10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 16, 2015

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Commission File Number 0-21886

BARRETT BUSINESS SERVICES, INC.

(Exact name of registrant as specified in its charter)

| Maryland | 52-0812977 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

|

| 8100 NE Parkway Drive, Suite 200 Vancouver, Washington |

98662 | |

| (Address of principal executive offices) | (Zip Code) | |

(360) 828-0700

(Registrants telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered |

|

| Common Stock, Par Value $0.01 Per Share |

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as indicated by Exchange Act Rule 12b-2).

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the aggregate market value of the common equity held by non-affiliates of the registrant: $330,349,417 at June 30, 2014

Indicate the number of shares outstanding of each of the registrants classes of common stock, as of the latest practicable date:

| Class |

Outstanding at March 2, 2015 |

|

| Common Stock, Par Value $.01 Per Share | 7,137,791 Shares |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the 2015 Annual Meeting of Stockholders are hereby incorporated by reference into Part III of Form 10-K.

Table of Contents

BARRETT BUSINESS SERVICES, INC.

2014 ANNUAL REPORT ON FORM 10-K

- 1 -

Table of Contents

PART I

| Item 1. | BUSINESS |

General

Company Background. Barrett Business Services, Inc. (BBSI, the Company, our or we), is a leading provider of business management solutions for small-and mid-sized companies. The Company has developed a management platform that integrates a knowledge-based approach from the management consulting industry with tools from the human resource outsourcing industry. This platform, through the effective leveraging of human capital, assists our business owner clients in more effectively running their business. We believe this platform, delivered through a decentralized organizational structure, differentiates BBSI from our competitors. BBSI was incorporated in Maryland in 1965.

Business Strategy. Our strategy is to align local operations teams with the mission of small and mid-sized business owners, driving value to their business. To do so, BBSI:

| | partners with business owners to leverage their investment in human capital through a high-touch, results-oriented approach; |

| | brings predictability to each client organization through a three-tiered management platform; and |

| | enables business owners to focus on their core business by reducing organizational complexity and maximizing productivity. |

Business Organization. We operate a decentralized delivery model using locally based teams, typically located within 50 miles of our client companies. We recruit senior level managers to oversee, develop and expand our business at the branch-office level. Additionally, we recruit professionals with expertise in human resources, risk management and workplace safety and various types of administration, including payroll, to field our client delivery teams. This structure fosters autonomous decision-making, allowing local teams of professionals to deliver plans that most closely align with the needs of each business owner client. It also assists us by incubating talent to support increased growth and capacity. We have clients with employees located in 22 states and the District of Columbia, through a network of 54 branch locations in California, Oregon, Washington, Idaho, Arizona, Nevada, Utah, Colorado, Maryland, Delaware and North Carolina. We also have several smaller recruiting locations in our general market areas, which are under the direction of a branch office.

BBSI believes that making significant investments in the best talent available allows us to leverage the value of this investment many times over. We motivate our management employees through a compensation package that includes a competitive base salary and the opportunity for profit sharing. At the branch level, profit sharing is in direct correlation to client performance, reinforcing a culture focused on achievement of client goals.

Services Overview. BBSIs core purpose is to advocate for business owners, particularly in the small-and mid-sized business segment. Our evolution from an entrepreneurially run company to a professionally managed organization has helped to form

- 2 -

Table of Contents

our view that all businesses experience inflection points at key stages of growth. The insights gained through our own growth, along with the trends we see in working with more than 3,000 companies each day, define our approach to guiding business owners through the challenges associated with being an employer.

BBSIs business teams align with each business owner client through a structured three-tiered progression. In doing so, business teams focus on the objectives of each business owner and deliver planning, guidance and resources in support of those objectives.

Tier 1: Tactical Alignment

The first stage focuses on the mutual setting of expectations and is essential to a successful client relationship. It begins with a process of assessment and discovery in which the business owners business objectives, attitudes, and culture are aligned with BBSIs processes, controls and culture. This stage includes an implementation process, which addresses the administrative components of employment.

Tier 2: Dynamic Relationship

The second stage of the relationship emphasizes organizational development as a means of achieving each clients business objectives. There is a focus on process improvement, development of best practices, supervisor training and leadership development.

Tier 3: Strategic Counsel

With an emphasis on advocacy on behalf of the business owner, the third stage of the relationship is more strategic and forward-looking with a goal of cultivating an environment in which all efforts are directed by the mission and long-term objectives of the business owner.

In addition to serving as resource and guide, BBSI has the ability to provide workers compensation coverage as a means of meeting statutory requirements and protecting our clients from employment-related injury claims. Through our internal claims managers and our third-party administrators, we provide claims management services for our co-employed clients. We work aggressively to manage and reduce job injury claims, identify fraudulent claims and structure optimal work programs, including modified duty employees.

