10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 17, 2008

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

Commission File Number 0-21886

BARRETT BUSINESS SERVICES, INC.

(Exact name of registrant as specified in its charter)

| Maryland | 52-0812977 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

|

| 8100 NE Parkway Drive, Suite 200 Vancouver, Washington |

98662 | |

| (Address of principal executive offices) | (Zip Code) | |

(360) 828-0700

(Registrants telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered |

|

| Common Stock, Par Value $0.01 Per Share |

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as indicated by Exchange Act Rule 12b-2).

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the aggregate market value of the common equity held by non-affiliates of the registrant: $226,592,000 at June 30, 2007.

Indicate the number of shares outstanding of each of the registrants classes of common stock, as of the latest practicable date:

| Class |

Outstanding at February 29, 2008 |

|

| Common Stock, Par Value $.01 Per Share |

11,033,069 Shares |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the 2008 Annual Meeting of Stockholders are hereby incorporated by reference into Part III of Form 10-K.

Table of Contents

BARRETT BUSINESS SERVICES, INC.

2007 ANNUAL REPORT ON FORM 10-K

- 1 -

Table of Contents

PART I

| Item 1. | BUSINESS |

General

Barrett Business Services, Inc. (Barrett, the Company, our or we), was incorporated in the state of Maryland in 1965. We offer a comprehensive range of human resource management services to assist small and medium-sized businesses manage the increasing costs and complexities of a broad array of employment-related issues. Our principal services, Professional Employer Organization (PEO) and staffing, assist our clients in leveraging their investment in human capital. We believe that the combination of these two principal services enables us to provide our clients with a unique blend of services not offered by our competition. Our platform of outsourced human resource management services is built upon our expertise in payroll processing, employee benefits and administration, workers compensation coverage, effective risk management and workplace safety programs and human resource administration.

In a PEO arrangement, we enter into a contract to become a co-employer of the clients existing workforce and assume responsibility for some or all of the clients human resource management responsibilities. Staffing services include on-demand or short-term staffing assignments, long-term or indefinite-term contract staffing and comprehensive on-site management. Our staffing services also include direct placement services, which involve fee-based search efforts for specific employee candidates at the request of our PEO clients, staffing customers or other companies.

Our ability to offer clients a broad mix of services allows us to effectively become the human resource department and a strategic business partner for our clients. We believe our approach to human resource management services is designed to positively affect our clients business results by:

| | allowing our clients to focus on core business activities instead of human resource matters; |

| | increasing our clients productivity by improving employee satisfaction and generating greater employee retention; |

| | reducing overall payroll expenses due to lower workers compensation costs; and |

| | assisting our clients in complying with complex and evolving human resource related regulatory and tax issues. |

We provide services to a diverse array of customers, including, among others, electronics manufacturers, various light-manufacturing industries, forest products and agriculture-based companies, transportation and shipping enterprises, food processing, telecommunications, public utilities, general contractors in numerous construction-related fields and various professional services firms. During 2007, we provided staffing services to approximately 2,300 staffing services customers, which compares to approximately 1,800 during 2006. In addition, at December 31, 2007, we served approximately 1,200 PEO clients and employed approximately 32,200 employees pursuant to PEO contracts, as compared to 1,100 PEO clients and approximately 25,300 employees as of December 31, 2006. We serve our clients, who have employees located in 25 states and the District of Columbia, through a

- 2 -

Table of Contents

network of 44 branch offices in California, Oregon, Washington, Idaho, Arizona, Utah, Colorado, Maryland, Delaware and North Carolina. We also have several smaller recruiting offices in our general market areas, which are under the direction of a branch office.

Market Opportunity

The human resource outsourcing industry is large and growing rapidly. Some of the key factors driving growth include the desire of businesses to outsource non-core business functions, to reduce regulatory compliance risk, to rationalize the number of service providers that they use, and to reduce costs by integrating human resource systems and processes.

The outsourcing of business processes continues to represent a growing trend within the United States. By utilizing the expertise of outsourcing service providers, businesses are able to reduce processing costs and administrative burdens while at the same time offering competitive benefits for their employees. The technical capabilities, knowledge and operational expertise that we have built, along with our broad portfolio of services for clients, have enabled us to capitalize on the growing business processing outsourcing trend.

We believe that the small and medium-sized business segment of the human resource outsourcing market is particularly attractive because:

| | this segment is large and has a low penetration rate by providers of outsourced comprehensive human resource services; |

| | small and medium-sized businesses typically have fewer in-house resources than larger businesses and, as a result, are generally more dependent on their service providers; |

| | quality of service, ease-of-use and responsiveness to clients needs are key considerations of this business segment in selecting a service provider; |

| | small and medium-sized businesses generally do not require customized solutions, enabling service providers to achieve significant economies of scale through an integrated technology and service platform; and |

| | this segment is generally characterized by a relatively high client retention rate and lower client acquisition costs. |

Our Strategic Approach

Our long-term goal is to become the leading provider of human resource outsourcing services for small and medium-sized businesses. We seek to differentiate our strategic position by offering a full spectrum of PEO and staffing services, along with, but to a far lesser extent, permanent placement and administrative service organization (ASO) services. We believe that the integrated nature of our service platform assists our clients and customers in successfully aligning and strengthening their organizational structure to meet the demands of their businesses. In pursuit of this goal, we have adopted the operating and growth strategies described below to provide the framework for our future growth, while maintaining the quality and integrity of our current service offerings.

- 3 -

Table of Contents

Operating Strategy

| | Provide a broad scope of services. We provide our clients with a broad range of human resource management tools and professional services that meet their critical human resource needs. We believe that most human resource service providers offer discrete services, requiring client companies to engage and manage multiple vendors in order to obtain a comprehensive human resource management solution. Companies that purchase services from multiple vendors typically fail to realize the benefits and economies of scale of having a single, integrated source of human resource information. Our comprehensive solutions allow our clients to maximize the value realized from integrating information and establishing a partnership with a single vendor to address all of their human resource needs. We believe that the aggregate cost of purchasing discrete services from multiple vendors is greater than the cost of purchasing our integrated solution, such that we can offer cost savings and managerial efficiencies to our clients. |

| | Promote a decentralized and autonomous management philosophy and structure. We hire senior-level managers to oversee, develop and expand our business at the branch-office level. We believe that highly experienced senior-level branch managers possess the skill set to handle the day-to-day demands of our business and still be proactive in solving client needs and focusing on further business development. We believe that by making significant investments in the best management talent available, within their respective areas of expertise, we can leverage the value of this investment many times over. We have also found that this philosophy facilitates our ability to attract and retain additional experienced senior-level managers to oversee our branch offices. |

| | Motivate employees through a competitive compensation package. We offer a very competitive base salary structure at the branch-office level and provide the opportunity to earn additional profit sharing on a quarterly basis. This profit sharing is earned by each branch-level employee based upon branch office profitability after achieving certain minimum profitability standards. Our risk managers have an opportunity to earn incentive compensation based upon the workers compensation claims experience of their specific client base. All profit sharing and incentive compensation measures are tangible and objective, with few subjective components. |

| | Control workers compensation costs through effective risk management. We are committed to the proactive mitigation of workers compensation risk through stringent underwriting and disciplined management processes. Our chief executive officer defines and maintains our strict underwriting standards. Our underwriting process begins with the selection of only the best candidate companies. Next, our professional risk managers in the field corroborate the underwriting data by assessing the candidates operating culture, workplace safety standards and human resource administration philosophies, including compensation rates and benefit levels. If the candidate company satisfies all underwriting standards, then we accept the company and immediately implement a plan to further strengthen their workplace safety standards and practices. If the clients safe-work culture or adherence to workplace safety procedures declines to unsatisfactory levels, we will terminate the relationship under the terms of our contract. |

