DEF 14A: Definitive proxy statements

Published on April 24, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

Barrett Business Services, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

|

1) |

Title of each class of securities to which transaction applies: |

|

|

2) |

Aggregate number of securities to which transaction applies: |

|

|

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

4) |

Proposed maximum aggregate value of transaction: |

|

|

5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

1) |

Amount Previously Paid: |

|

|

2) |

Form, Schedule or Registration Statement No.: |

|

|

3) |

Filing Party: |

|

|

4) |

Date Filed: |

BARRETT BUSINESS SERVICES, INC.

8100 N.E. Parkway Drive, Suite 200

Vancouver, Washington 98662

(360) 828-0700

April 24, 2019

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Barrett Business Services, Inc., to be held at 1:00 p.m., Pacific Time, on Wednesday, May 29, 2019, at 8100 N.E. Parkway Drive, Suite 60, Vancouver, Washington 98662.

Matters to be presented for action at the meeting include the election of directors, approval of an Employee Stock Purchase Plan, an advisory vote to approve our executive compensation program, ratification of selection of our independent auditors and a stockholder proposal. We will also act on such other business as may properly come before the meeting or any postponements or adjournments thereof.

We look forward to speaking with those of you who are able to attend the meeting in person. Whether or not you can attend, please sign, date, and return your proxy as soon as possible, or follow the instructions for telephone or Internet voting on the accompanying proxy. If you do attend the meeting and wish to vote in person, you may revoke your proxy and vote personally.

|

Sincerely, |

|

|

|

Michael L. Elich |

|

President and Chief Executive Officer |

BARRETT BUSINESS SERVICES, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 29, 2019

You are invited to attend the annual meeting of stockholders (the "Annual Meeting") of Barrett Business Services, Inc., a Maryland corporation (the "Company"), to be held at 8100 N.E. Parkway Drive, Suite 60, Vancouver, Washington 98662, on Wednesday, May 29, 2019, at 1:00 p.m., Pacific Time.

Only stockholders of record at the close of business on April 12, 2019, will be entitled to notice of and to vote at the Annual Meeting or any postponements or adjournments thereof.

The Annual Meeting is being held to consider and vote on the following matters:

|

|

1. |

Election of directors; |

|

|

2. |

Approval of the Company’s 2019 Employee Stock Purchase Plan; |

|

|

3. |

Advisory vote to approve our executive compensation; |

|

|

4. |

Ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2019; |

|

|

5. |

A stockholder proposal; and |

|

|

6. |

The transaction of any other business that may properly come before the Annual Meeting or any postponements or adjournments thereof. |

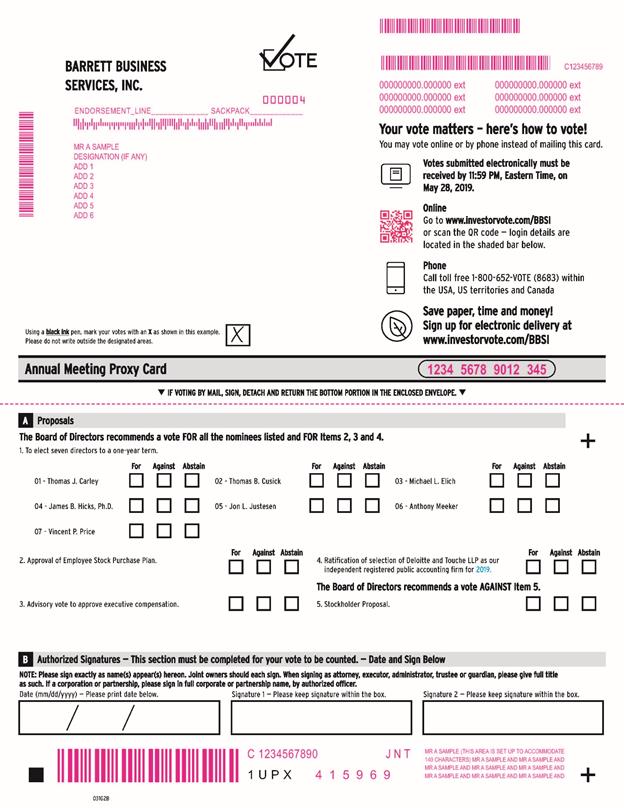

Please sign and date the accompanying proxy and return it promptly in the enclosed postage-paid envelope, or follow the instructions on the proxy for telephone or Internet voting, to avoid the expense of further solicitation. If you attend the Annual Meeting, you may revoke your proxy and vote your shares in person.

|

By Order of the Board of Directors |

|

|

|

Gary E. Kramer |

|

Secretary |

Vancouver, Washington

April 24, 2019

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 29, 2019:

The proxy statement for the 2019 annual meeting of stockholders and 2018 annual report to stockholders are available at http://shareholdermaterial.com/bbsi

BARRETT BUSINESS SERVICES, INC.

8100 N.E. Parkway Drive, Suite 200

Vancouver, Washington 98662

(360) 828-0700

PROXY STATEMENT

2019 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the "Board") of Barrett Business Services, Inc., a Maryland corporation (the "Company"), to be voted at the annual meeting of stockholders to be held on May 29, 2019 (the "Annual Meeting"), and any postponements or adjournments thereof. The proxy statement and accompanying form of proxy were first mailed to stockholders on approximately April 24, 2019.

VOTING, REVOCATION, AND SOLICITATION OF PROXIES

When a proxy in the accompanying form is properly executed and returned, the shares represented will be voted at the Annual Meeting in accordance with the instructions specified in the proxy. If no instructions are specified, the shares will be voted FOR Items 1, 2, 3 and 4, and AGAINST Item 5 in the accompanying Notice of Annual Meeting of Stockholders.

If you are a beneficial holder and do not provide specific voting instructions to your broker, the firm that holds your shares will not be authorized to vote your shares (known as a "broker non-vote") on non-routine matters under the New York Stock Exchange rules governing discretionary voting by brokers. Other than the ratification of the selection of our independent auditors, the action items being submitted to a vote at the Annual Meeting are not routine items. We encourage you to return your proxy promptly, or follow the instructions for telephone or Internet voting on the proxy, even if you plan to attend the Annual Meeting.

Any proxy given pursuant to this solicitation may be revoked by the person giving the proxy at any time prior to its exercise by written notice to the Secretary of the Company of such revocation, by a later-dated proxy received by the Company, or by attending the Annual Meeting and voting in person. The mailing address of the Company’s principal executive offices is 8100 N.E. Parkway Drive, Suite 200, Vancouver, Washington 98662. If your shares are held through a broker or other nominee, please follow their directions included with this proxy statement on how to vote your shares and, if necessary, how to change or revoke your voting instructions.

The solicitation of proxies will be made primarily by mail, but proxies may also be solicited personally or by telephone or email by our directors and officers without additional compensation for such services. The Company will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for their reasonable expenses in sending proxy materials to stockholders. All costs of solicitation of proxies will be borne by the Company.

OUTSTANDING VOTING SECURITIES

The close of business on April 12, 2019, has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. On the record date, the Company had 7,409,832 shares of Common Stock, $.01 par value ("Common Stock") outstanding. Each share of Common Stock is entitled to one vote at the Annual Meeting. The presence, in person or by proxy, of stockholders entitled to cast a majority of all votes entitled to be cast at the Annual Meeting is required to constitute a quorum. Abstentions and broker non-votes, if any, will be considered present for purposes of determining the presence of a quorum.