Categories of Services

We report financial results in two categories of services: Professional Employer Services (PEO) and Staffing. During 2014, we supported in excess of 3,600 PEO clients and approximately 129,000 employees. This compares to more than 3,200 PEO clients and approximately 111,000 employees during 2013. See Item 7 of this Report for information regarding the percentages of total net revenues provided by our PEO and staffing services for each of the last three fiscal years.

PEO. We enter into a client services agreement to establish a co-employment relationship with each client company, assuming responsibility for payroll, payroll taxes, workers compensation coverage and certain other administrative functions for the clients existing workforce. The client maintains physical care, custody and control of their workforce, including the authority to hire and terminate employees.

- 3 -

Table of Contents

Staffing and Recruiting. Our staffing services include on-demand or short-term staffing assignments, contract staffing, long-term or indefinite-term on-site management, and direct placement. Our recruiting experts maintain a deep network of professionals from which we source candidates. Through an assessment process, we gain an understanding of the short-and long-term needs of our clients, allowing us to identify and source the right talent for each position. We then conduct a rigorous screening process to help ensure a successful hire.

Clients and Client Contracts

Our business is typically characterized by long-term relationships that result in recurring revenue. Our client relationships are codified in a client services agreement, which typically provides for an initial term of one year with renewal for additional one-year periods but generally permits cancellation by either party upon 30 days written notice. In addition, we may terminate the agreement at any time for specified breach of contract, including nonpayment or failure to follow our workplace safety recommendations. Our annual client retention rate is in excess of 90%. We do not include clients we have terminated in our retention calculation.

The client services agreement also provides for indemnification of us by the client against losses arising out of any default by the client under the agreement, including failure to comply with any employment-related, health and safety, or immigration laws or regulations. Our client service agreement requires clients in a co-employment arrangement to maintain comprehensive liability coverage in the amount of $1.0 million for acts of their employees. Although no claims exceeding such policy limits have been paid by us to date, the possibility exists that claims for amounts in excess of sums available to us through indemnification or insurance may be asserted in the future, which could adversely affect profitability.

We have client services agreements with a diverse array of customers, including among others, electronics manufacturers, various light-manufacturing industries, agriculture-based companies, transportation and shipping enterprises, food processing, telecommunications, public utilities, general contractors in various construction-related fields, and professional services firms. None of our clients individually represented more than 1% of our total revenues in 2014.

Market Opportunity

As a company that aligns with the mission of business owners by providing resources and guidance to small and mid-size businesses, BBSI believes its growth is driven by the desire of business owners to focus on mission-critical functions, reduce complexity associated with the employment function, mitigate costs and maximize the investment in human capital. Our integrated management platform has enabled us to capitalize on these needs within the small to mid-size business sector.

The small and mid-sized business segment is particularly attractive because:

| | it is large, continues to grow and remains underserved by professional services companies; |

| | it typically has fewer in-house resources than larger businesses and, as a result, is generally more dependent on external resources; |

- 4 -

Table of Contents

| | we generally experience a relatively high client retention rate and lower client acquisition costs within this market segment; and |

| | we have found that small to mid-size businesses are responsive to quality of service, ease-of-use, and responsiveness to clients needs when selecting a PEO or staffing services provider. |

Competition

The business environment in which we operate is characterized by intense competition and fragmentation. BBSI is not aware of reliable statistics regarding the number of its competitors, but certain large, well-known companies typically compete with us in the same markets and also have greater financial and marketing resources than we do, including Automatic Data Processing, Inc., Manpower, Inc., Kelly Services, Inc., Insperity, Inc., TriNet, Group, Inc. and Paychex, Inc. We may face additional competition in the future from new entrants to the field, including other staffing services companies, payroll processing companies and insurance companies. The principal competitive factors in the business environment in which we operate are price and level of service.

We believe that our growth is attributable to our ability to provide small and mid-sized companies with the resources and knowledge base of a large employer delivered through a local operations team. Our level of integration with each client business provides us an additional competitive advantage.

Sales and Marketing

We believe our clients are our best advocates and powerful drivers of our brand awareness. We support our clients and foster advocacy through branch-based business teams. As such, sales and marketing efforts are led by area managers who lead teams responsible for client delivery and retention. Each integrated team is comprised of a client-facing Business Partner, HR Consultant, Risk Management Consultant, a Payroll Specialist and in some instances, a Recruiting Specialist. By developing business teams in our existing branches, we expect to see incremental growth in the markets where we currently do business, driven by our reputation and client referrals. BBSIs business development is the primary function of our area managers, and is focused on branch-level development of local business relationships. In some markets, our sales efforts are further supported by Business Development Managers.

