of the votes cast. Banks and brokers acting as nominees are not permitted to vote proxies for the removal or election of directors without express voting instructions from the beneficial owner of the shares. Therefore, we urge all beneficial owners to give voting instructions to their brokers on those voting items if their shares are held in street name (shares held in the name of a bank, broker, or nominee on a persons behalf).

Revocation of Proxies

Stockholders of BBSI may revoke their proxies at any time prior to exercise by attending the Special Meeting and voting in person (although attendance at the Special Meeting will not in and of itself constitute revocation of a proxy), by delivering a written notice of revocation, or by delivering a subsequently dated proxy which is properly completed. A revocation may be delivered either to Stockholders for BBSI Value in care of Okapi

Partners LLC (Okapi or Okapi Partners) at the address set forth on the back cover of this Proxy Statement or to the Companys address at 8100 N.E. Parkway Drive, Suite 200 Vancouver, Washington 98662 or any other address provided by BBSI. Although a revocation is effective if delivered to BBSI, we request that either the original or photostatic copies of all revocations be mailed to Stockholders for BBSI Value in care of Okapi at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the stockholders of record on the Record Date. Additionally, Okapi may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the proposals described herein.

IF YOU WISH TO VOTE TO REMOVE THE FIVE DIRECTORS AND FOR OUR NOMINEES TO BE ELECTED TO THE BOARD AT THE TIME OF THE SPECIAL MEETING, AND TO GRANT TO THE PERSON NAMED IN THE PROXIES THE ABILITY TO VOTE IN THEIR DISCRETION ON ALL OTHER MATTERS AS MAY PROPERLY COME BEFORE THE SPECIAL MEETING, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED GREEN PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

Proxy Solicitation; Expenses

The solicitation of proxies pursuant to this Proxy Statement is being made by Stockholders for BBSI Value. Executed proxies may be solicited in person, by mail, telephone, facsimile, or email. Solicitation may be made by us, including our Nominees, or our employees and their affiliates, none of whom will receive additional compensation for such solicitation. Proxies will be solicited from individuals, brokers, banks, bank nominees and other institutional holders. We have requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. We will reimburse these record holders for their reasonable out-of-pocket expenses.

Stockholders for BBSI Value has retained Okapi Partners to solicit proxies on its behalf in connection with the Special Meeting. Okapi Partners will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders, and will employ approximately [6-20] people in its efforts. We have agreed to reimburse Okapi Partners for its reasonable expenses and to pay to Okapi Partners a fee of up to $[150,000]. Okapi Partners will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws.

The entire expense of this proxy solicitation, including the reasonable expenses incurred by our Nominees in connection with this solicitation, is being borne by the Estate and Kimberly J. Jacobsen Sherertz. If our Nominees are elected to the Board, Ms. Sherertz and the Estate will seek reimbursement of such expenses from BBSI and will not submit such reimbursement to a vote of stockholders. In addition to the engagement of Okapi Partners described above, costs related to the solicitation of proxies include expenditures for printing, postage, legal and related expenses and are expected not to exceed $[200,000], of which approximately $[$70,000] has been expended to date.

ADDITIONAL INFORMATION

Certain Information Concerning the Participants in this Solicitation

Ms. Sherertz was appointed sole personal representative of the Estate on February 4, 2011. The address of the Estate and Ms. Sherertz is 25011 NE Cresap Road, Battle Ground, Washington 98604-8238. Ms. Sherertz is employed as an administrator by Oregon Logistics Distribution Company, an employee leasing company whose business address is 25011 NE Cresap Road, Battle Ground, Washington 98604-8238. The Estate directly beneficially owns 2,485,929 shares of Common Stock (approximately 25.13%). Ms. Sherertz beneficially owns 55,349 shares of Common Stock, including 40,349 shares held on behalf of her minor children (approximately 0.56%). As the sole representative of the Estate, Ms. Sherertz is in possession of sole voting and investment power for the Common Stock held by the Estate, and may also be deemed to beneficially own the 2,488,429 shares of Common Stock of the Company held by the Estate. The Estate disclaims beneficial ownership of 55,349 shares of Common Stock directly owned by Ms. Sherertz or held by her on behalf of her minor children. As of the date hereof, Ms. Sherertz may be deemed the beneficial owner of 2,541,278 shares of the Companys Common Stock, or approximately 25.69% of the total number of shares outstanding. Please see Schedules I and II of this Proxy Statement for more information on Ms. Sherertzs and the Estates ownership of Common Stock.

The Estate is currently obligated to repay a short term bridge loan with Wells Fargo Bank, National Association that was used to exercise 102,697 options on January 4, 2011. The Estate has pledged certain BBSI shares it owns to secure the loan. This information was previously disclosed in a Schedule 13D amendment (Amendment No. 6) filed with the Commission on January 12, 2012.

The business address for Mr. Gillman is 15 E. 5th Street, 32nd Floor, Tulsa, Oklahoma 74103. The principal occupation of Mr. Gillman is providing portfolio management services to Nadel and Gussman, LLC, a management company that employs personnel for business entities related to family members of Herbert Gussman. Mr. Gillman may be deemed the beneficial owner of the shares of the Companys Common Stock beneficially owned by Ms. Sherertz and the Estate by virtue of their joint filings on Form 13D and their group formation, but expressly disclaims such ownership.

The other participants in this solicitation are the Nominees. Their names, business addresses, and present principal occupations are listed above under Background on the Nominees. None of the Nominees owns shares of Common Stock beneficially, directly, or indirectly. The Nominees expressly disclaim any beneficial ownership of shares owned by the Estate and Ms. Sherertz.

For information regarding purchases and sales of securities of BBSI during the past two years by the participants, see Schedule I.

None of the participants is involved in any material pending legal proceedings with respect to the Company. Except for what is set forth in this Proxy Statement, there is no other arrangement or understanding between any participant, Nominee and any other person pursuant to which he was or is to be selected as a Nominee or director.

Stockholders for BBSI Value reserve the right to retain one or more financial advisors and proxy solicitors, who may be considered participants in a solicitation under Regulation 14A of the Exchange Act.

Other than as disclosed in this Proxy Statement, the participants in this solicitation have had no discussions or other contact with the Company prior to the initiation of this proxy solicitation.