- 4 -

Table of Contents

Growth Strategy

| | Support, strengthen and expand branch office operations. We believe that increasing the penetration of our existing markets is an effective and cost-efficient means of growth as we are able to capitalize on our reputation and growing brand awareness in the territories in which we operate. We believe that there is substantial opportunity to further penetrate these territories. We intend to increase our penetration in our existing markets by continued growth through the effective use of insurance broker networks, referrals from current clients and marketing efforts within the local business community. |

| | Increase client utilization of our services. We believe that we will be able to continue to maintain our average level of professional service fees per client employee and improve client retention as our clients more fully utilize our current service offerings, including cross selling between staffing, PEO and permanent placement. We invest substantial time integrating our services into our client organizations to optimize their effectiveness and measure their results. Our long-term partnership philosophy provides us with the opportunity to expand our PEO and staffing services. |

| | Enhance management information systems. We continue to invest in developing our information technology infrastructure. We believe that our platform gives us a competitive advantage by allowing us to provide a high level of flexibility to satisfy a variety of demands of our small and medium-sized business clients on a cost-effective basis. Furthermore, we believe that our current technology platform is capable of supporting our planned develop-ment of new business units and increased market share for the foreseeable future. |

| | Penetrate new markets. We intend to open additional branch offices in new geographic markets as opportunities arise. Since the beginning of 2003, we have opened four new offices in California to expand our presence in select geographic markets, including Bakersfield, Fresno, Redding and San Diego. We have developed a well-defined approach to geographic expansion which we will use as a guide for entering new markets. |

| | Pursue strategic acquisitions. Since our initial public offering in June 1993, we have completed 26 acquisitions of complementary businesses. In 2006, we acquired certain assets of Pro HR, LLC, a privately held PEO company with three offices, two of which are in Idaho and one in Western Colorado. Effective July 2, 2007, we acquired certain assets of Strategic Staffing, Inc., a privately held staffing services company with 6 offices, 5 of which are in Utah and one in Colorado. Effective December 3, 2007, we acquired certain assets of Phillips Temps, Inc., a privately held staffing services company with one office in Denver, Colorado. In addition, effective February 4, 2008, we acquired certain assets of First Employment Services, Inc., a privately-held staffing services company with two offices in Arizona. In order to increase our client base, expand our presence in existing markets, enter new markets and broaden our service offerings, we may continue to pursue strategic acquisitions, particularly in the staffing area. |

- 5 -

Table of Contents

Our Services

Our services are typically provided under a variety of contractual arrangements through which we offer a continuum of proactive human resource management services. While some services are more frequently associated with our PEO arrangements, our expertise in such areas as safety services and personnel-related regulatory compliance may also be used by our staffing services customers. Our human resource management services are built upon the following five areas of expertise:

| | Payroll Processing. For both our PEO and staffing services employees, we assist our clients in managing employment-related administration by providing payroll processing, employment-related tax filings and administration. These services are administered at each branch office, as well as centralized at our headquarters in Vancouver, Washington. |

| | Employee Benefits and Administration. We assist our PEO clients in retaining the best employees for their businesses by helping them obtain, at their cost, comprehensive health benefits, including medical, dental and vision benefits, life and accident insurance, short-term and long-term disability. We also provide, at no cost to our PEO clients and our staffing employees, a 401(k) retirement savings plan and a Section 125 cafeteria plan. |

| | Human Resource Management. We focus on developing and implementing a client-specific proactive human resource management system for each PEO client company. Through these efforts, clients achieve a more productive workforce through the disciplined application of standards for hiring and firing. Specifically, we assist our clients in attracting the right people by providing best recruiting practices, job description development, skills testing, salary information, drug testing, interview guidelines and assistance, evaluating job applications and references and compliance with a broad range of employment regulations. |

| | Risk Management. We focus on developing and implementing a client-specific proactive risk management program so as to further mitigate risk of injury associated with workplace practices. These efforts enable our clients and us to achieve a reduction in accidents and workers compensation claims. We provide such tactical services as safety training and safety manuals for both workers and supervisors, job-site visits and meetings, improvements in workplace procedures and equipment to further reduce the risk of injury, compliance with OSHA requirements, environmental regulations, and workplace regulations of the U.S. Department of Labor and state agencies and leading accident investigations. We have at least one risk manager available at each branch office to perform workplace safety assessments for each prospective client and to implement systems to improve work practices. All risk managers report directly to our Chief Executive Officer. Each risk manager has the authority to cancel our business relationship with any customer or client company. |

| | Workers Compensation Coverage. We assist our clients in protecting their businesses from employment-related injury claims by providing workers compensation coverage. Through our internal claims managers and our third-party administrators, we provide claims management services for our PEO clients. We |

- 6 -

Table of Contents

| work aggressively to manage and reduce job injury claims, including identifying fraudulent claims and taking advantage of our staffing services to return injured workers to active employment earlier. As a result of our efforts to manage workers compensation costs, we are often able to reduce our clients overall expenses arising out of job-related injuries and insurance. |

PEO Services. In a PEO services arrangement, we enter into a contract to become a co-employer of the clients existing workforce and assume responsibility for some or all of the human resource management responsibilities, including payroll and payroll taxes, employee benefits, health insurance, workers compensation coverage, workplace safety programs, compliance with federal and state employment laws, labor and workplace regulatory requirements, and related administrative responsibilities. We have the right to hire and fire our PEO employees, although the client remains responsible for day-to-day assignments, supervision and training and, in most cases, recruiting.

We began offering PEO services to Oregon customers in 1990 and subsequently expanded these services to other states, primarily California. In 2007, approximately 85% of our PEO service fee revenues were generated from customers in California with an additional 6% of revenues generated in Oregon.

We have entered into co-employer arrangements with a wide variety of clients, including companies involved in moving and shipping, professional firms, construction, retail, manufacturing and distribution businesses. PEO clients are typically small to mid-sized businesses with up to several hundred employees. None of our PEO clients individually represented more than 2% of our total revenues in 2007.

Prior to entering into a co-employer arrangement, we perform an analysis of the potential clients actual personnel and workers compensation costs based on information provided by the prospect. We introduce our workplace safety program and recommend improvements in procedures and equipment following a risk assessment of the prospects facilities. The potential client must agree to implement recommended changes as part of the co-employer arrangement. We also offer financial incentives to PEO clients to maintain a safe-work environment.

Our standard PEO services agreement typically provides for an initial term of one year with automatic renewal for one-year periods. Our agreements generally permit cancellation by either party upon 30 days written notice. In addition, we may terminate the agreement at any time for specified reasons, including nonpayment or failure to follow our workplace safety program.