On a regional and national level, we seek to expand and align our services to meet business demand, which may include opening additional offices to better support a clients geographic needs, or adding new business teams within an existing branch location. We believe our business teams serve a dual purpose: 1) Delivering high-quality guidance to our clients, thereby supporting client business growth and driving client referrals, and 2) Incubating talent at the branch level to support expansion into new markets.

Our business growth has three sources: referrals from existing clients, direct business-to-business sales efforts by our area managers, and an extensive referral network. Our referral partners include insurance brokers, financial advisors, attorneys, CPAs, and other business professionals who can facilitate an introduction to prospective clients. These partners, typically in exchange for a fee equal to a small percentage of payroll, facilitate introductions to business owners on our behalf.

- 5 -

Table of Contents

Growth Strategy

Our growth strategy is focused in the following areas:

| | Support, strengthen and expand branch office operations through the ongoing development of business units. We believe that strengthening and expanding the operations of each location is an efficient and effective means of increasing market share in the geographic areas in which we do business. Because we understand that successful and satisfied client companies are a powerful driver of brand awareness, we focus on creating and expanding business units within each branch that provide tactical and strategic guidance to our client base. As our presence in each market grows through the addition of branch business units, we believe market awareness of our reputation and services increases. |

| | Enhance management information systems. We continue to invest in developing our information technology infrastructure, particularly in systems that allow increased engagement between our clients and their supporting business teams. We believe that this approach gives us a competitive advantage by allowing us to provide a high level of interaction with our small and medium-sized business clients on a cost-effective basis. Furthermore, we believe that our current technology platform is capable of supporting our planned development of new business units for the foreseeable future. |

| | Penetrate new markets. We intend to open additional branch offices in new geographic markets as opportunities arise. We have developed a well-defined approach to geographic expansion, which will serve as a guide for entering new markets. We believe our decentralized organizational model built on teams of senior-level professionals allows us to incubate talent as we expand into new markets. |

Workers Compensation

Through our client services agreement, we have the ability to provide workers compensation coverage to our clients. We provide this coverage through a variety of methods, all of which are subject to rigorous underwriting to assess financial stability, risk factors and cultural alignment related to safety and the clients desire to improve their operations. In providing this coverage, we are responsible for complying with applicable statutory requirements for workers compensation coverage. Additionally, risk mitigation is an important contributor to our principal goal of helping business owners operate their business more efficiently. It is in the mutual interests of the client and BBSI to commit to workplace safety and risk mitigation.

Elements of Workers Compensation System. State law (and for certain types of employees, federal law) generally mandates that an employer reimburse its employees for the costs of medical care and other specified benefits for injuries or illnesses, including catastrophic injuries and fatalities, incurred in the course and scope of employment. The benefits payable for various categories of claims are determined by state regulation and vary with the severity and nature of the injury or illness and other specified factors. In return for this guaranteed protection, workers compensation is an exclusive remedy and employees are generally precluded from seeking other damages from their employer for workplace injuries. Most states require employers to maintain workers compensation insurance or otherwise

- 6 -

Table of Contents

demonstrate financial responsibility to meet workers compensation obligations to employees. In many states, employers who meet certain financial and other requirements are permitted to self-insure. See Regulatory and Legislative Issues below for a discussion of recent developments in California.

Self Insurance for Workers Compensation. In August 1987, we became a self-insured employer for workers compensation coverage in Oregon. We subsequently obtained self-insured employer status for workers compensation in California, Delaware, Maryland and Colorado, as well as in Washington for our staffing and management employees. Regulations governing self-insured employers in each jurisdiction typically require the employer to maintain surety bonds, surety deposits of government securities, letters of credit or other financial instruments to cover workers claims in the event the employer is unable to pay for such claims. Effective January 1, 2015, BBSI no longer maintains a certificate to self-insure in the state of California, and now maintains individual policies for all California-based clients. See Regulatory and Legislative Issues below for a discussion of recent developments in California.

To manage our financial exposure to catastrophic injuries and fatalities, we maintain excess workers compensation insurance coverage. Our wholly owned, fully licensed captive insurance company incorporated in Arizona, Associated Insurance Company for Excess (AICE), provides us with excess workers compensation coverage from $1.0 million up to $5.0 million per occurrence in the states of Oregon, California, Delaware and Washington. Additional excess workers compensation insurance coverage is provided through annual policies issued by ACE Group (ACE) from $5.0 million to $15.0 million per occurrence, except for our Maryland and Colorado operations.

Our excess insurance policy in Maryland has a $1.0 million retention with a $25.0 million limit and our excess insurance policy in Colorado has a $2.0 million retention and statutory limits on a per occurrence basis. This approach results in an effective per occurrence retention, on a consolidated basis, of $5.0 million. This higher per occurrence retention may result in higher workers compensation costs to us with a corresponding negative effect on our operating results. AICE provides us with access to an alternative mechanism for excess insurance coverage, as well as certain income tax benefits arising from the ability to accelerate the deduction, for tax purposes, of certain accruals for workers compensation claims.

