DEF 14A: Definitive proxy statements

Published on June 1, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Barrett Business Services, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

BARRETT BUSINESS SERVICES, INC.

8100 N.E. Parkway Drive, Suite 200

Vancouver, Washington 98662

(360) 828-0700

June 1, 2016

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Barrett Business Services, Inc., to be held at 2:00 p.m., Pacific Time, on Friday, June 24, 2016, at the Heathman Lodge, 7801 N.E. Greenwood Drive, Vancouver, Washington 98662.

Matters to be presented for action at the meeting include the election of directors and an advisory vote to approve our executive compensation. We will also act on such other business as may properly come before the meeting or any postponements or adjournments thereof.

We look forward to speaking with those of you who are able to attend the meeting in person. Whether or not you can attend, please sign, date, and return your proxy as soon as possible, or follow the instructions for telephone or Internet voting on the accompanying proxy. If you do attend the meeting and wish to vote in person, you may revoke your proxy and vote personally.

Sincerely,

Michael L. Elich

President and Chief Executive Officer

BARRETT BUSINESS SERVICES, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 24, 2016

You are invited to attend the annual meeting of stockholders (the Annual Meeting) of Barrett Business Services, Inc., a Maryland corporation (the Company), to be held at the Heathman Lodge, 7801 N.E. Greenwood Drive, Vancouver, Washington 98662, on Friday, June 24, 2016, at 2:00 p.m., Pacific Time.

Only stockholders of record at the close of business on May 9, 2016, will be entitled to notice of and to vote at the Annual Meeting or any postponements or adjournments thereof.

The Annual Meeting is being held to consider and vote on the following matters:

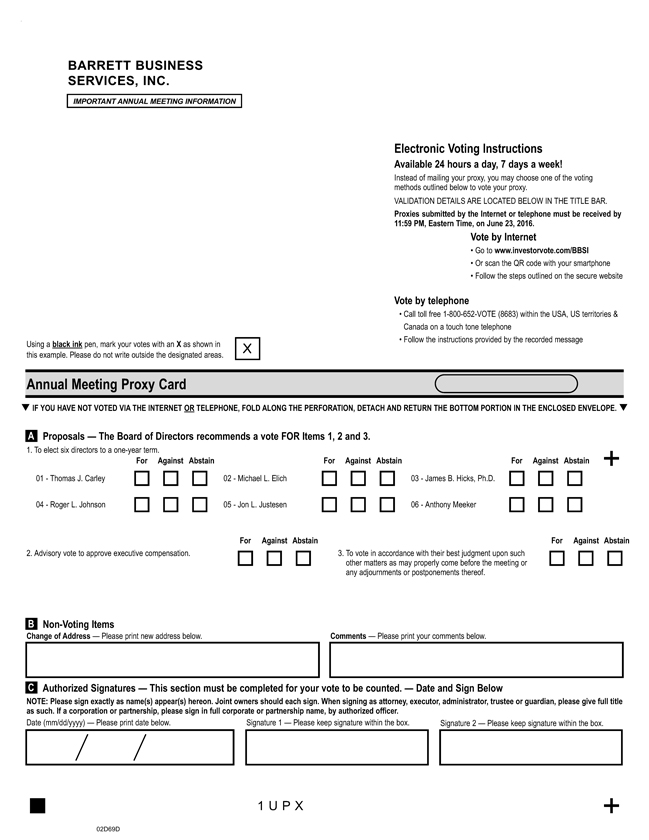

| 1. | Election of six directors; |

| 2. | An advisory vote to approve our executive compensation; and |

| 3. | The transaction of any other business that may properly come before the Annual Meeting or any postponements or adjournments thereof. |

Please sign and date the accompanying proxy and return it promptly in the enclosed postage-paid envelope, or follow the instructions on the proxy for telephone or Internet voting, to avoid the expense of further solicitation. If you attend the Annual Meeting, you may revoke your proxy and vote your shares in person.

By Order of the Board of Directors

Thomas J. Carley

Secretary

Vancouver, Washington

June 1, 2016

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON JUNE 24, 2016:

The proxy statement for the 2016 annual meeting of stockholders and 2015 annual report to stockholders are available at http://BarrettBusinessServices.Investorroom.com.

BARRETT BUSINESS SERVICES, INC.

8100 N.E. Parkway Drive, Suite 200

Vancouver, Washington 98662

(360) 828-0700

PROXY STATEMENT

2016 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the Board) of Barrett Business Services, Inc., a Maryland corporation (the Company), to be voted at the annual meeting of stockholders to be held on June 24, 2016 (the Annual Meeting), and any postponements or adjournments thereof. The proxy statement and accompanying form of proxy were first mailed to stockholders on approximately June 1, 2016.

VOTING, REVOCATION, AND SOLICITATION OF PROXIES

When a proxy in the accompanying form is properly executed and returned, the shares represented will be voted at the Annual Meeting in accordance with the instructions specified in the proxy. If no instructions are specified, the shares will be voted FOR Items 1, 2 and 3.

If you are a beneficial holder and do not provide specific voting instructions to your broker, the firm that holds your shares will not be authorized to vote your shares (known as a broker non-vote) on non-routine matters under the New York Stock Exchange rules governing discretionary voting by brokers. The action items being submitted to a vote at the Annual Meeting are not routine items. We encourage you to return your proxy promptly, or follow the instructions for telephone or Internet voting on the proxy, even if you plan to attend the Annual Meeting.

Any proxy given pursuant to this solicitation may be revoked by the person giving the proxy at any time prior to its exercise by written notice to the Secretary of the Company of such revocation, by a later-dated proxy received by the Company, or by attending the Annual Meeting and voting in person. The mailing address of the Companys principal executive offices is 8100 N.E. Parkway Drive, Suite 200, Vancouver, Washington 98662. If your shares are held through a broker or other nominee, please follow their directions included with this proxy statement on how to vote your shares and, if necessary, how to change or revoke your voting instructions.

The solicitation of proxies will be made primarily by mail, but proxies may also be solicited personally or by telephone or email by our directors and officers without additional compensation for such services. The Company will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for their reasonable expenses in sending proxy materials to stockholders. The Company has retained Georgeson LLC to assist in soliciting proxies for an estimated fee of $8,500 plus reimbursement for certain expenses. All costs of solicitation of proxies will be borne by the Company.

OUTSTANDING VOTING SECURITIES

The close of business on May 9, 2016, has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. On the record date, the Company had 7,210,251 shares of Common Stock, $.01 par value (Common Stock) outstanding. Each share of Common Stock is entitled to one vote at the Annual Meeting. The presence, in person or by proxy, of stockholders entitled

1

to cast a majority of all votes entitled to be cast at the Annual Meeting is required to constitute a quorum. Abstentions and broker non-votes, if any, will be considered present for purposes of determining the presence of a quorum.

ITEM 1 ELECTION OF DIRECTORS

The directors will be elected at the Annual Meeting to serve until the next annual meeting of stockholders and until their successors are elected and qualify. Our Charter and Bylaws authorize the Board to set the number of positions on the Board within a range of three to nine, with the current number fixed at six. Vacancies on the Board, including vacancies resulting from an increase in the number of positions, may be filled by the Board for a term ending with the next annual meeting of stockholders and when a successor is duly elected and qualifies.

Provided that a quorum is present at the Annual Meeting, a nominee will be elected if the nominee receives the affirmative vote of a majority of the total votes cast on his election (that is, the number of shares voted for a director nominee must exceed the number of votes cast against that nominee). Each of our director nominees is currently serving on the Board. Even if a nominee who is currently serving as a director is not re-elected, Maryland law provides that the director would continue to serve on the Board as a holdover director. But under our Bylaws, if stockholders do not re-elect a director, the director is required to submit his resignation to the Board. In that event, our Nominating and Governance Committee (the Nominating Committee) would recommend to the Board whether to accept or reject the resignation. The Board would then consider and act on the Nominating Committees recommendation, publicly disclosing its decision and the reasons supporting it within 90 days following the date that the election results were certified.