The PEO services agreement also provides for indemnification of us by the client against losses arising out of any default by the client under the agreement, including failure to comply with any employment-related, health and safety, or immigration laws or regulations. We require our PEO clients to maintain comprehensive liability coverage in the amount of $1.0 million for acts of our work-site employees. Although no claims exceeding such policy limits have been paid by us to date, the possibility exists that claims for amounts in excess of sums available to us through indemnification or insurance may be asserted in the future, which could adversely affect our profitability.

- 7 -

Table of Contents

Staffing Services. Our staffing services include on-demand or short-term staffing assignments, contract staffing, long-term or indefinite-term on-site management, direct placement and human resource administration. Short-term staffing involves demands for employees caused by such factors as seasonality, fluctuations in customer demand, vacations, illnesses, parental leave and special projects without incurring the ongoing expense and administrative responsibilities associated with recruiting, hiring and retaining additional permanent employees. As more and more companies focus on effectively managing variable costs and reducing fixed overhead, the use of employees on a short-term basis allows firms to utilize the just-in-time approach for their personnel needs, thereby converting a portion of their fixed personnel costs to a variable expense.

Contract staffing refers to our responsibilities to provide employees for our clients for a period of more than three months or an indefinite period. This type of arrangement often involves outsourcing an entire department in a large corporation or providing the workforce for a large project.

In an on-site management arrangement, we place an experienced manager on site at a clients place of business. The manager is responsible for conducting all recruiting, screening, interviewing, testing, hiring and employee placement functions at the clients facility for a long-term or indefinite period.

Direct placement services involve fee-based search efforts for specific employee candidates at the request of our PEO clients, staffing customers or other companies.

Our staffing services customers operate in a broad range of businesses, including agriculture-based companies, electronic manufacturers, transportation and logistics companies, food processors, professional firms and construction. Such customers generally range in size from small local firms to companies with international operations that use our services on a domestic basis. None of our staffing services customers individually represented more than 3% of our total revenues in 2007.

In 2007, the light-industrial sector generated approximately 81% of our staffing services revenues, while clerical office staff accounted for 14% of such revenues and technical personnel represented the balance of 5%. Our light-industrial workers perform such tasks as operation of machinery, manufacturing, loading and shipping, site preparation for special events, construction-site cleanup and janitorial services. Technical personnel include electronic parts assembly workers and designers of electronic parts.

We employ a variety of methods to recruit our work force for staffing services, including among others, referrals by existing employees, online job boards, our Web site for job postings, newspaper advertising, and marketing brochures distributed at colleges and vocational schools. The employee application process may include an interview, skills assessment test, reference verification, drug screening, criminal background checks and pre-employment physicals. The recruiting of qualified employees requires more effort when unemployment rates are low. We use a comprehensive pre-employment screening test to ensure that applicants are appropriately qualified for employment.

Our staffing services employees are not under our direct control while working at a customers business. We have not experienced any significant liability due to claims arising

- 8 -

Table of Contents

out of negligent acts or misconduct by our staffing services employees. Claims could be asserted against us which could have a material adverse effect on our financial condition and results of operations.

Sales and Marketing

Our sales and marketing efforts are led by our branch managers and a small team of sales professionals, coupled with strong ties with the insurance brokerage community. Our marketing efforts are principally focused on branch-level development of local business relationships. On a regional and national level, efforts are made to expand and align our services to fulfill the needs of local customers with multiple locations, which may include using our on-site personnel and the opening of additional offices to better serve a customers broader geographic needs. We also rely on an extensive network of insurance brokers for referrals for PEO services, particularly in California, in exchange for an ongoing fee which is a very small percentage of payroll. Business development is the primary function of our branch managers.

Risk Assessment

All prospective clients are evaluated individually on the basis of total predicted profitability. This analysis takes into account workers compensation risk and claims history, unemployment claims history and creditworthiness. The workers compensation risk profile also includes an assessment of the prospects internal culture regarding workplace safety, compensation rates and benefits provided to its employees.

Management Information Systems

We perform all functions associated with payroll administration through our internal management information system. Each branch office performs payroll data entry functions and maintains an independent database of employees and customers, as well as payroll and invoicing records. All processing functions are centralized at our corporate headquarters in Vancouver, Washington.

Acquisitions

We have completed 26 acquisitions since our initial public offering in June 1993. Our acquisition targets are typically traditional light industrial staffing companies. We have acquired PEO companies less frequently due to underwriting issues associated with the target companys existing customers; we prefer to apply our own underwriting criteria prior to establishing a business relationship with a PEO customer. Due to the current concentration of our operations in California and Oregon, our acquisition plans will likely focus on expanding our geographic footprint into contiguous regions. There can be no assurance, however, that any additional transactions will be consummated in the future.

Competition

The staffing services and PEO businesses are characterized by intense competition. The staffing services market includes competitors of all sizes, including national competitors such as Manpower, Inc. and Kelly Services, Inc., that have substantially greater financial, marketing and other resources than we do. In addition to national companies, we compete with numerous regional and local firms for both customers and employees. There are relatively few barriers to entry into the staffing services business. The principal competitive factors in the staffing services industry are price, the ability to provide qualified workers in a timely manner and the monitoring of job performance.

- 9 -

Table of Contents

We may face additional PEO competition in the future from new entrants to the field, including other staffing services companies, payroll processing companies and insurance companies. Certain PEO companies that periodically compete with us in the same markets have greater financial and marketing resources than we do, such as Administaff, Inc., Gevity HR, Inc., and Paychex, Inc., among others. Competition in the PEO industry is based largely on price, although service and quality can also provide competitive advantages. A significant limiting factor to the growth of the PEO industry is the perception of potential clients that they have the capacity to handle human resource issues internally. We believe that our past growth in PEO service fee revenues is attributable to our ability to provide small and medium-sized companies with the opportunity to reduce workers compensation costs and to provide enhanced benefits to their employees while reducing their overall personnel administration costs. Our competitive advantage may be adversely affected by a substantial increase in the costs of maintaining our self-insured workers compensation program, or changes in the regulatory environment, particularly in California. A general market decrease in the level of workers compensation insurance premiums may also decrease demand for PEO services among some prospective client companies.

Self-Insured Workers Compensation Program

A principal service we provide to our customers, particularly our PEO clients, is workers compensation coverage. As the employer of record, we are responsible for complying with applicable statutory requirements for workers compensation coverage. Our workplace safety services are closely tied to our approach to the management of workers compensation risk.

Elements of Workers Compensation System. State law (and for certain types of employees, federal law) generally mandates that an employer reimburse its employees for the costs of medical care and other specified benefits for injuries or illnesses, including catastrophic injuries and fatalities, incurred in the course and scope of employment. The benefits payable for various categories of claims are determined by state regulation and vary with the severity and nature of the injury or illness and other specified factors. In return for this guaranteed protection, workers compensation is an exclusive remedy and employees are generally precluded from seeking other damages from their employer for workplace injuries. Most states require employers to maintain workers compensation insurance or otherwise demonstrate financial responsibility to meet workers compensation obligations to employees. In many states, employers who meet certain financial and other requirements are permitted to self-insure.