1

ITEM 1 – ELECTION OF DIRECTORS

The directors will be elected at the Annual Meeting to serve until the next annual meeting of stockholders and until their successors are elected and qualify. Our Charter and Bylaws authorize the Board to set the number of positions on the Board within a range of three to nine, with the current number fixed at seven. Vacancies on the Board, including vacancies resulting from an increase in the number of positions, may be filled by the Board for a term ending with the next annual meeting of stockholders and when a successor is duly elected and qualifies.

Provided that a quorum is present at the Annual Meeting, a nominee will be elected if the nominee receives the affirmative vote of a majority of the total votes cast on his election (that is, the number of shares voted "for" a director nominee must exceed the number of votes cast "against" that nominee). Each of our director nominees is currently serving on the Board. Even if a nominee who is currently serving as a director is not re-elected, Maryland law provides that the director would continue to serve on the Board as a "holdover director." But under our Bylaws, if stockholders do not re-elect a director, the director is required to submit his resignation to the Board. In that event, our Nominating and Governance Committee (the "Nominating Committee") would recommend to the Board whether to accept or reject the resignation. The Board would then consider and act on the Nominating Committee's recommendation, publicly disclosing its decision and the reasons supporting it within 90 days following the date that the election results were certified.

A duly executed proxy will be voted FOR the election of the nominees named below, other than proxies marked to vote "against" or to "abstain" from voting on one or more nominees. Shares not represented in person or by proxy at the Annual Meeting, shares voted to "abstain," and broker non-votes, if any, will have no effect on the outcome of the election of directors.

The Board recommends that stockholders vote FOR each of the nominees named below to serve as a director until the next annual meeting of stockholders and his successor is duly elected and qualifies. If for some unforeseen reason a nominee should become unavailable for election, the proxy may be voted for the election of such substitute nominee as may be designated by the Board.

The following table sets forth information with respect to each person nominated for election as a director, including their current principal occupation or employment and ages as of April 1, 2019. All nominees for election as directors are current Board members.

|

Name |

|

Principal Occupation |

|

Age |

|

Director Since |

|

Thomas J. Carley |

|

Chief Operating Officer of Urth Organic Corporation |

|

60 |

|

2000 |

|

|

|

|

|

|

|

|

|

Thomas B. Cusick |

|

Executive Vice President and Chief Operating Officer of Columbia Sportswear Company, an outdoor apparel, footwear, accessories, and equipment company listed on the Nasdaq Global Select Market |

|

51 |

|

2016 |

|

|

|

|

|

|

|

|

|

Michael L. Elich |

|

President and Chief Executive Officer of the Company |

|

54 |

|

2011 |

|

|

|

|

|

|

|

|

|

James B. Hicks, Ph.D. |

|

Professor of Research in Biological Sciences, University of Southern California |

|

72 |

|

2001 |

|

|

|

|

|

|

|

|

|

Jon L. Justesen |

|

Co-owner and Chief Executive Officer of Justesen Ranches located in eastern Oregon |

|

67 |

|

2004 |

|

|

|

|

|

|

|

|

|

Anthony Meeker |

|

Retired Managing Director of Victory Capital Management, Inc., Cleveland, Ohio, an investment management firm |

|

80 |

|

1993 |

|

|

|

|

|

|

|

|

|

Vincent P. Price |

|

Executive Vice President and Chief Financial Officer of Cambia Health Solutions, a nonprofit health insurance corporation |

|

55 |

|

2017 |

2

The Nominating Committee evaluates the Board’s membership from time to time in determining whether to recommend that incumbent directors be nominated for re-election. In this regard, the Nominating Committee considers whether the professional and educational background, business experience and expertise represented on the Board as a whole enables it to satisfy its oversight responsibilities in an effective manner.

The experience, qualifications, attributes and skills of each director of the Company, including his business experience during the past five years, are described below.

Thomas J. Carley has served as Chief Operating Officer and a director of Urth Organic Corporation, a privately held distributor of organic microbial fertilizers and soil amendments, since August 2018. He previously acted as the financial principal of Portal Capital, an investment management company that he co-founded, from July 2006 to June 2018. Mr Carley served as the Company’s interim Principal Financial and Accounting Officer from March 4, 2016 until August 10, 2016, and remained an employee of the Company through August 31, 2016. Mr. Carley has an MBA from the University of Chicago Graduate School of Business, with an emphasis in Accounting and Finance, and an A.B. degree in Economics and Classics from Dartmouth College.

Mr. Carley brings financial expertise to the Company and the Board through his prior experience in the areas of public accounting and financial analysis, including experience as an accountant with Price Waterhouse & Co., now known as PricewaterhouseCoopers LLP, as well as President and Chief Financial Officer of Jensen Securities, a securities and investment banking firm in Portland, Oregon, for eight years in the 1990’s. He is chair of the Board’s Risk Management Committee created in January 2017.

Thomas B. Cusick has served as Executive Vice President and Chief Operating Officer of Columbia Sportswear Company, an outdoor and active lifestyle apparel and footwear company listed on the Nasdaq Global Select Market, since July 2017. He previously served as Columbia’s Executive Vice President and Chief Financial Officer from 2015 until 2017. He was promoted to Chief Financial Officer in 2009 and served as Vice President, Corporate Controller and Chief Accounting Officer of Columbia from 2002 until 2009. Prior to joining Columbia, Mr. Cusick spent seven years with Cadence Design Systems, Inc. (and OrCAD, a company acquired by Cadence in 1999), a public company that develops system design enablement solutions, and certain of its subsidiaries. He began his career at the public accounting firm of KPMG, LLP. He received a B.S. degree in accounting from the University of Idaho.

Mr. Cusick brings financial expertise to the Board through his experience as an executive officer of a public company and his work with public company audit committees. He is chair of the Board’s Audit and Compliance Committee.

Michael L. Elich joined the Company in October 2001 as Director of Business Development. He was appointed Vice President and Chief Operating Officer in May 2005. He was appointed interim President and Chief Executive Officer in January 2011 upon the death of William W. Sherertz. Effective February 17, 2011, Mr. Elich was elected to the Board and his position as President and Chief Executive Officer was confirmed. From 1995 to 2001, Mr. Elich served as Executive Vice President and Chief Operating Officer of Skills Resource Training Center, a staffing services company with offices in Oregon, Washington and Idaho that was later acquired by the Company in 2004. Mr. Elich graduated from Montana State University with a B.S. degree in Economic Science. He is a member of Tournament Golf Foundation, a non-profit organization that has donated more than $18 million to charities since its inception in 1972.

Mr. Elich brings to the Board his deep knowledge of the Company’s operations and industry and significant management experience.

3

James B. Hicks, Ph.D., has been Professor of Research in Biological Sciences at the University of Southern California since 2014. From 2004 until 2016, Dr. Hicks was Professor of Biomedical Research at Cold Spring Harbor Laboratory in New York. He is a co-founder and director of Virogenomics, Inc., a private biotechnology company located in the Portland, Oregon metropolitan area, for which he previously served as Chief Technology Officer. Dr. Hicks was a director of AVI BioPharma, Inc. (now Sarepta Therapeutics, Inc.), from 1997 until October 2007 and a member of AVI BioPharma, Inc.’s audit committee and chair of its compensation committee. Between 1990 and 2006, Dr. Hicks co-founded five biotech or internet companies. He completed a postdoctoral program at Cornell University, received a Ph.D. from the University of Oregon, and received a B.A. degree from Willamette University.

Through his experience with other public companies, Dr. Hicks provides valuable business and financial insight to the Board. He is chair of the Board’s Compensation Committee.

Jon L. Justesen is co-owner and Chief Executive Officer of Justesen Ranches, which operates in four counties in two states. He is also owner and President of Buckhollow Ranch, Inc., and has 35 years of experience creating wealth as a private investor. During Mr. Justesen’s 40 plus years of successfully growing and managing agribusinesses in eastern Oregon, he has overseen operations involving timber, wheat and cattle production, property management and development, and resource-based recreational activities.