Additionally, we formed Ecole Insurance Company, a wholly owned fully licensed insurance company in Arizona (Ecole), to provide workers compensation coverage to our employees working in Arizona, beginning with claims occurring on or after March 1, 2010. Additional reinsurance coverage for Ecole is provided by ACE from $5.0 million to statutory limits per occurrence.

Claims Management. As a self-insured employer, our workers compensation expense is tied directly to the incidence and severity of workplace injuries to our employees. We seek to contain our workers compensation costs through an aggressive approach to claims management. We use managed-care systems to reduce medical costs and keep time-loss costs to a minimum by assigning injured workers, whenever possible, to short-term assignments which accommodate the workers physical limitations. We believe that these

- 7 -

Table of Contents

assignments minimize both time actually lost from work and covered time-loss costs. We employ internal, professionally licensed claims adjusters and engage third-party claims administrators (TPAs) to provide the principal claims management expertise. Typical management procedures include performing thorough and prompt on-site investigations of claims filed by employees, working with physicians to encourage efficient medical management of cases, denying questionable claims and attempting to negotiate early settlements to eliminate future development of claims costs. We also maintain a corporate-wide pre-employment drug screening program and a mandatory post-injury drug test. The program is believed to have resulted in a reduction in the frequency of fraudulent claims and in accidents in which the use of illegal drugs appears to have been a contributing factor.

Elements of Self-Insurance Costs. The costs associated with our self-insured workers compensation program include case reserves for reported claims, an additional expense provision for potential future increases in the cost of open injury claims (known as adverse loss development) and claims incurred in prior periods but not reported (referred to as IBNR), fees payable to our TPAs, additional claims administration expenses, administrative fees payable to state workers compensation regulatory agencies, legal fees, fees paid for business referrals, premiums for excess workers compensation insurance, and costs associated with forming and operating our wholly owned, fully licensed captive insurance company for excess coverage. The state assessments are typically based on payroll amounts and, to a limited extent, the amount of permanent disability awards during the previous year. Excess insurance premiums are also based in part on the size and risk profile of our payroll and loss experience.

Changes to Self-Insurance in California. In September 2012, California Senate Bill 863 (SB 863), was signed into law. Under SB 863, the California Director of Self-Insurance was required not to issue certificates of consent to self-insure after January 1, 2013, to any employer engaged in the activities of a professional employer organization, a leasing employer, a temporary services employer or any employer the Director determines to be in the business of providing employees to other employers. Additionally, the Director was required to revoke any previously issued certificate of consent to self-insure in favor of any employer engaged in these types of activities not later than January 1, 2015. To address this issue, in February 2014, BBSI entered into an arrangement typically known as a fronted program with ACE. Under this arrangement, the risk of loss up to the first $5.0 million per claim is retained by BBSI through an indemnity agreement, although ACE will be responsible for any claims BBSI is unable to satisfy. In addition, ACE continues to be BBSIs carrier for costs in excess of $5.0 million per claim. During 2014, we transitioned all California-based clients and their employees to ACE policies prior to December 31, 2014 in compliance with SB 863. During 2015, we expect to incur increased costs associated with the fronted insurance program, as 2015 will represent the first full year of complete coverage.

Workers Compensation Claims Experience and Reserves

We recognize our liability for the ultimate payment of incurred claims and claims adjustment expenses by accruing liabilities which represent estimates of future amounts necessary to pay claims and related expenses with respect to covered events that have occurred. When a claim involving a probable loss is reported, our internal claims management personnel or our TPA establishes a case reserve for the estimated amount of ultimate loss. The estimate reflects an informed judgment based on established case reserving practices

- 8 -

Table of Contents

and the experience and knowledge of our claims management staff and the TPA regarding the nature and expected amount of the claim, as well as the estimated expenses of settling the claim, including legal and other fees and expenses of claims administration. The adequacy of such case reserves in part depends on the professional judgment of both our claims management staff and our TPA to properly and comprehensively evaluate the economic consequences of each claim. Our reserves include an additional component for both estimated future adverse loss development in excess of initial case reserves on open claims and for incurred but not reported claims (together IBNR) based upon actuarial estimates provided by the Companys independent actuary. Our reserves do not include an estimated provision for the incidence of unknown or unreported catastrophic claims.