A duly executed proxy will be voted FOR the election of the nominees named below, other than proxies marked to vote against or to abstain from voting on one or more nominees. Shares not represented in person or by proxy at the Annual Meeting, shares voted to abstain, and broker non-votes, if any, will have no effect on the outcome of the election of directors.

The Board recommends that stockholders vote FOR each of the nominees named below to serve as a director until the next annual meeting of stockholders and his successor is duly elected and qualifies. If for some unforeseen reason a nominee should become unavailable for election, the proxy may be voted for the election of such substitute nominee as may be designated by the Board.

The following table sets forth information with respect to each person nominated for election as a director, including their current principal occupation or employment and ages as of May 1, 2016. All of the nominees for election as directors are current Board members.

| Name |

Principal Occupation |

Age | Director Since |

|||

| Thomas J. Carley |

Interim Chief Financial Officer of the Company | 57 | 2000 | |||

| Michael L. Elich |

President and Chief Executive Officer of the Company | 51 | 2011 | |||

| James B. Hicks, Ph.D. |

Research Professor, University of Southern California and Cold Spring Harbor Laboratory, a nonprofit research institution in New York | 69 | 2001 | |||

| Roger L. Johnson |

Founder and Managing Partner of Summa Global Advisors, LLC, an investment advisory firm | 72 | 2006 | |||

| Jon L. Justesen |

Co-owner and Chief Executive Officer of Justesen Ranches located in eastern Oregon | 64 | 2004 | |||

| Anthony Meeker |

Retired Managing Director of Victory Capital Management, Inc., Cleveland, Ohio, an investment management firm | 77 | 1993 | |||

2

The Nominating and Governance Committee (the Nominating Committee) evaluates the Boards membership from time to time in determining whether to recommend that incumbent directors be nominated for re-election. In this regard, the Nominating Committee considers whether the professional and educational background, business experience and expertise represented on the Board as a whole enables it to satisfy its oversight responsibilities in an effective manner.

The experience, qualifications, attributes and skills of each director of the Company, including his business experience during the past five years, are described below.

Thomas J. Carley has served as the Companys interim Principal Financial and Accounting Officer since March 4, 2016. Mr. Carley was President and Chief Financial Officer of Jensen Securities, a securities and investment banking firm in Portland, Oregon, for eight years until February 1998, when the company was sold to D.A. Davidson & Co. Thereafter, he was a research analyst at D.A. Davidson & Co. covering technology companies and financial institutions, as well as the Company, until December 1999. Mr. Carley was a private investor until July 2006, when he co-founded Portal Capital, an investment management company. Since July 2006, Mr. Carley has acted as principal of Portal Capital with responsibility for all of Portal Capitals financial duties. Mr. Carley has an MBA from the University of Chicago Graduate School of Business, with an emphasis in Accounting and Finance, and an A.B. degree in Economics and Classics from Dartmouth College. He is also a director of Urth Organic Corporation, a distributor of organic agricultural products.

Mr. Carley brings financial expertise to the Company and the Board through his prior experience in the areas of public accounting and financial analysis, including experience as an accountant with Price Waterhouse & Co., now known as PricewaterhouseCoopers LLP. Mr. Carley served as Chair of the Boards Audit and Compliance Committee beginning in 2002 until March 4, 2016.

Michael L. Elich joined the Company in October 2001 as Director of Business Development. He was appointed Vice President and Chief Operating Officer in May 2005. He was appointed interim President and Chief Executive Officer in January 2011 upon the death of William W. Sherertz. Effective February 17, 2011, Mr. Elich was elected to the Board and his position as President and Chief Executive Officer was confirmed. From 1995 to 2001, Mr. Elich served as Executive Vice President and Chief Operating Officer of Skills Resource Training Center, a staffing services company with offices in Oregon, Washington and Idaho later acquired by the Company in 2004. Mr. Elich graduated from Montana State University with a B.S. degree in Economic Science. He is a member of Tournament Golf Foundation, a non-profit organization that has donated more than $14 million to childrens charities since its inception in 1972.

Mr. Elich brings to the Board his deep knowledge of the Companys operations and industry and significant management experience.

James B. Hicks is Research Professor of Cancer Genetics at Cold Spring Harbor Laboratory and a Research Professor at the University of Southern California. He also serves as Vice President for Science and director of GenDx, Inc., a cancer diagnostic company based in New York. He is a co-founder and director of Virogenomics, Inc., a biotechnology company located in the Portland, Oregon metropolitan area, for which he previously served as Chief Technology Officer. Dr. Hicks was a director of AVI BioPharma, Inc., from 1997 until October 2007 and a member of AVI BioPharma, Inc.s audit committee. Between 1990 and 2006, Dr. Hicks co-founded five biotech or internet companies. He completed a postdoctoral program at Cornell University, received a Ph.D. from the University of Oregon, and received a B.A. degree from Willamette University.

Through his experience with other public companies, Dr. Hicks provides valuable business and financial insight to the Board. He is chair of the Boards Compensation Committee.

Roger L. Johnson has been the Managing Partner of Summa Global Advisors, LLC, since October 2008. He was a Principal of Coldstream Capital Management, Inc., a wealth management firm headquartered in Bellevue, Washington, from 2005 until 2008. Mr. Johnson was President and CEO of Western Pacific Investment

3

Advisers, Inc., for 15 years until its acquisition by Coldstream in 2005. Mr. Johnson is an ROTC Distinguished Military Graduate of Gonzaga University, with a B.A. degree in Psychology and minors in business administration and philosophy. After college, Mr. Johnson was an Infantry Captain in the U.S. Army in Vietnam, where his assignments included serving as a platoon leader in the 101st Airborne Division, an infantry advisor, and a company commander. Mr. Johnson has 42 years of experience in the financial services industry, including extensive experience in asset allocation and portfolio management. Mr. Johnson serves as director, secretary, and treasurer of Waverly Historic Foundation.

As a result of his involvement in the financial services industry, Mr. Johnson contributes his business, leadership and management perspectives as a director of the Company and chair of the Boards Investment Committee.

Jon L. Justesen is co-owner and Chief Executive Officer of Justesen Ranches, which operates in four counties in two states. He is also owner and President of Buckhollow Ranch, Inc., and has 35 years of experience creating wealth as a private investor. During Mr. Justesens 40 plus years of successfully growing and managing agribusinesses in eastern Oregon, he has overseen operations involving timber, wheat and cattle production, property management and development, and resource-based recreational activities.

Mr. Justesen brings to the Board leadership and business management skills developed during his lifelong career managing substantial ranching operations. He also provides the Company with connections to potential customers through his personal network of business contacts developed in several geographic markets in which the Company operates. Mr. Justesen is chair of the Boards Nominating Committee.

Anthony Meeker serves as Chairman of the Board. He retired in 2003 as a Managing Director of Victory Capital Management, Inc. (formerly known as Key Asset Management, Inc.), where he was employed for 10 years. Mr. Meeker was previously a director of First Federal Savings and Loan Association of McMinnville, Oregon and Oregon Mutual Insurance. He also serves on the board of two charitable organizations, MV Advancements, which provides employment, residential, and community services to clients with disabilities, and Oregon State Capitol Foundation. From 1987 to 1993, Mr. Meeker was Treasurer of the State of Oregon. His duties as state treasurer included investing the assets of the state, including the then $26 billion state pension fund, managing the state debt, and supervising all cash management programs. Mr. Meeker also managed the workers compensation insurance reserve fund of the State Accident Insurance Fund, providing oversight to ensure adequate actuarial reserves. He received a B.A. degree from Willamette University.

Mr. Meekers experience in the insurance industry assists the Company in managing risk with respect to workers compensation and overseeing its captive insurance subsidiaries. Mr. Meeker also brings leadership skills and a unique insight as a result of his public service as state treasurer and service on other corporate boards.

Mr. Johnson and Mr. Justesen are first cousins.

The Board recommends that stockholders vote FOR each of the nominees named above.

Litigation Involving Directors and Officers

As described below and in more detail in Item 3. Legal Proceedings in the Companys Annual Report on Form 10-K for the year ended December 31, 2015 (the 2015 Form 10-K), the Company is a party to certain legal proceedings that also involve our directors and certain officers.