Mr. Justesen brings to the Board leadership and business management skills developed during his lifelong career managing substantial ranching operations. He also provides the Company with connections to potential customers through his personal network of business contacts developed in several geographic markets in which the Company operates. Mr. Justesen is chair of the Board’s Nominating Committee.

Anthony Meeker serves as Chairman of the Board. He retired in 2003 as a Managing Director of Victory Capital Management, Inc. (formerly known as Key Asset Management, Inc.), where he was employed for 10 years. Mr. Meeker was previously a director of First Federal Savings and Loan Association of McMinnville, Oregon and Oregon Mutual Insurance. He also serves on the board of two charitable organizations, MV Advancements, which provides employment, residential, and community services to clients with disabilities, and Oregon State Capitol Foundation. From 1987 to 1993, Mr. Meeker was Treasurer of the State of Oregon. His duties as state treasurer included investing the assets of the state, including the then $26 billion state pension fund, managing the state debt, and supervising all cash management programs. Mr. Meeker also managed the workers’ compensation insurance reserve fund of the State Accident Insurance Fund, providing oversight to ensure adequate actuarial reserves. He received a B.A. degree from Willamette University.

Mr. Meeker’s experience in the insurance industry assists the Company in managing risk with respect to workers’ compensation and overseeing its captive insurance subsidiaries. Mr. Meeker also brings leadership skills and a unique insight as a result of his public service as state treasurer and service on other corporate boards.

Vincent P. Price is Executive Vice President and Chief Financial Officer of Cambia Health Solutions, a nonprofit corporation headquartered in Portland, Oregon, and dedicated to transforming health care by creating a person focused and economically sustainable system through health insurance plans and related products and services. Mr. Price joined Cambia in 2009. Prior to joining Cambia, he spent 15 years as a senior finance executive with Intel Corporation, a leader in the design and manufacturing of advanced integrated digital technology platforms, followed by seven years as a consultant to start-up companies. He serves on the board of trustees of BCS Financial’s Plan Investment Fund and the Oregon Health Sciences University Foundation. He received his bachelor's degree in business from South Dakota State University. His Master of Business Administration is from Arizona State University.

Mr. Price brings his business, financial, and risk management experience as an executive officer of a large health care organization to the Board.

The Board recommends that stockholders vote FOR each of the nominees named above.

4

Litigation Involving Directors and Officers

As described below and in more detail in Note 12 to our audited financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2018 (the "2018 Form 10-K"), the Company has been involved in certain legal proceedings that also may involve our directors and certain officers.

On June 17, 2015, a shareholder derivative lawsuit was filed against the Company, its then directors and certain of its officers and a former officer in the Circuit Court for Baltimore City, Maryland. The complaint alleged breaches of fiduciary duty, unjust enrichment and other violations of law and sought various remedies. The Court issued an order dated December 31, 2018, dismissing the action for lack of personal jurisdiction over the officers and directors named in the suit.

We have indemnification agreements with each of our current directors and certain of our executive officers, under which we are generally required to indemnify each such director or officer against expenses, including attorney fees, judgments, fines and settlements, arising from the claims described above (subject to certain exceptions, including liabilities resulting from conduct committed in bad faith or active and deliberate dishonesty or resulting in actual receipt of an improper personal benefit in money, property, or services). For a more detailed discussion of indemnification of our directors and officers, see "Related Person Transactions" below.

Meetings and Committees OF THE BOARD OF DIRECTORS

The Board held six meetings in 2018. Each director attended at least 75% of the total number of the meetings of the Board and the meetings held by each committee of the Board on which he served during his respective periods of service in 2018.

The Company does not have a policy regarding directors' attendance at the Company's annual meeting of stockholders. All of the incumbent directors attended last year's annual meeting.

The Board has determined that Messrs. Carley, Cusick, Hicks, Justesen, Meeker, and Price are independent directors as defined in Rule 5605(a)(2) of the listing standards applicable to companies listed on The Nasdaq Stock Market.

Board Leadership Structure

Michael L. Elich has served as the Company's Chief Executive Officer since January 20, 2011, and as a director since February 17, 2011. Anthony Meeker, a long-time outside director of the Company, serves as Chairman of the Board. Mr. Meeker is an ex officio member of each Board committee of which he is not a voting member.

Each of our directors other than Mr. Elich, including each member of the Board’s audit, nominating and compensation committees, is an independent director under the Nasdaq listing rules. The outside directors also meet at least two times per year in executive session without the President and Chief Executive Officer or other management being present.

5

The Board believes that its leadership structure reflecting the separation of the Chairman and Chief Executive Officer positions serves the best interests of the Company and its stockholders by giving an independent director a direct and significant role in establishing priorities and the strategic direction and oversight of the Company. The Board believes that the manner in which it oversees risk management at the Company has not affected its leadership structure.

The Board’s Role in Risk Oversight

The Company's management is responsible for identifying, assessing and managing the material risks facing the Company. The Board has historically performed an important role in the review and oversight of risk, and generally oversees risk management practices and processes. The Board, either as a whole or through the Audit and Compliance Committee (the “Audit Committee”), the Risk Management Committee, and other Board committees, periodically discusses with management strategic and financial risks associated with the Company's operations, their potential impact on the Company, and the steps taken to manage these risks.

While the Board is ultimately responsible for risk oversight, the Board's committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. In particular, the Audit Committee focuses on financial and enterprise risk and, through discussions by the Audit Committee or its Chair with management and the Company’s independent registered public accounting firm (the “independent auditors”), oversees the Company's policies and practices with respect to risk and particular areas of risk exposure. The Audit Committee also assists the Board in fulfilling its duties and oversight responsibilities relating to the Company's compliance and ethics programs. The Nominating Committee oversees the functioning of the Board and its committees, the Company's corporate governance practices, and succession planning for the Company's executive positions. The Compensation Committee monitors the Company's incentive compensation programs to assure that management is not encouraged to take actions involving excessive risk. The Risk Management Committee oversees the Company's workers' compensation insurance and other insured and self-insured risks, as well as risks associated with the Company's investment portfolio and information technology.

Audit and Compliance Committee

The Audit Committee reviews and pre-approves audit and legally-permitted non-audit services provided by the independent auditors, makes decisions concerning the engagement or discharge of the independent auditors, and reviews with management and the independent auditors the results of their audit, the adequacy of internal accounting controls, and the quality of financial reporting. The Audit Committee also oversees the Company's Code of Business Conduct and Code of Ethics for Senior Financial Officers. It reviews for potential conflicts of interest, and determines whether or not to approve, any transaction by the Company with a director or officer (including their family members) that would be required to be disclosed in the Company's annual proxy statement. The Audit Committee held four meetings in 2018.

The current members of the Audit Committee are Messrs. Cusick (chair) and Meeker and Dr. Hicks. The Board has determined that Thomas B. Cusick is qualified to be an "audit committee financial expert" as defined by the SEC's rules under the Securities Exchange Act of 1934 (the "Exchange Act"). The Board has also determined that each current member of the Audit Committee meets the financial literacy and independence requirements for audit committee membership specified in applicable rules of the Securities and Exchange Commission (the “SEC”) under the Exchange Act and in listing standards applicable to companies listed on The Nasdaq Stock Market. The Audit Committee's activities are governed by a written charter, a copy of which is available on the Company's website at www.barrettbusiness.com in the "Investor Relations" section.