As part of the case reserving process, historical data is reviewed and consideration is given to the anticipated effect of various factors, including known and anticipated legal developments, inflation and economic conditions. Reserve amounts are based on managements estimates, and as other data becomes available, these estimates are revised, which may result in increases or decreases in existing case reserves. Managements internal accrual process for workers compensation expense is based upon the immediate recognition of an expense and the related liability at the time a claim occurs; the value ascribed to the expense and liability is based upon our internal claims management and the TPAs estimate of ultimate claim cost coupled with a provision for estimated future development based upon an actuarial review performed by our independent actuary. We believe our total accrued workers compensation claims liabilities at December 31, 2014 are adequate. It is possible, however, that our actual future workers compensation obligations may exceed the amount of our accrued liabilities, with a corresponding negative effect on future earnings, due to such factors as unanticipated adverse loss development of known claims and, to a much lesser extent, of claims incurred but not reported.

Failure to successfully manage the severity and frequency of workplace injuries would result in increased workers compensation expense and would have a negative effect, which may be substantial, on our operating results and financial condition. BBSI maintains clear guidelines for our area managers and risk management consultants, directly tying their continued employment to their diligence in understanding and addressing the risks of accident or injury associated with the industries in which client companies operate and in monitoring clients compliance with workplace safety requirements. We have a policy of zero tolerance for avoidable workplace injuries. Each of our risk management consultants has the authority to cancel any client at any time based upon their assessment of their safe-work practices or philosophies.

Employees and Employee Benefits

At December 31, 2014, we had approximately 93,040 total employees, including approximately 10,280 staffing services employees, approximately 82,400 employees under our client service agreements, 515 managerial, sales and administrative employees, and 4 executive officers. The number of employees at any given time may vary significantly due to business conditions at customer or client companies. Substantially all of our managerial, sales and administrative employees have entered into a standard form of employment agreement which, among other provisions, contains covenants not to engage in certain activities in competition with us for 18 months following termination of employment and to maintain the confidentiality of certain proprietary information. We believe our employee relations are good.

- 9 -

Table of Contents

We offer various qualified employee benefit plans to our employees, including those employees for whom we are the administrative employer in a co-employment agreement who so elect. These qualified employee benefit plans include our 401(k) plan to which employees may begin making contributions upon reaching 21 years of age and completing 1,000 hours of service in any consecutive 12-month period. We may also make contributions to the 401(k) plan, which vest over six years and are subject to certain legal limits, at the sole discretion of our Board of Directors.

We make matching contributions to the 401(k) plan under a safe harbor provision, whereby we match 100% of contributions by management and staffing employees to the 401(k) plan up to 3% of each participating employees annual compensation and 50% of the employees contributions up to an additional 2% of annual compensation. We also offer a cafeteria plan under Section 125 of the Internal Revenue Code; and group health, life insurance and disability insurance plans. Generally, qualified employee benefit plans are subject to provisions of both the Internal Revenue Code and the Employee Retirement Income Security Act of 1974 (ERISA). In order to qualify for favorable tax treatment under the Internal Revenue Code, qualified plans must be established and maintained by an employer for the exclusive benefit of its employees.

Regulatory and Legislative Issues

Business Operations. We are subject to the laws and regulations of the jurisdictions within which we operate, including those governing self-insured employers under the workers compensation systems in Oregon, Maryland, Delaware and Colorado, as well as in Washington for staffing and management employees. As a result of legislation in California related to our self-insurance program, we transitioned out of self-insurance in California during 2014 into an insured program with ACE. During the fourth quarter of 2014, the Company received confirmation from the Office of Self Insured Plans that BBSI was in full compliance with all regulatory collateral requirements for California self-insurance. See Workers Compensation-Changes in Self-Insurance in California above. We are also subject to laws and regulations governing our two wholly owned, fully licensed insurance companies in Arizona. While the specific laws and regulations vary among these jurisdictions, they typically require some form of licensing and often have statutory requirements for workplace safety and notice of change in obligation of workers compensation coverage in the event of contract termination. Although compliance with these requirements imposes some additional financial risk on us, particularly with respect to those clients who breach their payment obligation to us, such compliance has not had a material adverse effect on our business to date.

Employee Benefit Plans. Our operations are affected by numerous federal and state laws relating to labor, tax and employment matters. Through our client services agreement, we assume certain obligations and responsibilities as the administrative employer under federal and state laws. Because many of these federal and state laws were enacted prior to the development of nontraditional employment relationships, such as professional employer, temporary employment, and outsourcing arrangements, many of these laws do not specifically address the obligations and responsibilities of nontraditional employers. In addition, the definition of employer under these laws is not uniform.

- 10 -

Table of Contents

As an employer, we are subject to all federal statutes and regulations governing our employer-employee relationships. Subject to the discussion of risk factors below, we believe that our operations are in compliance in all material respects with applicable federal statutes and regulations.

Additional Information

Our filings with the SEC, including our annual report on Form 10-K, quarterly reports on Form 10-Q, periodic reports on Form 8-K and amendments to these reports, are accessible free of charge at our website at http://www.barrettbusiness.com as soon as reasonably practicable after filing with the SEC. By making this reference to our website, we do not intend to incorporate into this report any information contained in the website. The website should not be considered part of this report.