In November 2014, three purported class action lawsuits were filed in the United States District Court for the Western District of Washington against the Company and Michael L. Elich, our Chief Executive Officer, and James D. Miller, former Chief Financial Officer. The lawsuits have been consolidated into a single action

4

captioned In re Barrett Business Services Securities Litigation. The complaint alleges violations of the federal securities laws and related claims arising from declines in the market price for our Common Stock during the putative class period and seeks compensatory damages, plus interest, and costs and expenses.

On June 17, 2015, a shareholder derivative lawsuit was filed against the Company, its directors and certain of its officers and a former officer in the Circuit Court for Baltimore City, Maryland. The complaint alleges breaches of fiduciary duty, unjust enrichment and other violations of law and seeks recovery of various damages, as well as the proceeds of sales of Common Stock by certain of the Companys officers and directors in 2013 and 2014.

The Company has also received two subpoenas from the Division of Enforcement of the Securities and Exchange Commission (the SEC) in connection with the SECs investigation of the Companys accounting practices relating to its workers compensation reserves and unsupported journal entries made by the Companys former Chief Financial Officer.

We have indemnification agreements with each of our current directors and certain of our executive officers and a former officer, under which we are generally required to indemnify each such director or officer against expenses, including attorney fees, judgments, fines and settlements, arising from the claims described above (subject to certain exceptions, including liabilities resulting from conduct committed in bad faith or active and deliberate dishonesty or resulting in actual receipt of an improper personal benefit in money, property, or services). For a more detailed discussion of indemnification of our directors and officers, see Related Person Transactions below.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Board held eight meetings in 2015. Each director attended at least 75 percent of the total number of the meetings of the Board and the meetings held by each committee of the Board on which he served during 2015.

The Company does not have a policy regarding directors attendance at the Companys annual meeting of stockholders. All of the directors attended last years annual meeting.

The Board has determined that Messrs. Hicks, Johnson, Justesen, and Meeker are independent directors as defined in Rule 5605(a)(2) of the listing standards applicable to companies listed on The Nasdaq Stock Market.

Board Leadership Structure

Michael L. Elich has served as the Companys Chief Executive Officer since January 20, 2011, and as a director since February 17, 2011. Anthony Meeker, a long-time outside director of the Company, serves as Chairman of the Board and as Chair of the Audit and Compliance Committee.

Each of our directors other than Messrs. Elich and Carley, including each member of the Boards audit, nominating and compensation committees, is an independent director under the Nasdaq listing rules. The outside directors also meet at least two times per year in executive session without the President and Chief Executive Officer or other management being present.

The Board believes that its leadership structure reflecting the separation of the Chairman and Chief Executive Officer positions serves the best interests of the Company and its stockholders by giving an independent director a direct and significant role in establishing priorities and the strategic direction and oversight of the Company. The Board believes that the manner in which it oversees risk management at the Company has not affected its leadership structure.

5

The Boards Role in Risk Oversight

The Companys management is responsible for identifying, assessing and managing the material risks facing the Company. The Board has historically performed an important role in the review and oversight of risk, and generally oversees risk management practices and processes. The Board, either as a whole or through the Audit and Compliance Committee (the Audit Committee) and other board committees, periodically discusses with management strategic and financial risks associated with the Companys operations, their potential impact on the Company, and the steps taken to manage these risks. As discussed in greater detail in Item 9A Controls and Procedures in our 2015 Form 10-K, the Audit Committee has overseen two independent investigations into events affecting the Companys financial statements and internal control over financial reporting during the past seven months. As a result of the knowledge gained in the course of those investigations, the Audit Committee has directed the Companys management to make significant improvements to the Companys processes and procedures relating to its estimation of workers compensation reserves, financial recordkeeping, accounting practices and procedures, and corporate governance, among other matters.

While the Board is ultimately responsible for risk oversight, the Boards committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. In particular, the Audit Committee focuses on financial and enterprise risk and, through discussions by the Committee or its Chair with management, the Companys director of insurance, its outside actuarial consultants and actuary, and its independent registered public accounting firm, oversees the Companys policies and practices with respect to risk and particular areas of risk exposure, including with respect to the Companys workers compensation liabilities and management of its insurance subsidiaries. The Audit Committee also assists the Board in fulfilling its duties and oversight responsibilities relating to the Companys compliance and ethics programs. The Nominating Committee oversees the functioning of the Board and its committees, the Companys corporate governance practices, and succession planning for the Companys executive positions. The Compensation Committee monitors the Companys incentive compensation programs to assure that management is not encouraged to take actions involving excessive risk. The Investment Committee oversees the investment advisers retained by the Company and monitors the Companys investments in marketable securities and other financial instruments.

Audit and Compliance Committee

The Audit Committee reviews and pre-approves audit and legally-permitted non-audit services provided by the Companys independent registered public accounting firm (the independent auditors), makes decisions concerning the engagement or discharge of the independent auditors, and reviews with management and the independent auditors the results of their audit, the adequacy of internal accounting controls, and the quality of financial reporting. The Audit Committee also oversees the Companys Code of Business Conduct and Code of Ethics for Senior Financial Officers. It reviews for potential conflicts of interest, and determines whether or not to approve, any transaction by the Company with a director or officer (including their family members) that would be required to be disclosed in the Companys annual proxy statement. The Audit Committee held six meetings in 2015.

The current members of the Audit Committee are Messrs. Meeker (chair), Hicks and Johnson. As a result of the resignation of Mr. Carley from the Audit Committee in March 2016, the Board has determined that no member of the Audit Committee qualifies as an audit committee financial expert as defined by the SECs rules under the Securities Exchange Act of 1934 (the Exchange Act). The Board has determined that each current member of the Audit Committee meets the financial literacy and independence requirements for audit committee membership specified in applicable rules of the SEC under the Exchange Act and in listing standards applicable to companies listed on The Nasdaq Stock Market. The Board is in the process of recruiting an additional independent director who would qualify as an audit committee financial expert and would also serve as Chair of the Audit Committee. The Audit Committees activities are governed by a written charter, a copy of which is available on the Companys website at www.barrettbusiness.com in the Investor Relations section.

6

Compensation Committee

The Compensation Committee reviews the compensation of executive officers of the Company and makes recommendations to the Board regarding base salaries and other forms of compensation to be paid to executive officers, including decisions to grant options and other stock-based awards. The current members of the Compensation Committee are Dr. Hicks (chair) and Messrs. Johnson and Justesen, each of whom is independent as defined in Rule 5605(a)(2) and Rule 5605(d)(2)(A) of the listing standards for companies listed on The Nasdaq Stock Market. The Compensation Committee held four meetings in 2015.

The Compensation Committees responsibilities are outlined in a written charter, a copy of which is available on the Companys website at www.barrettbusiness.com in the Investor Relations section. The Compensation Committee is charged with carrying out the Boards overall responsibilities relating to compensation of the Companys executive officers and directors. Its specific duties include reviewing the Companys cash incentive and equity compensation programs for executive officers and director compensation arrangements, and recommending changes to the Board as it deems appropriate. In the course of reviewing the Companys compensation policies and practices, the Compensation Committee has considered whether the Companys compensation program encourages employees to take risks that are reasonably likely to have a material adverse effect on the Company. The Committee believes that the Companys compensation program is not likely to have that effect.

The Chief Executive Officer reviews the performance of each executive officer (other than himself) and may make recommendations to the Compensation Committee regarding salary adjustments, stock-based awards and the selection, target amounts and satisfaction of performance goals for cash and stock incentive awards. The Compensation Committee is responsible for annually evaluating the CEOs performance and establishing his base salary and incentive compensation. If present at a Compensation Committee meeting, the CEO is excused during discussions of his compensation. The Compensation Committee exercises its own discretion in accepting or modifying the CEOs recommendations regarding the performance and compensation of the Companys other executive officers. The Compensation Committee also administers the Companys stock incentive plans.