Compensation Committee

The Compensation Committee reviews the compensation of executive officers of the Company and makes recommendations to the Board regarding base salaries and other forms of compensation to be paid to executive officers, including decisions to grant stock options and other stock-based awards. The current members of the Compensation Committee are Dr. Hicks (chair) and Messrs. Cusick, Justesen and Price, each of whom is "independent" as defined in Rule 5605(a)(2) and Rule 5605(d)(2)(A) of the listing standards for companies listed on The Nasdaq Stock Market. The Compensation Committee held nine meetings in 2018.

6

The Compensation Committee's responsibilities are outlined in a written charter, a copy of which is available on the Company's website at www.barrettbusiness.com in the "Investor Relations" section. The Compensation Committee is charged with carrying out the Board's overall responsibilities relating to compensation of the Company's executive officers and directors. Its specific duties include reviewing the Company's cash incentive and equity compensation programs for executive officers and director compensation arrangements, and recommending changes to the Board as it deems appropriate. In the course of reviewing the Company's compensation policies and practices, the Compensation Committee has considered whether the Company's compensation program encourages employees to take risks that are reasonably likely to have a material adverse effect on the Company. The Committee believes that the Company's compensation program is not likely to have that effect.

The Chief Executive Officer reviews the performance of each executive officer (other than himself) and may make recommendations to the Compensation Committee regarding salary adjustments, stock-based awards and the selection, target amounts and satisfaction of performance goals for cash and stock incentive awards. The Compensation Committee is responsible for annually evaluating the CEO's performance and establishing his base salary and incentive compensation. The Company's Chief Financial Officer may attend meetings of the Compensation Committee at the invitation of the Committee chair to provide information relevant to the Committee's determination of the satisfaction of corporate performance goals tied to cash and stock incentive compensation and the development of appropriate corporate performance targets for future awards of incentive compensation, as well as financial and accounting issues associated with the Company's executive compensation program. The Compensation Committee exercises its own discretion in accepting or modifying the CEO's recommendations regarding the performance and compensation of the Company's other executive officers. If present at a Compensation Committee meeting, the CEO and CFO are each excused during discussions of his compensation.

The Compensation Committee also administers the Company's stock incentive plans. The Compensation Committee, as it deems appropriate and as permitted by applicable law, may delegate its responsibilities to a subcommittee under the Company's 2015 Stock Incentive Plan, which was approved at the 2015 annual meeting of stockholders. The Compensation Committee has delegated authority, within specified limits, to the CEO to make stock-based awards in his discretion to corporate and branch personnel who are not executive officers.

Under its charter, the Compensation Committee has the sole authority to retain the services of outside consultants to assist it in making decisions regarding executive compensation and other compensation matters for which it is responsible. For several years, the Compensation Committee has engaged Mercer, a nationally recognized compensation consultant, to assist the committee in structuring and implementing the Company's executive compensation program. The Compensation Committee solicited information from Mercer regarding any potential conflicts of interest prior to each engagement and determined that no conflicts existed.

In the fall of 2016, the Compensation Committee requested that Mercer update its analysis of the Company's peer group, as discussed in greater detail under "Executive Compensation--Compensation Discussion and Analysis" below. Also at the Compensation Committee's request, in December 2016, Mercer performed an assessment of the Company's compensation program for non-employee directors compared to the Company's peer group; the committee reviewed Mercer's analysis in approving changes to the director compensation program effective July 1, 2017. In the fall of 2018, the Compensation Committee again retained Mercer to assist in updating the Company’s peer group used for comparison purposes as well as providing an analysis of the competitiveness of the Company’s executive compensation program by executive officer position based on published survey data for similarly sized entities in the services industry and benchmarking data for companies in the updated peer group. The Compensation Committee used the Mercer report in setting executive compensation levels for salaries, cash incentive target bonuses and target stock-based awards for 2019.

Compensation Committee Interlocks and Insider Participation

Dr. Hicks and Messrs. Cusick, Justesen and Price served on the Compensation Committee during 2018. During 2018, none of the Company's executive officers served on the board of directors of any entity whose directors or officers serve on the Compensation Committee.

7

Nominating and Governance Committee

The Nominating Committee evaluates and recommends candidates for nomination by the Board in director elections and otherwise assists the Board in determining and evaluating the composition of the Board and its committees. The Nominating Committee is also responsible for developing corporate governance policies, principles and guidelines for the Company and succession planning with respect to the Company's executive officers. The current members of the Nominating Committee are Messrs. Justesen (chair), Carley, and Price. The Nominating Committee held one meeting in 2018.

The Board has determined that each current member of the Nominating Committee is an independent director as defined in Rule 5605(a)(2) of the listing standards applicable to companies listed on The Nasdaq Stock Market. The Nominating Committee is governed by a written charter, which is available on the Company's website at www.barrettbusiness.com in the "Investor Relations" section.

The Nominating Committee does not have any specific, minimum qualifications for director candidates. In evaluating potential director nominees, the Nominating Committee will consider:

|

|

• |

The candidate’s ability to commit sufficient time to the position; |

|

|

• |

Professional and educational background that is relevant to the financial, regulatory, industry and business environment in which the Company operates; |

|

|

• |

Demonstration of ethical behavior; |

|

|

• |

Whether the candidate contributes to the goal of bringing diverse perspectives, business experience, and expertise to the Board; and |

|

|

• |

The need to satisfy independence and financial expertise requirements relating to Board and committee composition. |

While the Board has not adopted a formal policy with respect to the consideration of diversity in identifying director nominees, the Nominating Committee believes it is important that the Board as a whole represent a diversity of backgrounds, experience, gender and race. Accordingly, the Nominating Committee has committed to continue its search for women and minority candidates to include in the pool from which future Board members will be chosen.

The Nominating Committee relies on its periodic evaluations of the Board in determining whether to recommend nomination of current directors for re-election. The Nominating Committee may poll current directors for suggested candidates or engage an executive search firm when called upon to identify new director candidates, because of a vacancy or a decision to expand the Board.

The Nominating Committee will also consider director candidates suggested by stockholders for nomination by the Board. Stockholders wishing to suggest a candidate to the Nominating Committee should do so by sending the candidate’s name, biographical information, and qualifications to: Nominating Committee Chair c/o Corporate Secretary, Barrett Business Services, Inc., 8100 N.E. Parkway Drive, Suite 200, Vancouver, Washington 98662. Candidates suggested by stockholders will be evaluated by the same criteria and process as candidates from other sources.

Risk Management Committee

The Risk Management Committee is responsible for oversight of the Company's enterprise-wide risk management program. The committee monitors the Company’s activities with regard to insurance risks; financial risks, including business models, interest rates, liquidity and the Company's investment portfolio; and technology risks, including information security and cyber defense mechanisms. The Risk Management Committee held four meetings in 2018. Its current members are Messrs. Carley (chair), Meeker, and Price.