The SEC maintains a website at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers with publicly traded securities, including the Company.

| Item 1A. | RISK FACTORS |

In addition to other information contained in this report, the following risk factors should be considered carefully in evaluating our business.

Our workers compensation loss reserves may be inadequate to cover our ultimate liability for workers compensation costs.

We maintain reserves (recorded as accrued liabilities on our balance sheet) to cover our estimated liabilities for our workers compensation claims under our insurance arrangement with ACE in California, our self-insured status in Oregon, Delaware, Maryland and Colorado and our captive insurance subsidiary Ecole in Arizona. The determination of these reserves is based upon a number of factors, including current and historical claims activity, claims payment patterns and medical cost trends and developments in existing claims. Accordingly, reserves do not represent an exact calculation of liability. Reserves may be affected by both internal and external events, such as adverse developments on existing claims or changes in medical costs, medical condition of the claimant, claims handling procedures, administrative costs and legal fees, inflation, and legal trends and legislative changes. Reserves are adjusted from time to time to reflect new claims, claim developments, or systemic changes, and such adjustments are reflected in the results of the periods in which the reserves are changed Our revenues include an additional component for both estimated future adverse loss development in excess of initial case reserves on open claims and for incurred but not reported claims based upon actuarial estimates provided by the Companys independent actuary The estimated accrual does not include an estimated provision for the incidence of unknown catastrophic claims. Moreover, because of the uncertainties that surround estimating workers compensation loss reserves, we cannot be certain that our reserves are adequate. If our reserves are insufficient to cover our actual losses, we would have to increase our reserves and incur charges to our earnings that could be material to our results of operations and financial condition. See Item 1. Business Workers Compensation above for additional information.

- 11 -

Table of Contents

Our retention for workers compensation claims is $5.0 million per occurrence under our insurance arrangement with ACE in California as well as in the majority of our self-insured states.

In view of the Companys favorable historical experience with large catastrophic claims and an opportunity to realize savings from lower excess workers compensation insurance premiums, we maintain our retention at $5.0 million per occurrence, except in Colorado and Maryland where our retention is at $2.0 million and $1.0 million per occurrence, respectively. Additionally, Ecoles retention is at $5.0 million per occurrence for coverage in Arizona. Thus, the Company has financial risk for most workers compensation claims under $5.0 million, on a per occurrence basis. This level of per occurrence retention may result in higher workers compensation costs to us with a corresponding negative effect on our operating results and financial condition.

Adverse developments in the market for excess workers compensation insurance could lead to increases in our costs.

We are a state-approved self-insured employer for workers compensation coverage in Oregon, Delaware, Maryland and Colorado, as well as in Washington for our staffing and management employees. To manage our financial exposure in the event of catastrophic injuries or fatalities, we maintain excess workers compensation insurance with a per occurrence retention of $5.0 million effective January 1, 2007, except in Colorado and Maryland where our retention is at $2.0 million and $1.0 million per occurrence, respectively. Additionally, Ecoles retention is at $5.0 million per occurrence for coverage in Arizona. Changes in the market for excess workers compensation insurance may lead to limited availability of such coverage, additional increases in our insurance costs or further increases in our self-insured retention, any of which may have a material adverse effect on our financial condition.

Our ability to continue our business operations in California is dependent on maintaining workers compensation insurance coverage.

We recently renewed our workers compensation insurance arrangement with ACE for our employees in California. The annual renewal extends through February 1, 2016, with the possibility of additional annual renewals. If ACE is unwilling or unable to renew our arrangement in the future, we would need to seek alternative coverage. If replacement coverage were unavailable or available only on significantly less favorable terms, our business and results of operations would be materially adversely affected.

Our business is subject to risks associated with geographic market concentration.

Our California operations accounted for approximately 77% of our total net revenues in 2014. As a result of the current importance of our California operations and anticipated continued growth from these operations, our profitability over the next several years is expected to be largely dependent on economic and regulatory conditions in California. If California experiences an economic downturn, or if the regulatory environment changes in a way that adversely affects our ability to do business or limits our competitive advantages, our profitability and growth prospects may be materially and adversely affected.

- 12 -

Table of Contents

Economic conditions, particularly in California, may impact our ability to attract new clients and cause our existing clients to reduce staffing levels or cease operations.

Weak economic conditions typically have a negative impact on small-and mid-sized businesses, which make up the majority of our clients. In turn, these businesses could cut costs, including trimming employees from their payrolls, or ceasing operations altogether. These forces may result in decreased revenues due both to the downsizing of our current clients and difficulties in attracting new clients, and may also result in additional bad debt expense to the extent that existing clients cease operations.

We may be unable to draw on our revolving credit facility in the future.