The Compensation Committee, as it deems appropriate and as permitted by applicable law, may delegate its responsibilities to a subcommittee. The Compensation Committee has delegated authority, within specified limits, to the CEO to make stock-based awards in his discretion to corporate and branch personnel who are not executive officers under the Companys 2015 Stock Incentive Plan, which was approved at the 2015 annual meeting of stockholders, and previously under the 2009 Stock Incentive Plan.

Under its charter, the Compensation Committee has the sole authority to retain the services of outside consultants to assist it in making decisions regarding executive compensation and other compensation matters for which it is responsible. During 2013, the Compensation Committee retained Mercer, a nationally-recognized compensation consultant, to provide advice regarding the Companys executive compensation plans, policies and practices. Before engaging Mercer, the Compensation Committee solicited information from Mercer regarding any potential conflicts of interest and determined that no conflicts existed.

As discussed in more detail under Executive Compensation Compensation Discussion and Analysis below, in 2013 Mercer provided advice to the Compensation Committee regarding the composition of an appropriate industry peer group and benchmarks to assist in analyzing the Companys competitive position with respect to executive compensation and market survey data supporting compensation packages. Mercer also assisted the Compensation Committee in developing the structure, parameters and components of performance-based annual cash incentive compensation, which culminated in the adoption of a new Annual Cash Incentive Award Plan in March 2014. The performance goals under the new plan were approved by the stockholders at the 2014 annual meeting. The Compensation Committee did not seek advice from Mercer or another outside compensation consultant during 2015, but has engaged Mercer to provide updated information regarding the Companys executive compensation program and compensation levels and structure as compared to its peer companies and companies within its industry during 2016.

7

Nominating and Governance Committee

The Nominating Committee evaluates and recommends candidates for nomination by the Board in director elections and otherwise assists the Board in determining and evaluating the composition of the Board and its committees. The Nominating Committee is also responsible for developing corporate governance policies, principles and guidelines for the Company and succession planning with respect to the Companys executive officers. The current members of the Nominating Committee are Messrs. Justesen (chair) Johnson, and Meeker. Mr. Carley also served on the Nominating Committee during 2015. The Nominating Committee held two meetings in 2015.

The Board has determined that each current member of the Nominating Committee is an independent director as defined in Rule 5605(a)(2) of the listing standards applicable to companies listed on The Nasdaq Stock Market. The Nominating Committee is governed by a written charter, which is available on the Companys website at www.barrettbusiness.com in the Investor Relations section.

The Nominating Committee does not have any specific, minimum qualifications for director candidates or a policy regarding the consideration of diversity in identifying nominees for director. In evaluating potential director nominees, the Nominating Committee will consider:

| | The candidates ability to commit sufficient time to the position; |

| | Professional and educational background that is relevant to the financial, regulatory, industry and business environment in which the Company operates; |

| | Demonstration of ethical behavior; |

| | Whether the candidate contributes to the goal of bringing diverse perspectives, business experience, and expertise to the Board; and |

| | The need to satisfy independence and financial expertise requirements relating to Board and committee composition. |

The Nominating Committee relies on its periodic evaluations of the Board in determining whether to recommend nomination of current directors for re-election. The Nominating Committee polls current directors for suggested candidates when called upon to identify new director candidates, because of a vacancy or a decision to expand the Board. In the fall of 2015, the Nominating Committee engaged a national executive search firm with the goal of adding two or more individuals to the Board with expertise and experience in the governance of public companies, including an independent oversight perspective at the board level, service on an audit committee, and public company accounting and auditing. As potential candidates are identified, with the assistance of the executive search firm, the Nominating Committee will conduct interviews and perform such investigations into the candidates background as the Nominating Committee deems appropriate.

The Nominating Committee also will consider director candidates suggested by stockholders for nomination by the Board. Stockholders wishing to suggest a candidate to the Nominating Committee should do so by sending the candidates name, biographical information, and qualifications to: Nominating Committee Chair c/o Corporate Secretary, Barrett Business Services, Inc., 8100 N.E. Parkway Drive, Suite 200, Vancouver, Washington 98662. Candidates suggested by stockholders will be evaluated by the same criteria and process as candidates from other sources.

8

DIRECTOR COMPENSATION FOR 2015

The following table summarizes compensation paid to the Companys outside directors for services during 2015. No outside director received perquisites or other personal benefits with a total value exceeding $10,000 during 2015.

| Name |

Fees Earned or Paid in Cash(1) |

Stock Awards(2)(3) |

All Other Compensation |

Total | ||||||||||||

| Thomas J. Carley(4) |

$ | 73,750 | $ | 49,987 | $ | | $ | 123,737 | ||||||||

| James B. Hicks, Ph.D. |

$ | 71,250 | $ | 49,987 | $ | | $ | 121,237 | ||||||||

| Roger L. Johnson |

$ | 68,750 | $ | 49,987 | $ | | $ | 118,737 | ||||||||

| Jon L. Justesen |

$ | 66,250 | $ | 49,987 | $ | | $ | 116,237 | ||||||||

| Anthony Meeker |

$ | 90,000 | $ | 49,987 | $ | | $ | 139,987 | ||||||||

| (1) | Directors (other than directors who are full-time employees of the Company, who do not receive directors fees) are entitled to receive an annual retainer payable monthly in cash. The annual retainer is $50,000 for each independent director other than the Chairman of the Board, whose annual retainer is $90,000, while committee chairs and committee members receive annual retainers as follows: Audit Committee, $15,000 and $7,500; Compensation Committee, $10,000 and $5,000; Nominating Committee, $7,500 and $3,750; and Investment Committee, $7,500, and $3,750. |

| (2) | Reflects the grant date fair value of 1,285 restricted stock units (RSUs) granted to each director using the closing share price on the grant date, July 1, 2015, of $38.90 per share. Each RSU represents a contingent right to receive one share of the Companys Common Stock. The RSUs vest in four equal annual installments beginning on July 1, 2016, and will be settled by delivery of unrestricted shares of Common Stock on the vesting date. |

| (3) | At December 31, 2015, each of the Companys outside directors held a total of 3,172 RSUs. Also as of that date, the Companys outside directors held stock options as follows: Mr. Carley, 5,875 shares; Dr. Hicks, 13,875 shares; Mr. Johnson, 9,000 shares; Mr. Justesen, 9,000 shares; and Mr. Meeker, 9,000 shares. |

| (4) | Effective March 4, 2016, Mr. Carley was appointed interim Chief Financial Officer of the Company with a base salary of $25,000 per month. |

CODE OF ETHICS

The Company has adopted a Code of Ethics for Senior Financial Officers (Code of Ethics), which is applicable to the Companys principal executive officer, principal financial officer, and principal accounting officer. The Code of Ethics focuses on honest and ethical conduct, the adequacy of disclosure in financial reports of the Company, and compliance with applicable laws and regulations. The Code of Ethics is included as part of the Companys Code of Business Conduct, which is generally applicable to all of the Companys directors, officers, and employees. The Code of Business Conduct is available on the Companys website at www.barrettbusiness.com in the Investor Relations section.

9

STOCK OWNERSHIP BY PRINCIPAL STOCKHOLDERS

AND MANAGEMENT

Beneficial Ownership Table

The following table sets forth information regarding the beneficial ownership of Common Stock as of April 30, 2016, by each director, by each executive officer named in the Summary Compensation Table under the heading Executive Compensation below, and by all current directors and executive officers of the Company as a group. In addition, it provides information, including names and addresses, about each other person or group known to the Company to own beneficially more than 5 percent of the outstanding shares of Common Stock.