8

DIRECTOR COMPENSATION FOR 2018

The following table summarizes compensation paid to the Company’s outside directors for services during 2018. No outside director received perquisites or other personal benefits with a total value exceeding $10,000 during 2018.

|

Name |

|

Fees Earned or Paid in Cash(1) |

|

|

Stock Awards(2)(3) |

|

|

All Other Compensation |

|

|

Total |

|

||||

|

Thomas J. Carley |

|

$ |

73,750 |

|

|

$ |

62,481 |

|

|

$ |

— |

|

|

$ |

136,231 |

|

|

Thomas B. Cusick |

|

$ |

80,000 |

|

|

$ |

62,481 |

|

|

$ |

— |

|

|

$ |

142,481 |

|

|

James B. Hicks, Ph.D. |

|

$ |

77,500 |

|

|

$ |

62,481 |

|

|

$ |

— |

|

|

$ |

139,981 |

|

|

Jon L. Justesen |

|

$ |

72,500 |

|

|

$ |

62,481 |

|

|

$ |

— |

|

|

$ |

134,981 |

|

|

Anthony Meeker |

|

$ |

112,500 |

|

|

$ |

62,481 |

|

|

$ |

— |

|

|

$ |

174,981 |

|

|

Vincent Price |

|

$ |

71,250 |

|

|

$ |

62,481 |

|

|

$ |

— |

|

|

$ |

133,731 |

|

|

(1) |

Directors (other than directors who are full-time employees of the Company, who do not receive directors’ fees) are entitled to receive an annual retainer payable monthly in cash. As of July 2017, the annual retainer was $60,000 for each outside director other than the Chairman of the Board, whose annual retainer was $100,000. Throughout 2018, committee chairs and committee members received annual retainers as follows: Audit Committee, $15,000 and $7,500; Compensation Committee, $10,000 and $5,000; Risk Management Committee, $10,000 and $5,000; and Nominating Committee, $7,500 and $3,750. |

|

(2) |

Reflects the grant date fair value of 647 restricted stock units ("RSUs") based on the closing share price as of the grant date, July 1, 2018, of $96.57 per share. Each RSU represents a contingent right to receive one share of the Company’s Common Stock. The RSUs vest in two equal annual installments beginning on July 1, 2019, and will be settled by delivery of unrestricted shares of Common Stock on the vesting date. |

|

(3) |

At December 31, 2018, the Company’s outside directors held RSUs as follows: Mr. Carley, 1,695 shares; Mr. Cusick, 1,793 shares; Dr. Hicks, 2,323 shares; Mr. Justesen, 2,323 shares; Mr. Meeker, 2,951 shares; and Mr. Price, 1,665 shares. Also as of that date, the Company’s outside directors held stock options as follows: Mr. Carley, 15,875 shares; Dr. Hicks, 13,875 shares; Mr. Justesen, 9,000 shares; and Mr. Meeker, 8,000 shares. |

CODE OF ETHICS

The Company has adopted a Code of Ethics for Senior Financial Officers ("Code of Ethics"), which is applicable to the Company's principal executive officer, principal financial officer, principal accounting officer, and controller. The Code of Ethics focuses on honest and ethical conduct, the adequacy of disclosure in financial reports of the Company, and compliance with applicable laws and regulations. The Code of Ethics is included as part of the Company's Code of Business Conduct, which is generally applicable to all of the Company's directors, officers, and employees. The Code of Business Conduct is available on the Company's website at www.barrettbusiness.com in the "Investor Relations" section.

Background and Experience of Executive Officers

In addition to Mr. Elich, whose background information is presented above under "Background and Qualifications of Directors," Gary E. Kramer, Gregory R. Vaughn, Gerald R. Blotz, and Heather E. Gould currently serve as executive officers of the Company.

9

Gary E. Kramer, age 39, joined the Company on August 1, 2016, as Vice President – Finance and serves as the Company’s Chief Financial and Accounting Officer. Prior to joining the Company, Mr. Kramer served as Senior Vice President for Global Services at Chubb Limited (formerly ACE Limited) beginning in 2013. In this role, Mr. Kramer led the Global Services team to support the growth of multinational businesses and meet the complex underwriting and servicing needs of large multinational customers. He also oversaw the delivery of sophisticated risk management products, programs, and services through all lines of business underwritten for global programs of U.S.-based companies. Between 2004 and 2013, Mr. Kramer held a variety of positions within the ACE Group companies, including Divisional Financial Officer of ACE Financial Solutions, Inc., and Senior Financial Analyst with ACE North America. Other positions held by Mr. Kramer during his career include Senior Accountant at Admiral Insurance Company from 2002 until 2004, and Treasury Analyst at Kimble Glass from 2000 until 2002.

Gregory R. Vaughn, age 63, has served as an officer of the Company since 1998. He joined the Company in July 1997 as Operations Manager. Mr. Vaughn was appointed Vice President in January 1998 and Chief Administrative Officer in February 2012. He was promoted to Chief Operating Officer-Corporate Operations in May 2014. Prior to joining the Company, Mr. Vaughn was Chief Executive Officer of Insource America, Inc., a privately-held human resource management company headquartered in Portland, Oregon, for approximately one year. Mr. Vaughn has also held senior management positions with Sundial Time Systems, Inc., and Continental Information Systems, Inc. Previously, Mr. Vaughn was employed as a technology consultant by Price Waterhouse & Co.

Gerald R. Blotz, age 49, joined the Company in May 2002 as Area Manager of the San Jose branch office. Mr. Blotz was promoted to Vice President, Chief Operating Officer-Field Operations in May 2014. Prior to joining the Company, Mr. Blotz was President and Chief Operating Officer of ProTrades Connection, where he was instrumental in building ProTrades to 44 offices in four states.

Heather E. Gould, age 45, joined the Company in March 2012 as Director of Marketing. In March 2015, she was promoted to Executive Director of Strategic Alignment. Then, in January 2017, she was promoted to Vice President and Chief Strategy Officer. Before joining the Company, Ms. Gould was Account Director at HMH Agency, an integrated communications agency in Portland, Oregon. During her 22-year career, Ms. Gould has held various positons in advertising, brand strategy and marketing with multiple creative agencies, including Deutsch LA, Arnold Worldwide and WireStone, as well as a number of smaller agencies. During that time, she led and collaborated on multiple business-to-business and consumer-facing initiatives for clients such as Apple, Intel, HP, Kaiser Permanente, Mitsubishi Motors, Volkswagen and the National Australia Bank.

STOCK OWNERSHIP OF PRINCIPAL STOCKHOLDERS

AND MANAGEMENT

Beneficial Ownership Table

The following table sets forth information regarding the beneficial ownership of Common Stock as of April 1, 2019, by each director, by each executive officer named in the Summary Compensation Table under the heading "Executive Compensation" below, and by all current directors and executive officers of the Company as a group. In addition, it provides information, including names and addresses, about each other person or group known to the Company to own beneficially more than 5% of the outstanding shares of Common Stock.

10

Unless otherwise indicated, all shares listed as beneficially owned are held with sole voting and dispositive power.

|

Five Percent Beneficial Owners |

|

Amount and Nature of Beneficial Ownership(1) |

|

|

Percent |

|

||

|

JPMorgan Chase & Co.(2) |

|

|

549,868 |

|

|

|

7.2 |

% |

|

SMALLCAP World Fund (3) |

|

|

530,215 |

|

|

|

7.0 |

% |

|

BlackRock, Inc.(4) |

|

|

484,002 |

|

|

|

6.3 |

% |

|

The Vanguard Group(5) |

|

|

407,609 |

|

|

|

5.3 |

% |

|

Renaissance Technologies LLC(6) |

|

|

406,600 |

|

|

|

5.3 |

% |

|

Directors and Named Executive Officers |

|

Amount and Nature of Beneficial Ownership(1) |

|

|

|

Percent |

|

||

|

Gerald R. Blotz |

|

|

39,246 |

|

|

|

* |

|

|

|

Thomas J. Carley (7)(8) |

|

|

40,858 |

|

|

|

* |

|

|

|

Thomas B. Cusick |

|

|

573 |

|

|

|

* |

|

|

|

Michael L. Elich |

|

|

213,337 |

|

|

|

|

2.8 |

% |

|

Heather E. Gould |

|

|

5,960 |

|

|

|

* |

|

|

|

James B. Hicks, Ph.D.(9) |

|

|

26,276 |

|

|

|

* |

|

|

|

Jon L. Justesen |

|

|

34,235 |

|

|

|

* |

|

|

|

Gary E. Kramer |

|

|

10,335 |

|

|

|

* |

|

|

|

Anthony Meeker (8) |

|

|

16,562 |

|

|

|

* |

|

|

|

Vincent P. Price |

|

|

509 |

|

|

|

* |

|

|

|

Gregory R. Vaughn |

|

|

129,981 |

|

|

|

|

1.7 |

% |

|

All current directors and executive officers as a group (11 persons) |

|

|

517,872 |

|

|

|

|

6.8 |

% |

|

* |

Less than 1% of the outstanding shares of Common Stock. |

|

(1) |

Includes options to purchase Common Stock exercisable within 60 days following April 1, 2019, as follows: Mr. Blotz, 18,750 shares; Mr. Carley, 10,875 shares; Mr. Elich, 105,000 shares; Dr. Hicks, 11,875 shares; Mr. Justesen, 7,000 shares; Mr. Meeker, 7,000 shares; Mr. Vaughn, 56,260 shares; and all current directors and executive officers as a group, 216,760 shares. |