As discussed in more detail in Note 7 to the audited consolidated financial statements included in Item 15 of this Report, we maintain a credit agreement (the Agreement) with our principal bank, Wells Fargo Bank, National Association (the Bank). The Agreement, which expires October 1, 2017, provides for a revolving credit facility with a borrowing capacity of up to $14.0 million at December 31, 2014, to be used to finance working capital; there was no outstanding balance at that date. The Agreement also provides a term loan in the principal amount of $40.0 million maturing December 31, 2016, which we used to fund our workers compensation insurance reserves at December 31, 2014, as well as a standby letter of credit agreement providing for a total of approximately $114.0 million in cash-secured letters of credit and a term loan with a balance of approximately $5.1 million secured by our company office building in Vancouver, Washington.

If our business does not perform as expected, including if we generate less revenue than anticipated from our operations or encounter significant unexpected costs, we may fail to comply with the financial covenants under our credit facilities. If we do not comply with our financial covenants and we do not obtain a waiver or amendment from the Bank, the Bank may elect to cause all amounts owed to become immediately due and payable. In this event, we would seek to establish a replacement credit facility with one or more other lenders, including lenders with which we have an existing relationship, potentially at less desirable terms. There can be no guarantee that replacement financing would be available at commercially reasonable terms, if at all. Any of these risks and uncertainties could have a material adverse effect on our business, financial position, results of operations, and working capital.

If we are unable to maintain our brand image and corporate reputation, our business may suffer.

Our success depends in part on our ability to maintain our reputation for providing excellent service to our customers. Service quality issues, actual or perceived, even when false or unfounded, could tarnish the image of our brand and may cause customers to use other companies. Also, adverse publicity surrounding labor relations, data breaches, securities class actions, and the like, or attempts to connect our Company to these types of issues, could negatively affect our overall reputation. Damage to our reputation could reduce demand for our services and thus have an adverse effect on our business, financial position and results of operations.

- 13 -

Table of Contents

Our staffing business is vulnerable to economic fluctuations.

Demand for our staffing services is sensitive to changes in the level of economic activity in the regions in which we do business. As economic activity slows down, companies often reduce their use of temporary employees before undertaking layoffs of permanent staff, resulting in decreased demand for staffing services. During strong economic periods, on the other hand, we often experience shortages of qualified employees to meet customer needs.

Because we assume the obligation to make wage, tax and regulatory payments in respect of some employees, we are exposed to client credit risks.

We generally assume responsibility for and manage the risks associated with our clients employee payroll obligations, including liability for payment of salaries and wages (including payroll taxes), as well as group health and retirement benefits. These obligations are fixed, whether or not the client makes payments to us as required by our services agreement, which exposes us to credit risks. We attempt to mitigate this risk by invoicing our clients at the end of their specific payroll processing cycle. We also carefully monitor the timeliness of our clients payments and impose strict credit standards on our customers. If we fail to successfully manage our credit risk, our results of operations and financial condition could be materially and adversely affected.

Increases in unemployment claims could raise our state and federal unemployment tax rates which we may not be able to pass on to our customers.

During weak economic conditions in our markets, the level of unemployment claims tend to rise as a result of employee layoffs at our clients and lack of work in our temporary staffing pool. The rise in unemployment claims often results in higher state and federal unemployment tax rates which in most instances cannot be concurrently passed on to our customers either due to existing client services agreements or competitive pricing pressures. Increases in our state and federal unemployment tax rates could have a material adverse effect on our results of operations, particularly in the early part of the calendar year when effective payroll tax rates are at or near their maximum.

If we are determined not to be an employer under certain laws and regulations, our clients may stop using our services, and we may be subject to additional liabilities.

We are the administrative employer in our co-employment relationships under the various laws and regulations of the Internal Revenue Service and the U.S. Department of Labor. If we are determined not to be the administrative employer under such laws and regulations and are therefore unable to assume our clients obligations for employment and other taxes, our clients may be held jointly and severally liable for payment of such taxes. Some clients or prospective clients may view such potential liability as an unacceptable risk, discouraging current clients from continuing a relationship with us or prospective clients from entering into a new relationship with us. Any determination that we are not the administrative employer for purposes of ERISA could adversely affect our cafeteria benefits plan operated under Section 125 of the Internal Revenue Code and result in liabilities to us under the plan.

- 14 -

Table of Contents

We may be exposed to employment-related claims and costs and periodic litigation that could adversely affect our business and results of operations.