Unless otherwise indicated, all shares listed as beneficially owned are held with sole voting and dispositive power.

| Amount and Nature of Beneficial Ownership(1) |

Percent | |||||||

| Five Percent Beneficial Owners |

||||||||

| JPMorgan Chase & Co.(2) |

920,471 | 12.7 | % | |||||

| Heartland Advisors, Inc.(3) |

579,283 | 8.0 | % | |||||

| Cloverdale Capital Management, LLC(4) |

467,144 | 6.5 | % | |||||

| BlackRock, Inc.(5) |

411,539 | 5.7 | % | |||||

| Directors and Named Executive Officers |

||||||||

| Gerald R. Blotz |

16,981 | * | ||||||

| Thomas J. Carley |

35,127 | (7) | * | |||||

| Michael L. Elich |

125,685 | 1.7 | % | |||||

| James B. Hicks, Ph.D. |

24,386 | * | ||||||

| Roger L. Johnson |

15,253 | * | ||||||

| Jon L. Justesen |

40,752 | * | ||||||

| Anthony Meeker |

16,148 | (7) | * | |||||

| James D. Miller(6) |

24,902 | * | ||||||

| Gregory R. Vaughn |

112,385 | 1.5 | % | |||||

| All current directors and executive officers as a group (8 persons) |

386,717 | 5.2 | % | |||||

| * | Less than 1% of the outstanding shares of Common Stock. |

| (1) | Includes 1,939 restricted stock units held by Mr. Blotz vesting on May 2, 2016, and options to purchase Common Stock exercisable within 60 days following April 30, 2016, as follows: Mr. Blotz, 11,250 shares; Mr. Carley, 4,000 shares; Mr. Elich, 61,875 shares; Dr. Hicks, 12,000 shares; Mr. Johnson, 7,125 shares; Mr. Justesen, 7,125 shares; Mr. Meeker, 7,125 shares; Mr. Vaughn, 63,750 shares; and all current directors and executive officers as a group, 174,250 shares. |

| (2) | Based on information contained in the Schedule 13G amendment filed on January 11, 2016, by JPMorgan Chase & Co., 270 Park Avenue, New York, New York 10017, reporting sole voting power as to 781,941 shares, sole dispositive power as to 911,171 shares, and shared voting power as to 55 shares. |

| (3) | Based on information contained in the Schedule 13G amendment filed on February 5, 2016, by Heartland Advisors, Inc., and its Chairman, William J. Nasgowitz, 789 North Water Street, Milwaukee, Wisconsin 53202, reporting shared voting power as to 579,283 shares and shared dispositive power as to 564,298 shares, including 500,000 shares or 6.9% of the outstanding Common Stock, held by the Heartland Value Fund, a series of the Heartland Group, Inc., a registered investment company. |

| (4) | Based on information contained in the Schedule 13G filed on February 26, 2016, by Cloverdale Capital Management, LLC, and its sole member C. Jonathan Gattman, 2651 N. Harwood, Suite 424, Dallas, Texas 75201. |

| (5) | Based on information contained in the Schedule 13G amendment filed on January 25, 2016, by BlackRock, Inc., 55 East 52nd Street, New York, New York 10022, reporting sole voting power as to 397,827 shares and sole dispositive power as to 411,539 shares. |

10

| (6) | Mr. Miller ceased to be an officer of the Company on March 3, 2016. |

| (7) | Includes shares pledged as collateral for margin accounts with brokerage firms as follows: Mr. Carley, 27,127 shares; and Mr. Meeker, 1,000 shares. |

Anti-Hedging Policy

The Company has adopted an Anti-Hedging Policy, which is applicable to the Companys directors and executive officers, and prohibits them from directly or indirectly engaging in hedging against future declines in the market value of any Company securities through the purchase of financial instruments designed to offset such risk. Executive officers and directors who fail to comply with the policy are subject to Company-imposed sanctions, which may include a demotion in position, reduced compensation, restrictions on future participation in cash or equity incentive plans, or termination of employment.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 of the Exchange Act (Section 16) requires that reports of beneficial ownership of Common Stock and changes in such ownership be filed with the SEC by Section 16 reporting persons, including directors, executive officers, and certain holders of more than 10% of the outstanding Common Stock. To the Companys knowledge, based solely on a review of the copies of Forms 3, 4, and 5 (and amendments thereto) filed with the SEC and written representations by the Companys directors and executive officers, all Section 16 reporting persons complied with all applicable Section 16(a) filing requirements during 2015 on a timely basis other than one late report filed by Jon Justesen, a director of the Company, reporting an open market purchase and another late report filed by James Hicks, also a director of the Company, reporting 15 purchases of shares with reinvested dividends.

Stock Ownership Guidelines for Non-Employee Directors

The Board has adopted stock ownership guidelines such that each non-employee director is expected to own shares of BBSI common stock with a value equal to at least three times the regular annual cash retainer, currently $50,000, within three years of first being elected. The value of shares owned is calculated quarterly based on the higher of current market price or the average daily closing price for the preceding 12 months. Any shortfall resulting from an increase in the annual cash retainer or a decrease in the stock trading price (or both) is expected to be cured within two years following the end of the quarter in which the resulting required increase in share ownership first occurred.

ITEM 2 ADVISORY VOTE TO APPROVE COMPENSATION OF OUR EXECUTIVE OFFICERS

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the Dodd-Frank Act) included a provision that requires public companies to hold an advisory stockholder vote to approve or disapprove the compensation of their named executive officers. The Dodd-Frank Act also included a provision providing stockholders of a public company the opportunity to vote, on an advisory basis, on how frequently they would like the company to hold an advisory vote on the compensation of executive officers. At the 2011 annual meeting, the Companys stockholders approved the Boards recommendation that an advisory vote on executive compensation be conducted annually. Accordingly, we are conducting an advisory vote to approve the compensation of the Companys executive officers again this year.

The Compensation Committee believes that executive compensation should align with the stockholders interests, without encouraging excessive or unnecessary risk. This compensation philosophy and the program structure approved by the Compensation Committee are central to the Companys ability to attract, retain, and motivate individuals who can achieve our goals and provide stability in leadership. Our philosophies and goals with respect to compensation are explained in detail below under the subheading Executive Compensation Compensation Discussion and Analysis Compensation Philosophy and Objectives. A detailed description of compensation paid to our named executive officers in 2015 follows that discussion and analysis.

11

This advisory vote, which is not binding on the Company, the Compensation Committee, or the Board, is intended to address the overall compensation of our executive officers and the policies and practices described in this proxy statement. The Board and the Compensation Committee value the opinions of our stockholders and will take into account the outcome of the vote when considering future executive compensation arrangements.

The Board of Directors unanimously recommends that you vote, on an advisory basis, FOR the following resolution:

RESOLVED, that the compensation paid to our named executive officers, as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K adopted by the SEC, including the Compensation Discussion and Analysis, executive compensation tables and accompanying footnotes and narrative discussion, is hereby approved.

The above-referenced disclosures appear below under the heading Executive Compensation in this proxy statement.

The above resolution will be deemed to be approved if it receives the affirmative vote of a majority of the votes cast at the Annual Meeting, provided that a quorum is present at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the vote.

ITEM 3 DISCRETIONARY AUTHORITY OF PROXIES TO VOTE ON OTHER MATTERS

If any other matters properly come before the Annual Meeting or any adjournments or postponements thereof requiring a vote of the stockholders, the grant of discretionary authority to Messrs. Elich and Justesen, who are named as proxies in the proxy card accompanying this proxy statement, to vote in accordance with their best judgment on such matters will be submitted to a vote of the stockholders. Such event is unlikely because the deadline for stockholders to present proposals at the Annual Meeting was January 23, 2016. This item would be deemed to be approved upon receiving the affirmative vote of a majority of the votes cast at the Annual Meeting, provided that a quorum is present at the Annual Meeting. Abstentions and broker non-votes would have no effect on the outcome of the vote.

12

MATTERS RELATING TO OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Moss Adams LLP was the Companys independent registered public accounting firm with respect to its audited financial statements for the year ended December 31, 2015. The Company expects representatives of Moss Adams LLP to be present at the Annual Meeting and to be available to respond to appropriate questions. They will have the opportunity to make a statement at the Annual Meeting if they desire to do so.

Because the audit of the Companys financial statements for the year ended December 31, 2015, was completed shortly prior to the filing of the 2015 Form 10-K on May 26, 2016, the Audit Committee has not had an opportunity to consider its selection of an independent registered public accounting firm to audit the Companys annual financial statements for the year ended December 31, 2016. Accordingly, the Companys stockholders are not being asked to ratify the Audit Committees selection of auditors at the Annual Meeting.