|

(2) |

Based on information contained in the Schedule 13G amendment filed on January 18, 2019, by JPMorgan Chase & Co., 270 Park Avenue, New York, New York 10017, reporting sole voting power as to 481,322 shares and sole dispositive power as to 540,568 shares. |

|

(3) |

Based on information contained in the Schedule 13G filed on February 14, 2019, by SMALLCAP World Fund, Inc., 6455 Irvine Center Drive, Irvine, California 92618-4518. The fund reported that it is an investment company advised by Capital Research and Management Company and may vote the shares under certain circumstances. |

|

(4) |

Based on information contained in the Schedule 13G amendment filed on February 4, 2019, by BlackRock, Inc., 55 East 52nd Street, New York, New York 10055, reporting sole voting power as to 468,493 shares and sole dispositive power as to 484,002 shares. |

|

(5) |

Based on information contained in the Schedule 13G filed on February 11, 2019, by The Vanguard Group, 100 Vanguard Blvd, Malvern, Pennsylvania 19355, reporting sole voting power as to 14,757 shares, shared voting power as to 613 shares, sole dispositive power as to 392,992 shares and shared dispositive power as to 14,615 shares. |

11

|

(6) |

Based on information contained in the Schedule 13G filed on February 12, 2019, by Renaissance Technologies LLC, 800 Third Avenue, New York, New York 10022, reporting sole voting power and dispositive power as to 406,600 shares. |

|

(7) |

Includes 3,002 shares owned by Mr. Carley's spouse. |

|

(8) |

Includes shares pledged as collateral for margin accounts with brokerage firms as follows: Mr. Carley, 22,981 shares; and Mr. Meeker, 600 shares. |

|

(9) |

Includes 1,050 shares owned by Dr. Hick's spouse. |

Anti-Hedging Policy

The Company has adopted an Anti-Hedging Policy, which is applicable to the Company’s directors and executive officers, and prohibits them from directly or indirectly engaging in hedging against future declines in the market value of any Company securities through the purchase of financial instruments designed to offset such risk. Executive officers and directors who fail to comply with the policy are subject to Company-imposed sanctions, which may include a demotion in position, reduced compensation, restrictions on future participation in cash or equity incentive plans, or termination of employment.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 of the Exchange Act ("Section 16") requires that reports of beneficial ownership of Common Stock and changes in such ownership be filed with the SEC by Section 16 "reporting persons," including directors, executive officers, and certain holders of more than 10% of the outstanding Common Stock. To the Company's knowledge, based solely on a review of the copies of Forms 3, 4, and 5 (and amendments thereto) filed with the SEC and written representations by the Company's directors and executive officers, all Section 16 reporting persons complied with all applicable Section 16(a) filing requirements during 2018 on a timely basis, other than one report filed by Anthony Meeker, a director, reporting one sale transaction after the due date.

Stock Ownership Guidelines for Non-Employee Directors and Executive Officers

The Board has adopted stock ownership guidelines such that each non-employee director is expected to own shares of BBSI common stock with a value equal to at least three times the regular annual cash retainer, currently $60,000, within three years of first being elected. The value of shares owned is calculated quarterly based on the higher of current market price or the average daily closing price for the preceding 12 months. Any shortfall resulting from an increase in the annual cash retainer or a decrease in the stock trading price (or both) is expected to be cured within two years following the end of the quarter in which the resulting required increase in share ownership first occurred.

The Board also adopted a policy on stock ownership for the Company's executive officers. Under the policy, executive officers will have five years from the later of July 1, 2016, and the date the officer is notified of his or her selection, to achieve and maintain ownership of shares of Common Stock with a value equal to at least three times the officer's annual base salary. Shares will be valued at the greater of the then current market price and the original purchase price. Until the minimum ownership level is reached, the officer is expected to retain at least 50% of the shares of Common Stock received upon exercise of an option or vesting of RSUs and performance shares, after payment of the exercise price and withholding and payroll taxes. Participants who are not in compliance will not be permitted to sell or dispose of shares, except as described in the preceding sentence, until they reach the required ownership level. The Nominating Committee may make an exception in its sole discretion in the case of financial hardship.

12

ITEM 2 - APPROVAL OF NEW EMPLOYEE STOCK PURCHASE PLAN

The Board adopted a new Employee Stock Purchase Plan (the "ESPP") on April 8, 2019, subject to stockholder approval on or before the 12-month anniversary of such date. Our stockholders are now being asked to approve the ESPP, including the reservation of shares for issuance thereunder. The principal features and purposes of the ESPP are summarized below. The summary does not purport to be a complete description of all of the provisions of the ESPP and is qualified in its entirety by reference to the complete text of the ESPP, which is attached as Appendix A to this proxy statement. Any stockholder who wishes to obtain a copy of the ESPP may do so upon written request to the Secretary at our principal executive offices.

Summary of the ESPP

Purpose

The purpose of the ESPP is to enable eligible employees of the Company and its subsidiaries to acquire a proprietary interest in the future of the Company through the purchase of our common stock. The ESPP is intended to satisfy the requirements of an "employee stock purchase plan" under Section 423 ("Section 423") of the Internal Revenue Code of 1986, as amended (the "Code").

Plan Administration

The ESPP provides that the ESPP shall be administered by a committee or subcommittee of the Board duly appointed to administer the ESPP, whose administration, interpretation, and application of the ESPP and its terms will be final, conclusive, and binding on all participants if made in good faith. The Board has delegated administration of the ESPP to the Board's Compensation Committee.

Securities Subject to Plan

The ESPP provides for up to 300,000 shares of common stock (the "ESPP Shares") to be reserved for issuance pursuant to purchases made under the ESPP, subject to adjustment for changes in capitalization as provided in the ESPP. These shares will be made available from the Company's authorized but unissued or reacquired shares of common stock, shares of common stock purchased on the open market, or any combination thereof. If an outstanding purchase right for any reason terminates without having been exercised in full, the shares of common stock allocable to the unexercised portion of that purchase right will again be available for issuance under the ESPP. The ESPP Shares represent approximately 4.0% of the total number of shares of common stock outstanding as of April 1, 2019. The Board considered the potential dilutive impact to stockholders and the projected participation rate when establishing the number of ESPP Shares.

Eligibility and Participation

Employees of the Company and of its subsidiaries that may be designated by the Compensation Committee will be eligible to participate in the ESPP if they meet the eligibility requirements specified by the Compensation Committee. In no event may the required period of continuous employment be equal to or greater than two years. Also, the Compensation Committee may require that, to be eligible to participate, an employee must customarily work more than 20 hours per week or more than five months per calendar year, or such other criteria as are consistent with Section 423. The Compensation Committee intends to establish a cap on annual compensation such that our executive officers and approximately 20 other members of senior management will be excluded from participation in the ESPP. As of April 1, 2019, approximately 700 employees are eligible to participate in the ESPP.