Self Insurance for Workers Compensation. In August 1987, we became a self-insured employer for workers compensation coverage in Oregon. We subsequently obtained self-insured employer status for workers compensation in three additional states, California, Delaware and Maryland, as well as in Washington for our non-PEO services. Regulations governing self-insured employers in each jurisdiction typically require the employer to maintain surety deposits of government securities, letters of credit or other financial instruments to cover workers claims in the event the employer is unable to pay for such claims.

To manage our financial exposure from the incidence of catastrophic injuries and fatalities, we maintain excess workers compensation insurance pursuant to two annual

- 10 -

Table of Contents

policies with a major insurance company. Effective January 1, 2007, we formed a wholly owned, fully licensed captive insurance company to provide us with excess workers compensation coverage from $1.0 million up to $5.0 million per occurrence. Additional excess workers compensation insurance coverage is provided by a major insurance company from $5.0 million to $15.0 million per occurrence, except for our Maryland operations, where our excess insurance policy has a $1.0 million retention with a $25.0 million limit on a per occurrence basis. This approach results in an effective per occurrence retention, on a consolidated basis, of $5.0 million. This higher per occurrence retention may result in higher workers compensation costs to us with a corresponding negative effect on our operating results. The formation of the captive provides the Company with access to a broader, more competitive market for excess insurance coverage, as well as certain income tax benefits arising from the ability to accelerate the deduction, for tax purposes of, certain accruals for workers compensation claims.

Claims Management. As a self-insured employer, our workers compensation expense is tied directly to the incidence and severity of workplace injuries to our employees. We seek to contain our workers compensation costs through an aggressive approach to claims management. We use managed-care systems to reduce medical costs and keep time-loss costs to a minimum by assigning injured workers, whenever possible, to short-term assignments which accommodate the workers physical limitations. We believe that these assignments minimize both time actually lost from work and covered time-loss costs. We employ internal, professionally licensed claims adjusters and engage third-party claims administrators (TPAs) to provide the principal claims management expertise. Typical management procedures include performing thorough and prompt on-site investigations of claims filed by employees, working with physicians to encourage efficient medical management of cases, denying questionable claims and attempting to negotiate early settlements to eliminate future development of claims costs. We also maintain a corporate-wide pre-employment drug screening program and a mandatory post-injury drug test. The program is believed to have resulted in a reduction in the frequency of fraudulent claims and in accidents in which the use of illegal drugs appears to have been a contributing factor.

Elements of Self-Insurance Costs. The costs associated with our self-insured workers compensation program include case reserves for reported claims, an additional expense provision for potential future increases in the cost of open injury claims (known as adverse loss development) and claims incurred in prior periods but not reported (referred to as IBNR), fees payable to our TPAs, additional claims administration expenses, administrative fees payable to state and federal workers compensation regulatory agencies, legal fees, broker commissions for business referrals, premiums for excess workers compensation insurance, and costs associated with forming and operating our wholly owned fully licensed captive insurance company for excess coverage. The state assessments are typically based on payroll amounts and, to a limited extent, the amount of permanent disability awards during the previous year. Excess insurance premiums are also based in part on the size and risk profile of our payroll and loss experience.

Workers Compensation Claims Experience and Reserves

We recognize our liability for the ultimate payment of incurred claims and claims adjustment expenses by accruing liabilities which represent estimates of future amounts necessary to pay claims and related expenses with respect to covered events that have

- 11 -

Table of Contents

occurred. When a claim involving a probable loss is reported, our internal claims management personnel or our TPA establishes a case reserve for the estimated amount of ultimate loss. The estimate reflects an informed judgment based on established case reserving practices and the experience and knowledge of our claims management staff and the TPA regarding the nature and expected value of the claim, as well as the estimated expense of settling the claim, including legal and other fees and expenses of administering claims. The adequacy of such case reserves depends on the professional judgment of both our claims management staff and our TPA to properly and comprehensively evaluate the economic consequences of each claim. Also, on an aggregate basis, we have established an additional reserve for both future adverse loss development in excess of initial case reserves on open claims and for claims incurred but not reported, referred to as the IBNR reserve.

As part of the case reserving process, historical data is reviewed and consideration is given to the anticipated effect of various factors, including known and anticipated legal developments, inflation and economic conditions. Reserve amounts are necessarily based on managements estimates, and as other data becomes available, these estimates are revised, which may result in increases or decreases in existing case reserves. Managements internal accrual process for workers compensation expense is based upon the immediate recognition of an expense and the related liability at the time a claim occurs; the value ascribed to the expense and liability is based upon the Companys historical average claim cost by geographic region coupled with our internal claims management and the TPAs estimate of ultimate claim cost. Management reviews the adequacy of these average historical claim costs by geographic region at least annually. Managements accrual process also includes an internally developed methodology to project the number of medical only claims that may, in the future, convert to more costly time loss or indemnity claims. We believe our total accrued workers compensation claims liabilities at December 31, 2007, are adequate. It is possible, however, that our actual future workers compensation obligations may exceed the amount of our accrued liabilities, with a corresponding negative effect on future earnings, due to such factors as unanticipated adverse loss development of known claims, and to a much lesser extent, of claims incurred but not reported.

Failure to successfully manage the severity and frequency of workers compensation injuries would result in increased workers compensation expense and would have a negative effect, which may be substantial, on our operating results and financial condition. Management maintains clear guidelines for our branch office managers, account managers, and risk managers directly tying their continued employment to their diligence in understanding and addressing the risks of accident or injury associated with the industries in which client companies operate and in monitoring the compliance by clients with workplace safety requirements. We have a policy of zero tolerance for avoidable workplace injuries. Each of our risk managers has the authority to cancel any staffing customer or PEO client at any time based upon their assessment of their safe-work practices or philosophies.

Employees and Employee Benefits

At December 31, 2007, we had approximately 43,065 employees, including approximately 10,500 staffing services employees, approximately 32,200 PEO employees, approximately 365 managerial, sales and administrative employees and five executive officers. The number of employees at any given time may vary significantly due to business conditions at customer or client companies. During 2007, approximately 1% of our employees

- 12 -

Table of Contents

were covered by a collective bargaining agreement. Substantially all of our managerial, sales and administrative employees have entered into a standard form of employment agreement which, among other provisions, contains covenants not to engage in certain activities in competition with us for 18 months following termination of employment and to maintain the confidentiality of certain proprietary information. We believe our employee relations are good.

Benefits offered to our staffing services employees include a limited major-medical insurance plan, a Section 125 cafeteria plan which permits employees to use pretax earnings to fund various services, including health insurance premiums and childcare expenses, and a retirement savings plan (the 401(k) plan) under Section 401(k) of the Internal Revenue Code pursuant to which employees may begin making contributions upon reaching 21 years of age and completing 1,000 hours of service in any consecutive 12-month period. We may also make contributions to the 401(k) plan, which vest over six years and are subject to certain legal limits, at the sole discretion of our board of directors. Beginning in 2006, we made matching contributions to the 401(k) plan under a safe harbor provision, whereby we match 100% of contributions by management and staffing employees to the 401(k) plan up to 3% of each participating employees annual compensation and 50% of the employees contributions up to an additional 2% of annual compensation. Employees subject to a co-employer arrangement may participate in our benefit plans at the election of the co-employer.