Fees Paid to Principal Independent Registered Public Accounting Firm

The following fees were billed by Moss Adams LLP for professional services rendered to the Company in fiscal 2014 and 2015:

| 2014 | 2015 | |||||||

| Audit Fees(1) |

$ | 482,000 | $ | 1,212,000 | ||||

| Audit-Related Fees(2) |

$ | 42,500 | $ | 50,000 | ||||

| Tax Fees(3) |

$ | 14,000 | $ | 500 | ||||

| All Other Fees |

| | ||||||

| (1) | Consists of fees for professional services for the audit of the Companys annual financial statements for the year shown and for review of financial statements included in quarterly reports on Form 10-Q filed during that year. Includes estimated final billing of $277,000. |

| (2) | Refers to subsidiary audit services that are reasonably related to the audit or review of the Companys financial statements and that are not included in audit fees and provision of a consent in connection with the Companys filing of a Registration Statement on Form S-8 in July 2015. |

| (3) | Consists primarily of tax consulting services related to analysis of certain expense deductions and non-business income exclusions from taxable income in various states in which the Company conducts its business. |

Pre-Approval Policy

The Company has adopted a policy requiring pre-approval by the Audit Committee of all fees and services of the Companys independent registered public accounting firm (the independent auditors), including all audit, audit-related, tax, and other legally permitted services. Under the policy, a detailed description of each proposed service is submitted to the Audit Committee jointly by the independent auditors and the Companys Chief Financial Officer, together with a statement from the independent auditors that such services are consistent with the SECs rules on auditor independence. The policy permits the Audit Committee to pre-approve lists of audit, audit-related, tax, and other legally-permitted services. The maximum term of any pre-approval is 12 months. Additional pre-approval is required for services not included in the pre-approved categories and for services exceeding pre-approved fee levels. The policy allows the Audit Committee to delegate its pre-approval authority to one or more of its members provided that a full report of any pre-approval decision is provided to the full Audit Committee at its next scheduled meeting. The Audit Committee pre-approved 100% of the fees described above.

13

AUDIT COMMITTEE REPORT

In discharging its responsibilities, the Audit and Compliance Committee and its individual members have met with management and with the Companys independent auditors, Moss Adams LLP, to review the audit process and the Companys accounting functions and to review and discuss the Companys audited financial statements for the year ended December 31, 2015. In addition, the Audit Committee discussed various matters with Moss Adams LLP related to the Companys consolidated financial statements, including critical accounting policies and practices, matters requiring the restatement of the Companys previously issued financial statements as discussed in the Explanatory Note at the beginning of the Companys Annual Report on Form 10-K for the year ended December 31, 2015, and the Companys internal control over financial reporting, including material weaknesses and remedial measures. The Audit Committee also received the written disclosures and the letter from Moss Adams LLP required by Rule 3526, Communication with Audit Committees Concerning Independence, issued by the Public Company Accounting Oversight Board, and has discussed with Moss Adams LLP its independence from the Company and management and any matters that may affect their objectivity and independence.

Based on its review and discussions with management and the Companys independent auditors, the Audit Committee recommended to the Board of Directors that the Companys audited financial statements be included in the Companys Annual Report on Form 10-K for the year ended December 31, 2015.

AUDIT AND COMPLIANCE COMMITTEE

Anthony Meeker, Chair

James B. Hicks, Ph.D.

Roger L. Johnson

14

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Compensation Philosophy and Objectives. The Compensation Committee (for purposes of this section, the Committee) has responsibility for establishing, implementing, and continually monitoring adherence with the Companys compensation philosophy. The goal of the Committee is to ensure that the total compensation paid to the Companys executive officers is fair, reasonable, and competitive.

The Committee believes that the most effective executive compensation program is one that is designed to reward the achievement of specific annual or long-term strategic goals by the Company. The principles underlying our compensation policies are:

| | To attract and retain qualified people; |

| | To provide competitive compensation relative to compensation paid to similarly situated executives; and |

| | To align the interests of executives to build long-term stockholder value. |

The Committee has taken steps over the past several years to cause the Companys incentive compensation program to qualify, at least in substantial part, as performance-based compensation under Internal Revenue Code Section 162(m). See Deductibility of Executive Compensation below.

At the 2015 annual meeting of stockholders, more than 97% of the votes cast with respect to the advisory vote on executive compensation approved the compensation of the Companys named executive officers. The Committee took this indication of support into consideration in reviewing the Companys executive compensation program.

2015 Executive Compensation Components. For the fiscal year ended December 31, 2015, the principal components of compensation for executive officers were:

| | Base salary; |

| | Target annual cash incentive compensation |

| | Grants of incentive stock options; and |

| | Grants of restricted stock units. |

Base Salary

Salary levels of executive officers are reviewed periodically by the Committee and the CEO as part of the performance review process, as well as upon a promotion or other change in job responsibility. In determining base salaries for executives in 2015, the Committee primarily considered:

| | Available market data; |

| | Scope of responsibilities; and |

| | Individual performance of the executive. |

In light of the significant increases in executive officer base salaries, ranging from 22% to 30%, approved in 2014, the Committee determined not to adjust salary levels for 2015.

Annual Cash Incentive Compensation

The Companys executive officers were eligible to receive cash incentive bonuses following year end for services during 2015. The target bonus amounts were set by the Committee in March 2015 as follows: Mr. Elich,

15

$560,000; Mr. Miller, $280,000; Mr. Vaughn, $280,000; and Mr. Blotz, $280,000. Of the total bonus opportunity, 75% was awarded under the Companys Annual Cash Incentive Award Plan based on achievement of objective corporate performance goals selected by the Committee from among the goals approved by the Companys stockholders in 2014. The other 25% of the total bonus opportunity was reserved for award in the Committees discretion based on its subjective assessment of each officers performance during 2015.

Achievement above or below established target levels for the corporate financial metrics results in an upward or downward adjustment in the bonus amount payable for corporate level goals. The adjustment is calculated based on a defined factor (2.5% for 2015) multiplied by the percentage by which the actual achievement of a given metric is above or below the target level. If the Company fails to achieve a specified financial target at the 80% level or above, no part of the bonus associated with that metric is earned. The maximum bonus payable is 200% of the target bonus amount.

In late March 2016, the Committee performed a subjective evaluation of the performances of Messrs. Elich, Vaughn, and Blotz during 2015. On May 13, 2016, the Committee finalized its determination of the extent to which the corporate level goals for 2015 had been satisfied. An executive must remain employed by the Company through the date of the Committees determination to be eligible to receive a bonus.

For 2015, the corporate portion of the bonus was based 50% on achievement of earnings before interest, taxes, depreciation, and amortization (EBITDA), at a target level of $37,878,000, and 50% on achievement of gross non-GAAP revenues at a target level of $3,961,260,000. The Company achieved EBITDA of $39,962,000, 6% above the target amount, and gross non-GAAP revenues of $4,016,150,000, 1% above the target amount, for 2015, resulting in non-discretionary cash incentive bonuses for Messrs. Vaughn and Blotz as shown in the Non-Equity Incentive Plan Compensation column in the Summary Compensation Table below. The Committee also approved discretionary cash bonuses in the amount of $70,000 for each of Messrs. Vaughn and Blotz. The Committee determined that, in light of recent developments at the Company, payment of a cash incentive bonus to Mr. Elich for 2015 was inappropriate. Mr. Miller was not eligible for a bonus as his employment with the Company was terminated in March 2016.

Long-Term Equity Incentive Compensation

In February 2015, the Committee determined that no cash bonuses would be paid to the Companys executive officers for services in 2014. However, the Committee believed that the executive officers should receive equity incentive compensation in light of their significant efforts on behalf of the Company as follows:

| | The Companys achievement of record gross revenues in 2014; |

| | Successful implementation of a fronted workers compensation insurance program with the ACE Group with respect to the Companys customers in California during 2014; |

| | Successful negotiation of an expanded credit facility with the Companys principal lender in December 2014; and |

| | Full compliance with applicable state workers compensation reserve requirements as of December 31, 2014. |

Accordingly, the Committee granted incentive stock options to each executive officer under the 2009 Stock Incentive Plan as shown in the Grants of Plan-Based Awards table below.