An employee will not be eligible to participate in the ESPP during an offering period to the extent that, immediately after the grant of a purchase right, the employee (or any other person whose stock would be attributed to the employee under Section 424(d) of the Code) would own stock and/or hold outstanding purchase rights to purchase common stock possessing 5% or more of the total combined voting power or value of all classes of stock of the Company or of any subsidiary as determined in accordance with Section 423(b)(3) of the Code. Eligible employees become participants in the ESPP by delivering to the Company, prior to the applicable offering date, an enrollment form. At the end of each offering period, each participant in the offering period will be automatically enrolled in the next succeeding offering period at the same withholding percentage unless the participant changes his or her elections, withdraws from the ESPP, or terminates employment or otherwise ceases to be an eligible employee.

13

Offering Periods and Dates

Shares of common stock will be offered for purchase through a series of consecutive offering periods, each of which will generally be six months in duration, unless otherwise determined by the Compensation Committee; provided, however, that no offering period will have a duration exceeding 27 months. For each offering period in which an employee participates, he or she will be granted a right to purchase common stock.

Payroll Deductions

The purchase price of the shares is accumulated by payroll deductions during the offering period. Each employee participating in the ESPP may elect to have up to 15% of regular cash compensation (subject to other limitations described in the ESPP) deducted and credited to that employee's account under the ESPP. An employee's regular cash compensation generally includes base salary or wages, overtime, and payments for paid time off or in lieu of notice. Compensation excludes any incentive compensation, including profit share payments, as well as termination or severance compensation, stock-based compensation, or other compensation not described above.

Payroll deductions will be credited to an account established in the employee's name, shall be held as general assets of the Company, and shall not accrue interest unless otherwise required by applicable law. To the extent that an employee's payroll deductions exceed the amount required to purchase shares subject to purchase rights, the excess shall be carried forward to apply to the next purchase date if the employee's participation in the ESPP continues and the excess is less than the amount that would have been necessary to purchase an additional whole share; otherwise, it will be refunded promptly after the purchase date to the employee without interest.

Purchase of Common Stock; Exercise of Purchase Right

By electing to participate in the ESPP, each employee is in effect granted a right to purchase shares of common stock using payroll deductions accumulated as of each purchase date. However, no participant may (i) accrue rights to purchase stock with a value in excess of $25,000 (determined on the basis of the fair market value of the common stock on the start date of the offering period) in any calendar year; or (ii) purchase shares of common stock in excess of either the dollar limit or the share limit determined by the Compensation Committee to be applicable to an offering period, if any. If the total number of shares for which purchase rights are to be exercised on any purchase date exceeds the number of shares at the time available for issuance under the ESPP, then the Compensation Committee will prorate the available shares. An employee's purchase right will be exercised by applying the amount credited to the employee's account to the purchase of whole shares of common stock on each purchase date. If a balance remains in an employee's account because it is less than the price of one whole share, it will be carried over to the next offering period, if the employee's participation continues.

Purchase Price of Common Stock; Taxes on the Acquisition or Disposition of Stock

On any particular purchase date under the ESPP, the purchase price per share will be established by the Compensation Committee; provided, however, that such purchase price shall not be less than 85% of the fair market value of a share of common stock on the last business day in such offering period. On April 1, 2019, the closing market price of our common stock was $78.57, as reported by the Nasdaq Stock Market.

In general, the fair market value per share on any relevant date under the ESPP will be equal to the closing price quoted for such date by the principal exchange or trading market on which common stock is traded (as determined by the Compensation Committee). If the common stock is not listed on a stock exchange or if trading activities for the common stock are not reported, the fair market value will be determined by the Board or the Compensation Committee, consistent with applicable legal requirements.

The participating employee will be responsible for all taxes and other withholdings required in connection with the acquisition or disposition of shares purchased under the ESPP. See "U.S. Federal Income Tax Information," below. The participating employee will not have an interest or voting rights in any shares covered under the ESPP prior to issuance of the shares in his or her name.

14

Ability of the Board to Amend or Terminate the ESPP

The Board may amend or terminate the ESPP, or any purchase right granted thereunder, at any time, except that purchase rights previously granted under the ESPP will not be materially impaired without the consent of a participant (unless permitted by the ESPP or as required by applicable law or to qualify the ESPP pursuant to Section 423). Certain amendments may require the approval of the Company's stockholders. Unless the ESPP is earlier terminated, it will continue until all ESPP Shares have been issued. If the ESPP is terminated before an employee's right to purchase shares has been exercised under the ESPP, any funds deducted from the employee's compensation and credited to the employee's account under the ESPP will be refunded.

Withdrawal

An employee may withdraw from the ESPP by delivering to the Company a cancellation notice in accordance with the procedures prescribed by the Company. Such cancellation notice must be delivered by the deadline imposed by the Compensation Committee. An employee's withdrawal from an offering does not affect the employee's eligibility to participate in subsequent offerings under the ESPP.

Termination of Employment

Termination of a participant's continuous status as an employee for any reason, including retirement, death, or disability, cancels his or her participation in the ESPP immediately. In such event, the payroll deductions credited to the employee's account will be returned to the employee or, in the case of death, as provided in the ESPP.

Capital Changes and Corporate Transactions

In the event any change is made in the Company's capitalization, such as a merger, stock split or stock dividend, or any other material increase or decrease in the shares of common stock without the Company's receipt or payment of consideration, appropriate adjustments will be made to (i) the maximum number and class of securities issuable under the ESPP, (ii) the maximum number of securities purchasable per participant during an offering, and (iii) the number and class of securities and the price per share in effect under each outstanding purchase right. Such adjustments will prevent any dilution or enlargement of the rights and benefits of plan participants.

In the event of the occurrence of a corporate transaction as defined in the ESPP, the surviving, continuing, successor or purchasing corporation (an "acquiring corporation") may assume or continue the Company's rights and obligations under outstanding purchase rights or substitute substantially equivalent purchase rights for such acquiring corporation's stock. If such acquiring corporation elects not to assume, continue, or substitute the purchase rights under the ESPP, the purchase date of the then-current offering period will be accelerated to a date before the consummation of the transaction. All purchase rights that are neither assumed or continued by the acquiring corporation in connection with the corporation transaction nor exercised as of the date of the corporate transaction shall terminate and cease to be outstanding effective as of the date of the corporate transaction.

Nonassignability

During a participant's lifetime, purchase rights will be exercisable only by the participant. Purchase rights are not transferable except by will, the laws of descent and distribution or, if permitted by the Compensation Committee, by a beneficiary designation.

Accounts

Individual accounts will be maintained for each participant in the ESPP. After each purchase date, the participant's broker account will update with the number of shares purchased on behalf of the participant and the purchase price paid per share.

Compliance with Securities Laws

The issuance of shares under the ESPP will be subject to compliance with all applicable requirements of federal, state, and foreign law with respect to such securities and the requirements of any stock exchange upon which the shares may then be listed.