Regulatory and Legislative Issues

Business Operations. We are subject to the laws and regulations of the jurisdictions within which we operate, including those governing self-insured employers under the workers compensation systems in Oregon, California, Maryland and Delaware, as well as in Washington for non-PEO services. An Oregon PEO company is required to be licensed as a worker-leasing company by the Workers Compensation Division of the Oregon Department of Consumer and Business Services. We are in compliance with this licensing requirement. Temporary staffing companies are expressly exempt from the Oregon licensing requirement. Oregon PEO companies are also required to ensure that each PEO client provides adequate training and supervision for its employees to comply with statutory requirements for workplace safety and to give 30 days written notice in the event of a termination of its obligation to provide workers compensation coverage for PEO employees and other subject employees of a PEO client. Although compliance with these requirements imposes some additional financial risk on us, particularly with respect to those clients who breach their payment obligation to us, such compliance has not had a material adverse effect on our business to date.

Employee Benefit Plans. Our operations are affected by numerous federal and state laws relating to labor, tax and employment matters. By entering into a co-employer relationship with employees who are assigned to work at client locations (sometimes referred to as work-site employees), we assume certain obligations and responsibilities of an employer under these federal and state laws. Because many of these federal and state laws were enacted prior to the develop-ment of nontraditional employment relationships, such as professional employer, temporary employment, and outsourcing arrangements, many of these laws do not specifically address the obligations and responsibilities of nontraditional employers. In addition, the definition of employer under these laws is not uniform.

- 13 -

Table of Contents

As an employer, we are subject to all federal statutes and regulations governing our employer-employee relationships. Subject to the discussion of risk factors below, we believe that our operations are in compliance in all material respects with applicable federal statutes and regulations.

We offer various qualified employee benefit plans to our employees, including employees of our PEO clients who so elect. These qualified employee benefit plans include our 401(k) plan, a cafeteria plan under Section 125 of the Internal Revenue Code, and group health, life insurance and disability insurance plans. Generally, qualified employee benefit plans are subject to provisions of both the Internal Revenue Code and the Employee Retirement Income Security Act of 1974 (ERISA). In order to qualify for favorable tax treatment under the Internal Revenue Code, qualified plans must be established and maintained by an employer for the exclusive benefit of its employees.

Our filings with the SEC, including our annual report on Form 10-K, quarterly reports on Form 10-Q, periodic reports on Form 8-K and amendments to these reports, are accessible free of charge at our website at http://www.barrettbusiness.com as soon as reasonably practicable after filing with the SEC. By making this reference to our website, we do not intend to incorporate into this report any information contained in the website. The website should not be considered part of this report.

The SEC maintains a website at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers with publicly traded securities, including the Company.

| Item 1A. | RISK FACTORS |

In addition to other information contained in this report, the following risk factors should be considered carefully in evaluating our business.

Our workers compensation loss reserves may be inadequate to cover our ultimate liability for workers compensation costs.

We maintain reserves (recorded as accrued liabilities on our balance sheet) to cover our estimated liabilities for our self-insured workers compensation claims. The determination of these reserves is based upon a number of factors, including current and historical claims activity, claims payment patterns and medical cost trends and developments in existing claims. Accordingly, reserves do not represent an exact calculation of liability. Reserves can be affected by both internal and external events, such as adverse developments on existing claims or changes in medical costs, medical condition of the claimant, claims handling procedures, administrative costs, inflation, and legal trends and legislative changes. Reserves are adjusted from time to time to reflect new claims, claim developments, or systemic changes, and such adjustments are reflected in the results of the periods in which the reserves are changed. The Companys estimated accrual for workers compensation claims liabilities does not include an estimated provision for the incidence of catastrophic claims. Moreover, because of the uncertainties that surround estimating workers compensation loss reserves, we cannot be certain that our reserves are adequate. If our reserves are insufficient to cover our actual losses, we would have to increase our reserves and incur charges to our earnings that could be material.

- 14 -

Table of Contents

Our self-insured retention for workers compensation claims increased from $1.0 million per occurrence to $5.0 million per occurrence beginning January 1, 2007.

In view of the Companys historical experience with large catastrophic claims and an opportunity to realize savings from lower excess workers compensation insurance premiums, effective January 1, 2007, we increased our self-insured retention from $1.0 million to $5.0 million per occurrence, except in Maryland where our retention remains at $1.0 million per occurrence. Thus, the Company has increased financial risk for all workers compensation claims under $5.0 million, on a per occurrence basis.

Adverse developments in the market for excess workers compensation insurance could lead to increases in our costs.

We are a state-approved self-insured employer for workers compensation coverage in California, Oregon, Delaware and Maryland, as well as in Washington for our non-PEO services. To manage our financial exposure in the event of catastrophic injuries or fatalities, we maintain excess workers compensation insurance with a per occurrence retention of $5.0 million effective January 1, 2007 through our captive insurance company, except in Maryland where our retention remains at $1.0 million per occurrence. Prior to January 1, 2007, our self-insured retention was $1.0 million. Changes in the market for excess workers compensation insurance may lead to limited availability of such coverage, additional increases in our insurance costs or further increases in our self-insured retention, any of which may have a material adverse effect on our financial condition.

Changes in the market for workers compensation insurance in the state of California could adversely affect our business.

Our PEO service revenues in California have grown rapidly over the last four years due in part to difficult market conditions for workers compensation insurance in California and our status as a state-approved self-insured employer with respect to workers compensation coverage in that state. Since 2002, California has enacted several legislative reforms in an attempt to address the crisis in its workers compensation system, and it may attempt additional legislative or regulatory reforms in the future. Any successful legislative reforms or non-governmental changes in market conditions in California could lessen a key advantage we have in that state, leading to a reduction in our new business opportunities and a potential slowing in the growth of our PEO business in California. Any such slowing would adversely affect our results of operations.

Because we assume the obligation to make wage, tax and regulatory payments in respect of some employees, we are exposed to client credit risks.

We generally assume responsibility for and manage the risks associated with our clients employee payroll obligations, including liability for payment of salaries and wages (including payroll taxes), as well as group health and retirement benefits. These obligations are fixed, whether or not the client makes payments required by our services agreement, which exposes us to credit risks. We attempt to mitigate this risk by invoicing our staffing customers weekly and our PEO clients at the end of their specific payroll processing cycle. We also carefully monitor the timeliness of our clients payments and impose strict credit standards on our customers. If we fail to successfully manage our credit risk, our results of operations and financial condition could be materially and adversely affected.

- 15 -

Table of Contents

Our staffing business is vulnerable to economic fluctuations. Companies tend to use fewer temporary employees as economic activity slows, while recruiting employees to fill our customers needs becomes increasingly difficult during robust economic periods.

Demand for our staffing services is sensitive to changes in the level of economic activity in the regions in which we do business. As economic activity begins to improve, temporary employees are often added before full-time employees are hired as companies cautiously re-enter the labor market. As a result, our revenues derived from staffing services may be highest at the beginning of an economic recovery. During strong economic periods, however, we often experience shortages of qualified employees to meet customer needs. Also, as economic activity begins to slow down, as has occurred in our market areas in recent months, companies often reduce their use of temporary employees before undertaking layoffs of permanent staff, resulting in decreased demand for staffing services. A significant economic downturn, particularly in the Western United States, could have a material adverse effect on our results of operations and financial condition.