The Committee began awarding restricted stock units (RSUs) to the Companys executive officers, as well as outside directors, beginning in 2012. The change was made to provide a more immediate opportunity to receive an ownership stake in the Company than is afforded by employee stock options, and also because the Committee believes the accounting treatment of RSUs more fully reflects the cost to the Company and stockholders of equity compensation than stock options. The RSU grants are intended to serve as a significant incentive aligning the long-term interests of the executive team with the interests of the Companys stockholders.

16

In July 2015, the Committee approved additional grants of RSUs to the Companys executive officers under the Companys 2015 Stock Incentive Plan approved by the stockholders in May 2015. Mr. Elich was granted 20,000 RSUs and Messrs. Blotz, Miller, and Vaughn were each granted 10,000 RSUs. Each RSU represents a contingent right to receive one share of Common Stock. The RSUs will vest in four equal annual installments beginning in July 2016.

In late March 2016, the Committee granted additional equity awards to Messrs. Elich, Vaughn, and Blotz under the 2015 Stock Incentive Plan. The awards were in the form of performance shares, the vesting of which is conditioned on attaining specified target amounts of gross revenues, EBITDA, and net income for the year ending December 31, 2018, with issuance of shares of Common Stock in settlement of the awards, based on the market price of the shares on the settlement date, to occur no later than June 30, 2019. The dollar value of shares to be issued in settlement of the performance share awards if the target levels are achieved is as follows: Mr. Elich, $292,500; Mr. Vaughn, $120,000; and Mr. Blotz, $120,000, with one-third of the performance shares tied to achievement of each of the three financial metrics. Target award amounts are subject to upward or downward adjustment by 2.5% for each one percent by which the actual achievement of a given financial metric is above or below the target level, but not less than 80% of the target level or more than 140% of the target level. If achievement is below the 80% level, no part of the target award tied to that financial metric would be paid. At the 80% level, 50% of the target award for the related financial metric would be paid. The maximum payout is 200% of a target award. The performance share awards are not intended to replace the annual grants of RSUs to the executive officers.

Retirement Benefits

Employees, including executive officers, may participate in the Companys 401(k) defined contribution plan. The Company matches each employees contributions at a rate of 100% on the first 3% of salary deferrals and 50% on the next 2% of salary deferrals, with a maximum Company-paid match of $10,600. All executive officers participated and had contributions to the 401(k) plan matched at the maximum amount.

Change in Control Employment Agreements

The Company entered into agreements with Messrs. Elich and Vaughn in April 2011 and with Mr. Blotz in June 2015 that provide for severance benefits in the event that the officers employment is terminated by the Company without cause (as defined) or by the officer for good reason (as defined) following a change in control of the Company, as described in greater detail under Potential Payments upon Certain Terminations Following a Change in Control below. The Committee approved the agreements with the goal of providing the Companys stockholders with greater assurance of stability within senior management.

Death Benefit Agreements

The Company entered into agreements with Messrs. Elich and Vaughn in January 2014 and with Mr. Blotz in July 2015 that provide, in the event of the executive officers death, for the Company to make a lump sum payment to the executive officers designated beneficiary. These agreements are discussed in more detail under Potential Payments upon Death or Termination for Disability below.

Deductibility of Executive Compensation. The Committee reviews and considers the deductibility of executive compensation under Code Section 162(m), which limits the deductibility for federal income tax purposes of annual compensation totaling more than $1,000,000 paid to certain executive officers, with exceptions for qualifying performance-based compensation. Stock options granted under a stockholder-approved plan with an exercise price equal to fair market value on the date of grant qualify as performance-based. Until 2015, all other elements of our executive compensation program have not so qualified.

In 2014, the Compensation Committee recognized that the ongoing need to increase compensation levels to provide competitive pay to its executive officers could cause at least the CEOs compensation to exceed the

17

Section 162(m) $1,000,000 cap in the near future. As a result, the Committee recommended and the Board approved the submission of the Annual Cash Incentive Award Plan for approval by the stockholders at the 2014 annual meeting. Approval of the plan resulted in the approval of performance goals for purposes of Section 162(m). As a result, starting in 2015, target annual cash incentive bonuses awarded under the Annual Cash Incentive Award Plan subject to the achievement of objective performance goals are expected to qualify as performance-based compensation under Section 162(m).

Similarly, in early April 2015 the Committee recommended and the Board approved the submission of the 2015 Stock Incentive Plan for approval by the stockholders at the 2015 annual meeting. This plan permits the grant of various types of equity awards, some of which are designed to qualify as performance based under Section 162(m). As discussed above, the Committee granted equity based awards to the Companys executive officers in March 2016 that are intended to qualify in part as performance-based compensation under Section 162(m).

The Committee has determined to continue awarding some executive compensation, in addition to salaries and benefits, that does not meet the Section 162(m) requirements in an effort to assure that our compensation program is competitive with our peers and allows us to continue to attract and retain highly-qualified individuals with the skills and enthusiasm to generate significant value for our stockholders.

Peer Group and Survey Data for Comparison Purposes. During 2013 the Committee engaged Mercer, a nationally-recognized compensation consultant, to provide advice to the Committee regarding the structure and implementation of the Companys executive compensation program. Among other things, the Committee asked Mercer to analyze whether our compensation programs are reasonable and competitive in the marketplace. In July 2013, following discussions with the Committee, Mercer recommended and the Committee approved a peer group of 15 companies in the human resource and employment services industry and similar companies with a market capitalization ranging from a low of approximately $125,000,000 to a high of approximately $1,100,000,000. Members of the peer group include:

| CDI Corp. |

KForce Inc. |

|

| Exponent Inc. |

Korn/Ferry International |

|

| Franklin Covey Co. |

On Assignment Inc. |

|

| GP Strategies Corp. |

Performant Financial Corp. |

|

| Heidrick & Struggles Inc. |

RPX Corp. |

|

| Hill International Inc. |

Schawk Inc. |

|

| Hudson Global Inc. |

Wageworks Inc. |

|

| Intersections Inc. |

||

The peer group was developed in consultation with Mercer without consideration of individual company compensation practices, and no company was included or excluded from the peer group due to paying above-average or below-average compensation.

Mercer also provided the Committee with an analysis of compensation paid to the Companys executive officers compared to survey data for similarly sized companies in a 2012 report prepared by Mercer and a 2012/2013 survey conducted by another nationally-recognized compensation consulting firm. The survey data presented compensation amounts based on information from a large number of companies across a broad range of industries.

Based on its analysis of the peer group and survey data, Mercer advised, among other things, that the levels of actual and target total direct compensation for the Companys executive officers for 2012 placed Mr. Elich at

18

well below the 25th percentile compared to market, between the 25th and 50th percentiles for Mr. Miller, and at or above the 75th percentile for Mr. Vaughn. The Committee believes that Mr. Vaughns scope of duties and responsibilities is greater than for many of the companies included in the peer group and survey data with respect to the position of chief administrative officer, the comparison position used by Mercer for Mr. Vaughn. The Committee took the Mercer data into consideration in making decisions regarding salaries, target annual cash incentive bonuses and RSU awards for 2015.

In March 2016, the Committee authorized the Committee Chair to contact Mercer to obtain peer compensation data for the Chief Financial Officer position in light of the executive search to recruit a permanent CFO. The Committee also recently engaged Mercer to obtain an updated analysis of executive compensation data for all executive officer positions.