15

U.S Federal Income Tax Information

The ESPP is intended to qualify under the provisions of Sections 421 and 423 of the Code. Under these provisions, a participant will not have taxable income attributable to the grant of rights to purchase common stock or the receipt of purchased shares. However, when the participant disposes of shares purchased under the ESPP, he or she will generally be subject to tax. Upon disposition, if the shares have been held by the participant for more than two years after the first day of the offering period and more than one year after the purchase date of the shares, the participant will recognize taxable ordinary income equal to the excess of the fair market value of the shares at the time of the disposition over the purchase price of the shares or 15% of the fair market value of the shares on the first day of the applicable offering period, whichever is less. Any additional taxable gain on the disposition will be treated as a long-term capital gain. If the shares are disposed of before the expiration of the holding periods described above, the excess of the fair market value of the shares on the purchase date over the purchase price will be taxable as ordinary income, and any gain or loss on such disposition will be treated as a capital gain or loss. The Company is not entitled to a deduction for amounts taxable to a participant, except to the extent of ordinary income reported by the participant on disposition of shares before the expiration of the holding periods described above.

The foregoing is only a summary of the United States federal income tax consequences of the ESPP to participants and does not purport to be complete. Reference should be made to the applicable provisions of the Code. In addition, the summary does not discuss the income tax consequences of a participant's death or the income tax laws of any municipality, state, or foreign country in which the participant may reside, and to which the participant may be subject.

New Plan Benefits

Because benefits under the ESPP will depend on employees' elections to participate and the fair market value of common stock at various future dates, it is not possible to determine the benefits that will be received by employees if the ESPP is approved by the stockholders. Non-employee directors are not eligible to participate in the ESPP.

Board Recommendation to Approve ESPP

The Board recommends that stockholders vote "FOR" approval of the 2019 Employee Stock Purchase Plan. The ESPP will be approved if it receives the affirmative vote of a majority of the total votes cast on Item 2 at the Annual Meeting, provided that a quorum is present at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of this vote.

The Board of Directors recommends that stockholders vote FOR Item 2 to APPROVE the 2019 EMPLOYEE STOCK PURCHASE PLAN.

16

ITEM 3 – ADVISORY VOTE TO APPROVE COMPENSATION OF OUR EXECUTIVE OFFICERS

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act") included a provision that requires public companies to hold an advisory stockholder vote to approve or disapprove the compensation of their named executive officers. The Dodd-Frank Act also included a provision providing stockholders of a public company the opportunity to vote, on an advisory basis, on how frequently they would like the company to hold an advisory vote on the compensation of executive officers. At the 2017 annual meeting, the Company's stockholders approved the Board's recommendation that an advisory vote on executive compensation be conducted annually. Accordingly, we are conducting an advisory vote to approve the compensation of the Company's executive officers again this year. Unless the Board changes its policy, the next “say on pay” advisory vote will be held in 2020.

The Compensation Committee believes that executive compensation should align with the stockholders' interests, without encouraging excessive or unnecessary risk. This compensation philosophy and the program structure approved by the Compensation Committee are central to the Company's ability to attract, retain, and motivate individuals who can achieve our goals and provide stability in leadership. Our philosophies and goals with respect to compensation are explained in detail below under the subheading "Executive Compensation – Compensation Discussion and Analysis – Compensation Philosophy and Objectives." A detailed description of compensation paid to our named executive officers in 2018 follows that discussion and analysis.

This advisory vote, which is not binding on the Company, the Compensation Committee, or the Board, is intended to address the overall compensation of our executive officers and the policies and practices described in this proxy statement. The Board and the Compensation Committee value the opinions of our stockholders and will take into account the outcome of the vote when considering future executive compensation arrangements.

The Board of Directors unanimously recommends that you vote, on an advisory basis, FOR the following resolution:

"RESOLVED, that the compensation paid to our named executive officers, as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K adopted by the SEC, including the Compensation Discussion and Analysis, executive compensation tables and accompanying footnotes and narrative discussion, is hereby approved. "

The above-referenced disclosures appear below under the heading "Executive Compensation" in this proxy statement.

The above resolution will be deemed to be approved if it receives the affirmative vote of a majority of the votes cast at the Annual Meeting, provided that a quorum is present at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the vote.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Compensation Philosophy and Objectives. The Compensation Committee (for purposes of this section, the "Committee") has responsibility for establishing, implementing, and continually monitoring adherence with the Company’s compensation philosophy. The goal of the Committee is to ensure that the total compensation paid to the Company’s executive officers is fair, reasonable, and competitive.

The Committee believes that the most effective executive compensation program is one that is designed to reward the achievement of specific annual and long-term strategic goals by the Company. The principles underlying our compensation policies are:

|

|

• |

To attract, motivate, and retain high-quality executive officers; |

|

|

• |

To provide competitive compensation relative to compensation paid to similarly situated executives; and |

|

|

• |

To align the interests of executives with our overall risk profile to build long-term stockholder value. |

17

At the 2018 annual meeting of stockholders, more than 96% of the votes cast with respect to the advisory vote on executive compensation approved the compensation of the Company's named executive officers. The Committee took this indication of support into consideration in reviewing the Company's executive compensation program. Our executive compensation program processes are consistent with those established by the Committee and are monitored by the Company’s finance functions.

2018 Executive Compensation Components. For the fiscal year ended December 31, 2018, the principal components of compensation for executive officers were:

|

|

• |

Base salary; |

|

|

• |

Target annual cash incentive compensation, including both performance-based compensation and discretionary bonuses; |

|

|

• |

Grants of restricted stock units; |

|

|

• |

Grants of performance share awards; and |

|

|

• |

Retention grants in the form of stock options. |

Base Salary

Salary levels of executive officers are reviewed periodically by the Committee and the CEO as part of the performance review process, as well as in connection with a promotion or other change in job responsibility. In determining base salaries for executives in 2018, the Committee primarily considered:

|

|

• |

The Committee’s analyses of competitive compensation practices, including the information described below under the subheading “Peer Group and Survey Data for Comparison Purposes”; |

|

|

• |

Scope of responsibilities, including leadership, experience, skills, expertise, and knowledge; |

|

|

• |

Individual performance and contributions to the Company’s financial and strategic objectives; and |

|

|

• |

The overarching goal of the CEO to foster strategic alignment and teamwork among the Company’s executive officers. |

The Committee determined not to adjust the annual base salary levels for the CEO and COO positions for 2018, in light of the increases approved for 2017 ranging from 23% to 25%. The Committee approved increases in base salary levels for 2018 for the CFO and CSO positions by 25% to $500,000, based on the recommendation of the CEO that the four executive officers other than himself be placed on an equal footing from the standpoint of compensation. The CEO cited several factors in making his recommendation, including the significant crossover in areas of responsibility among the executives and the increased scope of responsibilities assigned to the CFO and CSO positions, including structuring the Company’s insurance program, risk analysis, implementation of strategic initiatives, and development of talent.

Annual Cash Incentive Compensation

The Company's executive officers were eligible to receive annual cash bonuses following yearend for services during 2018. The target bonus amounts were set by the Committee in March 2018 at 100% of base salary for Mr. Elich and 80% of base salary for the other executive officers. Of the total bonus opportunity, 75% was awarded under the Company's Annual Cash Incentive Award Plan based on achievement of objective corporate performance goals selected by the Committee. The other 25% of the total bonus opportunity was reserved for award in the Committee's discretion based on its assessment of each officer's performance of individual goals approved by the Committee in early 2018.

18

Achievement above or below established target levels for the corporate financial metrics results in an upward or downward adjustment in the cash incentive amount payable for corporate level goals. The adjustment is calculated based on a defined factor (2.5% for 2018) multiplied by the percentage by which the actual achievement of a given metric is above or below the target level. If the Company fails to achieve a specified financial target at the 80% level or above, no part of the cash incentive associated with that metric is earned. The maximum cash incentive payable is 200% of the target amount. An executive must remain employed by the Company through the date of the Committee's determination of performance to be eligible to receive annual cash incentive payouts.