If we are determined not to be an employer under certain laws and regulations, our clients may stop using our services, and we may be subject to additional liabilities.

We believe that we are an employer of employees provided to our PEO clients on a co-employment basis under the various laws and regulations of the Internal Revenue Service and the U.S. Department of Labor. If we are determined not to be an employer under such laws and regulations and are therefore unable to assume obligations of our clients for employment and other taxes, our clients may be held jointly and severally liable for payment of such taxes. Some clients or prospective clients may view such potential liability as an unacceptable risk, discouraging current clients from continuing a relationship with us or prospective clients from entering into a new relationship with us.

Any determination that we are not an employer for purposes of ERISA could adversely affect our cafeteria benefits plan operated under Section 125 of the Internal Revenue Code and result in liabilities to us under the plan.

We may be exposed to employment-related claims and costs and periodic litigation that could adversely affect our business and results of operations.

We either co-employ employees in connection with our PEO arrangements or place our employees in our customers workplace in connection with our staffing business. As such, we are subject to a number of risks inherent to our status as an employer, including without limitation:

| | claims of misconduct or negligence on the part of our employees, discrimination or harassment claims against our employees, or claims by our employees of discrimination or harassment by our clients; |

| | immigration-related claims; |

| | claims relating to violations of wage, hour and other workplace regulations; |

| | claims relating to employee benefits, entitlements to employee benefits, or errors in the calculation or administration of such benefits; and |

| | possible claims relating to misuse of customer confidential information, misappropriation of assets or other similar claims. |

- 16 -

Table of Contents

If we experience significant incidents involving any of the above-described risk areas we could face substantial out-of-pocket losses, fines or negative publicity. In addition, such claims may give rise to litigation, which may be time consuming, distracting and costly, and could have a material adverse effect on our business. With respect to claims involving our co-employer relationship with our PEO clients, although our PEO services agreement provides that the client will indemnify us for any liability attributable to the conduct of the client or its employees, we may not be able to enforce such contractual indemnification, or the client may not have sufficient assets to satisfy its obligations to us.

We operate in a complex regulatory environment, and failure to comply with applicable laws and regulations could adversely affect our business.

Corporate human resource operations are subject to a broad range of complex and evolving laws and regulations, including those applicable to payroll practices, benefits administration, employment practices and privacy. Because our clients have employees in many states throughout the United States, we must perform our services in compliance with the legal and regulatory requirements of multiple jurisdictions. Some of these laws and regulations may be difficult to ascertain or interpret and may change from time to time. Violation of such laws and regulations could subject us to fines and penalties, damage our reputation, constitute a breach of our client agreements, impair our ability to obtain and renew required licenses, and decrease our profitability or competitiveness. If any of these effects were to occur, our operating results and financial condition could be adversely affected.

Changes in government regulations may result in restrictions or prohibitions applicable to the provision of employment services or the imposition of additional licensing, regulatory or tax requirements.

Our PEO and staffing businesses are heavily regulated in most jurisdictions in which we operate. We cannot assure you that the states in which we conduct or seek to conduct business will not:

| | impose additional regulations that prohibit or restrict employment-related businesses like ours; |

| | require additional licensing or add restrictions on existing licenses to provide employment-related services; or |

| | increase taxes or make changes in the way in which taxes are calculated for providers of employment-related services. |

Any changes in applicable laws and regulations may make it more difficult or expensive for us to do business, inhibit expansion of our business, or result in additional expenses that limit our profitability or decrease our ability to attract and retain clients.

We may find it difficult to expand our business into additional states due to varying state regulatory requirements.

Future growth in our operations depends, in part, on our ability to offer our services to prospective clients in new states, which may subject us to different regulatory requirements and standards. In order to operate effectively in a new state, we must obtain all necessary

- 17 -

Table of Contents

regulatory approvals, adapt our procedures to that states regulatory requirements and modify our service offerings to adapt to local market conditions. In the event that we expand into additional states, we may not be able to duplicate in other markets the financial performance experienced in our current markets.

Acquisitions subject us to various risks, including risks relating to selection and pricing of acquisition targets, integration of acquired companies into our business and assumption of unanticipated liabilities.

We have completed 26 acquisitions since 1993 and may pursue additional acquisitions and investment opportunities. It cannot be assured, however, that management we will be able to identify or consummate any additional acquisitions. If we do pursue acquisitions, we may not realize the anticipated benefits of such acquisitions. Acquisitions involve many risks, including risks relating to the assumption of unforeseen liabilities of an acquired business, adverse accounting charges resulting from the acquisition, and difficulties in integrating acquired companies into our business, both from a cultural perspective, as well as with respect to personnel and client retention and technological integration. Acquired liabilities may be significant and may adversely affect our financial condition and results of operations. Our inability to successfully integrate acquired businesses may lead to increased costs, failure to generate expected returns, accounting charges, or even a total loss of amounts invested, any of which could have a material adverse effect on our financial condition and results of operations.

Our business is subject to risks associated with geographic market concentration.

Our California and Oregon operations accounted for approximately 55% and 17%, respectively, of our total net revenues in 2007. As a result of the current importance of our California and Oregon operations and anticipated continued growth from these operations, our profitability over the next several years is expected to be largely dependent on economic and regulatory conditions in these markets, particularly in California. If these states experience an economic downturn or growth rates slow, or if the regulatory environment changes in a way that adversely affects our ability to do business in these states or limits our competitive advantages in these markets, our profitability and growth prospects may be materially and adversely affected.

We face competition from a number of other companies.

We face competition from various companies that may provide all or some of the services we offer. Our competitors include companies that are engaged in staffing services such as Kelly Services, Inc. and Manpower Inc., companies that are focused on co-employment, such as Administaff, Inc. and Gevity HR, Inc., and companies that primarily provide payroll processing services, such as Automatic Data Processing, Inc. and Paychex, Inc. We also face competition from information technology outsourcing firms and broad-based outsourcing and consulting firms that perform individual projects.

Several of our existing or potential competitors have substantially greater financial, technical and marketing resources than we do, which may enable them to:

| | develop and expand their infrastructure and service offerings more quickly and achieve greater cost efficiencies; |

- 18 -

Table of Contents

| | invest in new technologies; |

| | expand operations into new markets more rapidly; |

| | devote greater resources to marketing; |

| | compete for acquisitions more effectively and complete acquisitions more easily; and |

| | aggressively price products and services and increase benefits in ways that we may not be able to match economically. |

In order to compete effectively in our markets, we must target our potential clients carefully, continue to improve our efficiencies and the scope and quality of our services, and rely on our service quality, innovation, education and program clarity. If our competitive advantages are not compelling or sustainable, then we are unlikely to increase or sustain profits and our stock price could decline.

The decline in market value of a portion of our investment portfolio could be other than temporary.