Summary Compensation Table

The following table sets forth information regarding compensation received by the persons serving as executive officers of the Company during 2015.

| Name and Principal Position |

Year | Salary | Bonus(1) | Stock Awards(2) |

Option Awards(3) |

Non-Equity Incentive Plan Compensation(4) |

All Other Compensation(5) |

Total Compensation |

||||||||||||||||||||||||

| Michael L. Elich |

2015 | $ | 650,000 | $ | 0 | $ | 778,000 | $ | 215,200 | $ | 0 | $ | 10,600 | $ | 1,653,800 | |||||||||||||||||

| President and Chief |

2014 | 650,000 | 0 | 978,600 | 0 | 0 | 10,400 | 1,639,000 | ||||||||||||||||||||||||

| Executive Officer |

2013 | 500,000 | 357,500 | 1,005,600 | 0 | 140,825 | 11,985 | 2,015,910 | ||||||||||||||||||||||||

| James D. Miller(6) |

2015 | $ | 325,000 | $ | 0 | $ | 389,000 | $ | 107,600 | $ | 0 | $ | 11,644 | $ | 833,244 | |||||||||||||||||

| Chief Financial |

2014 | 325,000 | 0 | 489,300 | 0 | 0 | 11,295 | 825,595 | ||||||||||||||||||||||||

| Officer |

2013 | 265,000 | 159,375 | 502,800 | 0 | 74,637 | 11,095 | 1,012,907 | ||||||||||||||||||||||||

| Gregory R. Vaughn |

2015 | $ | 400,000 | $ | 70,000 | $ | 389,000 | $ | 107,600 | $ | 228,375 | $ | 10,600 | $ | 1,205,575 | |||||||||||||||||

| Chief Operating |

2014 | 400,000 | 0 | 489,300 | 0 | 0 | 10,400 | 899,700 | ||||||||||||||||||||||||

| OfficerCorporate |

2013 | 325,000 | 181,875 | 502,800 | 0 | 91,536 | 10,200 | 1,111,411 | ||||||||||||||||||||||||

| Operations |

||||||||||||||||||||||||||||||||

| Gerald R. Blotz(7) |

2015 | $ | 400,000 | $ | 70,000 | $ | 389,000 | $ | 107,600 | $ | 228,375 | $ | 10,600 | $ | 1,205,575 | |||||||||||||||||

| Chief Operating |

2014 | 325,000 | 0 | 889,277 | 0 | 0 | 10,400 | 1,224,677 | ||||||||||||||||||||||||

| OfficerField |

||||||||||||||||||||||||||||||||

| Operations |

||||||||||||||||||||||||||||||||

| (1) | The amounts shown represent discretionary cash bonuses awarded by the Compensation Committee based on its evaluation of each officers individual performance. Additional information regarding the Companys annual cash incentive bonus program appears under the subheading Compensation Discussion and Analysis above. |

| (2) | Reflects the grant date fair value of RSUs granted to executive officers using the closing price of the Common Stock on the grant date. Each RSU represents a contingent right to receive one share of Common Stock. The RSUs vest in four equal annual installments beginning one year after the grant date and will be settled by delivery of unrestricted shares of Common Stock on the vesting date. Vesting of the RSUs would accelerate upon a change in control or a participants death or termination of employment by reason of disability. |

| (3) | The amounts shown represent the grant date fair value of employee stock options under the Companys 2009 Stock Incentive Plan. The actual value to be received pursuant to the option awards is dependent on the appreciation in our stock price prior to the exercise or expiration of the options. Additional details regarding the terms of outstanding stock options held by the named executive officers are described below under Incentive Compensation. Assumptions used in calculating grant date fair value are described in Note 11 to the consolidated financial statements included in the 2015 Form 10-K. |

| (4) | Amounts shown represent performance-based cash bonuses paid pursuant to the Companys annual cash incentive bonus program in effect during the years shown. Additional information regarding the bonus program appears under the subheading Compensation Discussion and Analysis above. As a result of the termination of Mr. Millers employment in March 2016, his award under the Annual Cash Incentive Award Plan for 2015 was forfeited. |

| (5) | Amounts shown for 2015 include $10,600 in employer contributions to the 401(k) plan for each executive officer and, for Mr. Miller, $1,044 in reimbursement of personal income taxes relating to personal use of a company- |

19

| owned property. No executive officer received perquisites or other personal benefits with a total value exceeding $10,000 during the years covered by the table. |

| (6) | All unvested RSUs and unexercised stock options were cancelled effective immediately upon the termination of Mr. Millers employment in March 2016. |

| (7) | Mr. Blotz was appointed as an executive officer effective May 1, 2014. |

Incentive Compensation

The following table sets forth information regarding awards under the Companys Annual Cash Incentive Award Plan, the 2009 Stock Incentive Plan, and the 2015 Stock Incentive Plan to the named executive officers during the year ended December 31, 2015.

Grants of Plan-Based Awards for the Year Ended December 31, 2015

| Name |

Grant Date | Approval Date |

Estimated potential payouts under |

All Other Stock Awards: Number of Shares of Stock or Units (#)(2) |

All Other Option Awards: Number of Shares Underlying Options(3) |

Exercise or Base Price of Option Awards(4) |

Grant Date Fair Value of Stock and Option Awards(5) |

|||||||||||||||||||||||||||||

| Threshold(1) | Target(1) | Maximum(1) | ||||||||||||||||||||||||||||||||||

| Michael L. Elich |

02/02/2015 | 02/02/2015 | 20,000 | $ | 29.99 | $ | 599,800 | |||||||||||||||||||||||||||||

| 03/06/2015 | 03/06/2015 | $ | 210,000 | $ | 420,000 | $ | 840,000 | |||||||||||||||||||||||||||||

| 07/01/2015 | 06/25/2015 | 20,000 | $ | 778,000 | ||||||||||||||||||||||||||||||||

| James D. Miller(6) |

02/02/2015 | 02/02/2015 | 10,000 | $ | 29.99 | $ | 299,900 | |||||||||||||||||||||||||||||

| 03/06/2015 | 03/06/2015 | $ | 105,000 | $ | 210,000 | $ | 420,000 | |||||||||||||||||||||||||||||

| 07/01/2015 | 06/25/2015 | 10,000 | $ | 389,000 | ||||||||||||||||||||||||||||||||

| Gregory R. Vaughn |

02/02/2015 | 02/02/2015 | 10,000 | $ | 29.99 | $ | 299,900 | |||||||||||||||||||||||||||||

| 03/06/2015 | 03/06/2015 | $ | 105,000 | $ | 210,000 | $ | 420,000 | |||||||||||||||||||||||||||||

| 07/01/2015 | 06/25/2015 | 10,000 | $ | 389,000 | ||||||||||||||||||||||||||||||||

| Gerald R. Blotz |

02/02/2015 | 02/02/2015 | 10,000 | $ | 29.99 | $ | 299,900 | |||||||||||||||||||||||||||||

| 03/06/2015 | 03/06/2015 | $ | 105,000 | $ | 210,000 | $ | 420,000 | |||||||||||||||||||||||||||||

| 07/01/2015 | 06/25/2015 | 10,000 | $ | 389,000 | ||||||||||||||||||||||||||||||||

| (1) | Represents the potential annual non-discretionary cash incentive bonus amounts under the Companys Annual Cash Incentive Award Plan based on the level of achievement of corporate performance goals as described under Compensation Discussion and Analysis above. The target amounts were payable if the overall achievement level was 100%. For each percentage point that achievement of the goal falls above or below the target level in a particular year, the bonus amount attributable to that goal is increased or reduced by 2.5%; provided the maximum bonus is 200% of target and no amounts are payable for achievement at 80% of the target levels or below. Actual bonuses paid are shown in the Summary Compensation Table above. |

| (2) | Reflects the grant of RSUs under the 2015 Stock Incentive Plan. Each RSU represents a contingent right to receive one share of Common Stock. The RSUs vest in four equal annual installments beginning on the one-year anniversary of the grant date, and will be settled by delivery of unrestricted shares of Common Stock on the vesting date. Vesting of the RSUs would accelerate upon a change in control or a participants death or termination of employment by reason of disability. |

| (3) | Reflects stock options granted under the 2009 Stock Incentive Plan that vest in four equal annual installments beginning one year after the date of grant and expire 10 years after the date of grant. |

| (4) | The exercise price is equal to the closing sale price of our Common Stock on the date of grant. |

| (5) | The amounts shown represent the grant date fair value of RSUs and stock options calculated in accordance with ASC Topic 718 and based on the closing sale price of the Common Stock on the respective grant date. |

20