A portion of the Companys investment portfolio is allocated to four closed-end bond funds with an original cost of $4.0 million. The recent dislocation in the capital markets has caused the market value to decline approximately $2.4 million below cost. To date, the Company has charged the cumulative decrement in value against equity pursuant to generally accepted accounting principles. Management currently views the decrement in value to be temporary in nature due to market conditions, coupled with the continuing financial performance of the underlying securities. If the decline in value of the closed-end bond funds is determined at some point in the future to be other than temporary, the Company will record a material impairment charge against its operating results for the full amount by which the then-fair value of the bond funds is below cost, which could result in a material decline in our stock price.

We are dependent upon certain key personnel and recruitment and retention of key employees may be difficult and expensive.

We believe that the successful operation of our business is dependent upon our retention of the services of key personnel, including our chief executive officer, other executive officers and branch managers. We may not be able to retain all of our executives, senior managers and key personnel in light of competition for their services. If we lose the services of one of our executive officers or a significant number of our senior managers, our operations and profitability likely would be adversely affected.

We do not have an expansive in-house sales staff and therefore rely extensively on brokers to make referrals.

We maintain only a minimal internal professional sales force. Instead, we rely heavily on insurance brokers to provide referrals to new business, especially in California, although each branch office manager is expected to be an effective leader in business development, including marketing efforts and sales closures. In connection with these arrangements, we

- 19 -

Table of Contents

pay a fee to brokers for new clients. As a result of our reliance on brokers, we are dependent on firms and individuals that do not have an exclusive relationship with us. If we are unable to maintain our relationships with brokers, if brokers increase their fees or if brokers lose confidence in our services, we could face declines in our business and additional costs and uncertainties as we attempt to hire and train an internal sales force.

We depend on attracting and retaining qualified employees; during periods of economic growth, our costs to do so increase and it becomes more difficult to attract and retain people.

The success of our staffing services depends on our ability to attract and retain qualified employees for placement with our customers. Our ability to attract and retain qualified personnel could be impaired by rapid improvement in economic conditions resulting in lower unemployment and increases in compensation. During periods of economic growth, we face growing competition for retaining and recruiting qualified personnel, which in turn leads to greater advertising and recruiting costs and increased salary expenses. If we cannot attract and retain qualified employees, the quality of our services may deteriorate and our reputation and results of operations could be adversely affected.

Our service agreements may be terminated on short notice, leaving us vulnerable to loss of a significant amount of customers in a short period of time, if business or regulatory conditions change or events occur that negatively affect our reputation.

Our PEO services agreements are generally terminable on 30 days notice by either us or the client. As a result, our clients may terminate their agreement with us at any time, making us particularly vulnerable to changing business or regulatory conditions or changes affecting our reputation or the reputation of our industry.

Our industry has at times received negative publicity and had some stigma associated with it that, if it were to predominate, could cause our business to decline.

Both PEOs and staffing services companies periodically have been tarnished by negative publicity or scandals from poor business judgment or even outright fraud. If we or our industry face negative publicity, customers confidence in the use of temporary personnel or co-employed workers may deteriorate, and they may be unwilling to enter into or continue our staffing or co-employment relationships. If a negative perception were to prevail, it would be more difficult for us to attract and retain customers.

Changes in state unemployment tax laws and regulations could adversely affect our business.

In recent years, there has been significant negative publicity relating to the use of staffing or PEO companies to shield employers from poor unemployment history and high unemployment taxes. New legislation enacted at the state or federal level to try to counter this perceived problem could have a material adverse effect on our business by limiting our ability to market our services or making our services less attractive to our customers and potential customers.

- 20 -

Table of Contents

We are dependent upon technology services and if we experience damage, service interruptions or failures in our computer and telecommunications systems, or if our security measures are breached, our client relationships and our ability to attract new clients may be adversely affected.

Our business could be interrupted by damage to or disruption of our computer and telecommunications equipment and software systems, and we may lose data. Our clients businesses may be adversely affected by any system or equipment failure we experience. As a result of any of the foregoing, our relationships with our clients may be impaired, we may lose clients, our ability to attract new clients may be adversely affected and we could be exposed to contractual liability. Precautions in place to protect ourselves from, or minimize the effect of, such events, may not be adequate.

In addition, our business involves the storage and transmission of clients proprietary information and confidential personal data of employees and security breaches could expose us to a risk of loss of this information, litigation and possible liability. If our security measures are breached as a result of third-party action, employee error, malfeasance or otherwise, and, as a result, someone obtains unauthorized access to client or employee data, our reputation will be damaged, our business may suffer and we could incur significant liability. Techniques used to obtain unauthorized access or to sabotage systems change frequently and are growing increasingly sophisticated. As a result, we may be unable to anticipate these techniques or to implement adequate preventative measures. If an actual or perceived breach of our security occurs, we could be liable and the market perception of our services could be harmed.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

| Item 2. | PROPERTIES |

We provide PEO and staffing services through all 44 of our branch offices. The following table shows the number of branch offices located in each state in which we operate. We also lease office space in other locations in our market areas which we use to recruit and place employees.

| Offices |

Number of Branch Offices |

|

| California |

15 | |

| Oregon |

9 | |

| Utah |

5 | |

| Washington |

4 | |

| Colorado |

3 | |

| Idaho |

3 | |

| Maryland |

2 | |

| Arizona |

1 | |

| Delaware |

1 | |

| North Carolina |

1 |

- 21 -

Table of Contents

We lease office space for our branch offices. At December 31, 2007, our leases had expiration dates ranging from less than one year to six years, with total minimum payments through 2013 of approximately $7.1 million. Effective March 11, 2006, we relocated our corporate headquarters office to Vancouver, Washington. We now occupy approximately 17 percent of the 63,500 square foot building we purchased during the third quarter of 2005 at a price of $8.85 million.

| Item 3. | LEGAL PROCEEDINGS |

The Company is periodically party to litigation incidental to providing employment services. Based on information currently known to management, although there are uncertainties inherent in litigation, there were no legal proceedings pending against the Company at December 31, 2007, or during the period beginning with that date through March 14, 2008, that individually or in the aggregate, will have a material adverse effect on the Companys financial condition or results of operations.

| Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of the Companys stockholders during the fourth quarter of 2007.

EXECUTIVE OFFICERS OF THE REGISTRANT

The following table identifies, as of February 29, 2008, each executive officer of the Company. Executive officers are elected annually and serve at the discretion of the Board of Directors.

| Name |

Age | Principal Positions and Business Experience |

Officer Since |

|||

| William W. Sherertz |

62 | President; Chief Executive Officer; Director | 1980 | |||

| Michael L. Elich |

42 | Vice President and Chief Operating Officer | 2005 | |||

| Michael D. Mulholland |

56 | Vice President-Finance, Treasurer and Secretary; Chief Financial Officer | 1994 | |||

| Gregory R. Vaughn |

52 | Vice President | 1998 | |||

| James D. Miller |

44 | Controller and Assistant Secretary; Principal Accounting Officer | 1994 | |||

William W. Sherertz has acted as Chief Executive Officer of the Company since 1980. He has also been a director of the Company since 1980, and was appointed President of the Company in March 1993. Mr. Sherertz also serves as Chairman of the Board of Directors.

Michael L. Elich joined the Company in October 2001 as Director of Business Development. He was appointed Vice President and Chief Operating Officer in May 2005. From 1995 to 2001, Mr. Elich served as Executive Vice President and Chief Operating Officer of Skills Resource Training Center, a staffing services company with offices in Oregon, Washington and Idaho that we acquired effective January 1, 2004.

- 22 -

Table of Contents

Michael D. Mulholland joined the Company in August 1994 as Vice President-Finance and Secretary and was appointed to the additional position of Treasurer in May 2005. From 1988 to 1994, Mr. Mulholland was employed by Sprouse-Reitz Stores Inc. (Sprouse), a former Nasdaq-listed retail company, serving as its Executive Vice President, Chief Financial Officer and Secretary. Prior to Sprouse, Mr. Mulholland held senior management positions with Lamb-Weston, Inc., a food processing company, from 1985 to 1988, and Keil, Inc., a regional retail company, from 1978 to 1985. Mr. Mulholland, a certified public accountant on inactive status, was also employed by Touche Ross & Co., now known as Deloitte & Touche LLP.

Gregory R. Vaughn joined the Company in July 1997 as Operations Manager. Mr. Vaughn was appointed Vice President in January 1998. Prior to joining Barrett, Mr. Vaughn was Chief Executive Officer of Insource America, Inc., a privately-held human resource management company headquartered in Portland, Oregon, since 1996. Mr. Vaughn has also held senior management positions with Sundial Time Systems, Inc. from 1995 to 1996 and Continental Information Systems, Inc. from 1990 to 1994. Previously, Mr. Vaughn was employed as a technology consultant by Price Waterhouse LLP, now known as PricewaterhouseCoopers LLP.

James D. Miller joined the Company in January 1994 as Controller. From 1991 to 1994, he was the Corporate Accounting Manager for Christensen Motor Yacht Corporation. Mr. Miller, a certified public accountant on inactive status, was employed by Price Waterhouse LLP, now known as PricewaterhouseCoopers LLP, from 1987 to 1991.

PART II

| Item 5. | MARKET FOR REGISTRANTS COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock (the Common Stock) trades on the Global Select Market segment of The Nasdaq Stock Market under the symbol BBSI. At February 29, 2008, there were 44 stockholders of record and approximately 1,900 beneficial owners of the Common Stock.

The following table presents the high and low sales prices of the Common Stock and cash dividends paid for each quarterly period during the last two fiscal years, as reported by The Nasdaq Stock Market. Any future determination as to the payment of dividends will be made at the discretion of the Board and will depend upon the Companys operating results, financial condition, capital requirements, general business conditions and such other factors as the Board deems relevant.

- 23 -

Table of Contents

| High | Low | Cash Dividends Declared |

|||||||

| 2006 |

|||||||||

| First Quarter |

$ | 27.60 | $ | 21.05 | $ | - | |||

| Second Quarter |

27.45 | 18.09 | - | ||||||

| Third Quarter |

22.70 | 18.20 | - | ||||||

| Fourth Quarter |

25.16 | 20.30 | 0.07 | ||||||

| 2007 |

|||||||||

| First Quarter |

$ | 25.15 | $ | 21.86 | $ | 0.07 | |||

| Second Quarter |

26.70 | 22.81 | 0.07 | ||||||

| Third Quarter |

27.70 | 22.21 | 0.07 | ||||||

| Fourth Quarter |

25.75 | 15.75 | 0.08 | ||||||

In November 2006, the Board adopted a stock repurchase program and authorized the repurchase of up to 500,000 shares of the Companys stock from time to time in open market purchases. In November 2007, the Board approved an increase in the authorized shares to be repurchased up to 1.0 million shares. The following table summarizes information related to stock repurchases during the quarter ended December 31, 2007.

| Month |

Shares Repurchased |

Average Price Per Share |

Total Value of Shares Repurchased as Part of Publicly Announced Plan |

Maximum Number of Shares that May Yet Be Repurchased Under the Plan |

||||||

| October |

- | - | - | - | ||||||

| November |

159,239 | $ | 16.35 | $ | 2,603,698 | 840,761 | ||||

| December |

- | - | - | - | ||||||

| Total |

159,239 | $ | 16.35 | $ | 2,603,698 | 840,761 | ||||

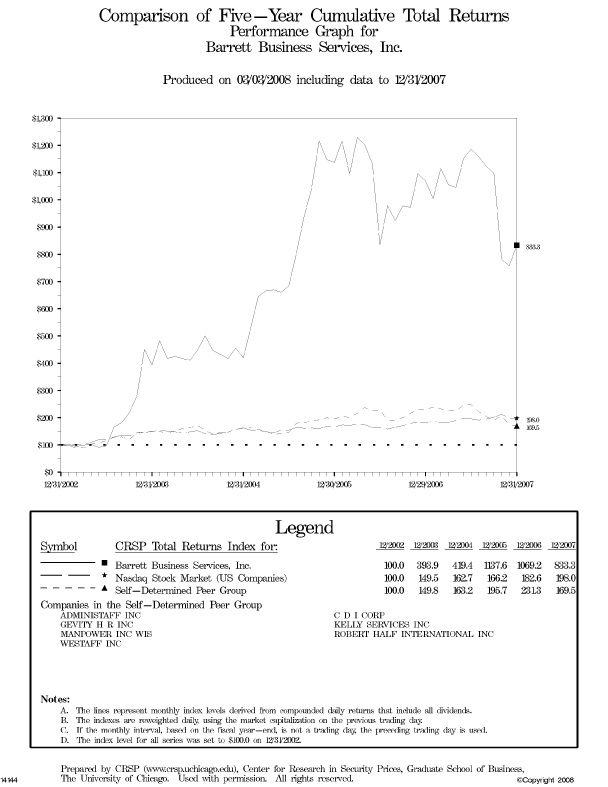

The following graph shows the cumulative total return at the dates indicated for the period from December 31, 2002, until December 31, 2007, for the Common Stock, The Nasdaq Stock Market, and a group of the Companys current peers in the staffing industry (the 2008 Peer Group). The 2008 Peer Group is comprised of seven companies included in the peer group used to prepare the performance graph included in the Companys Form 10-K for the year ended December 31, 2006.

The stock performance graph has been prepared assuming that $100 was invested on December 31, 2002, in the Common Stock, The Nasdaq Stock Market, and the 2008 Peer Group, and that dividends are reinvested. In accordance with the SECs disclosure rules, the stockholder return for each company in the 2008 Peer Group indices has been weighted on the basis of market capitalization as of the beginning of each annual period shown. The stock price performance reflected in the graph may not be indicative of future price performance.

- 24 -

Table of Contents

- 25 -

Table of Contents

| Item 6. | SELECTED FINANCIAL DATA |

The following selected financial data should be read in conjunction with the Companys financial statements and the accompanying notes listed in Item 15 of this report.

| Year Ended December 31, | ||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | ||||||||||||||||

| (In thousands, except per share data) | ||||||||||||||||||||

| Statement of operations: |

||||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Staffing services |

$ | 147,221 | $ | 123,500 | $ | 130,098 | $ | 123,514 | $ | 93,544 | ||||||||||

| Professional employer service fees |