We either co-employ employees in connection with our client services agreements or place our employees in our customers workplace in connection with our staffing business. As such, we are subject to a number of risks inherent to our status as the administrative employer, including without limitation:

| | claims of misconduct or negligence on the part of our employees, discrimination or harassment claims against our employees, or claims by our employees of discrimination or harassment by our clients; |

| | immigration-related claims; |

| | claims relating to violations of wage, hour and other workplace regulations; |

| | claims relating to employee benefits, entitlements to employee benefits, or errors in the calculation or administration of such benefits; and |

| | possible claims relating to misuse of customer confidential information, misappropriation of assets or other similar claims. |

If we experience significant incidents involving any of the above-described risk areas we could face substantial out-of-pocket losses, fines or negative publicity. In addition, such claims may give rise to litigation, which may be time consuming, distracting and costly, and could have a material adverse effect on our business. With respect to claims involving our co-employer relationships, although our client services agreement provides that the client will indemnify us for any liability attributable to the conduct of the client or its employees, we may not be able to enforce such contractual indemnification, or the client may not have sufficient assets to satisfy its obligations to us.

We are dependent upon technology services and if we experience damage, service interruptions or failures in our computer and telecommunications systems, our client relationships and our ability to attract new clients may be adversely affected.

We rely extensively on our computer systems to manage our branch network, perform employment-related services, accounting and reporting, and summarize and analyze our financial results. Our systems are subject to damage or interruption from telecommunications failures, power-related outages, computer viruses and malicious attacks, security breaches and catastrophic events. If our systems are damaged or fail to function properly, we may incur substantial costs to repair or replace them, experience loss of critical data and interruptions or delays in our ability to manage our operations, and encounter a loss of client confidence. In addition, our clients businesses may be adversely affected by any system or equipment failure or breach we experience. As a result, our relationships with our clients may be impaired, we may lose clients, our ability to attract new clients may be adversely affected and we could be exposed to contractual liability. We may invest in upgrades or replacements to our existing systems or additional security measures, each of which can involve substantial costs and risks relating to installation and implementation.

- 15 -

Table of Contents

If our efforts to protect the security of personal information about our employees and clients are unsuccessful, we could be subject to costly government enforcement actions and private litigation and our reputation could suffer.

The nature of our business involves the receipt, storage, and transmission of personal and proprietary information about thousands of employees and some clients. If we experience a significant data security breach or fail to detect and appropriately respond to a significant data security breach, we could be exposed to government enforcement actions and private litigation. In addition, our employees and clients could lose confidence in our ability to protect their personal and proprietary information, which could cause them to terminate their relationships with us. Any loss of confidence arising from a significant data security breach could hurt our reputation, further damaging our business.

We operate in a complex regulatory environment, and failure to comply with applicable laws and regulations could adversely affect our business.

Corporate human resource operations are subject to a broad range of complex and evolving laws and regulations, including those applicable to payroll practices, benefits administration, employment practices and privacy. Because our clients have employees in many states throughout the United States, we must perform our services in compliance with the legal and regulatory requirements of multiple jurisdictions. Some of these laws and regulations may be difficult to ascertain or interpret and may change from time to time. Violation of such laws and regulations could subject us to fines and penalties, damage our reputation, constitute a breach of our client agreements, impair our ability to obtain and renew required licenses, and decrease our profitability or competitiveness. If any of these effects were to occur, our operating results and financial condition could be adversely affected.

Changes in government regulations may result in restrictions or prohibitions applicable to the provision of employment services or the imposition of additional licensing, regulatory or tax requirements.

Our business is heavily regulated in most jurisdictions in which we operate. We cannot assure you that the states in which we conduct or seek to conduct business will not:

| | impose additional regulations that prohibit or restrict employment-related businesses like ours; |

| | require additional licensing or add restrictions on existing licenses to provide employment-related services; or |

| | increase taxes or make changes in the way in which taxes are calculated for providers of employment-related services. |

Any changes in applicable laws and regulations may make it more difficult or expensive for us to do business, inhibit expansion of our business, or result in additional expenses that limit our profitability or decrease our ability to attract and retain clients.

- 16 -

Table of Contents

The tax status of our insurance subsidiaries could be challenged resulting in an acceleration of income tax payments.

In conjunction with our workers compensation program, we operate two wholly owned insurance subsidiaries, AICE and Ecole. We treat the two subsidiaries as insurance companies for federal income tax purposes, with respect to our consolidated federal income tax return. In the event the Internal Revenue Service (IRS) were to determine that the subsidiaries do not qualify as insurance companies, we could be required to make accelerated income tax payments to the IRS that we otherwise would have deferred until future periods.

We may find it difficult to expand our business into additional states due to varying state regulatory requirements.

Future growth in our operations depends, in part, on our ability to offer our services to prospective clients in new states, which may subject us to different regulatory requirements and standards. In order to operate effectively in a new state, we must obtain all necessary regulatory approvals, adapt our procedures to that states regulatory requirements and modify our service offerings to adapt to local market conditions. In the event that we expand into additional states, we may not be able to duplicate in other markets the financial performance experienced in our current markets.

Acquisitions subject us to various risks, including risks relating to selection and pricing of acquisition targets, integration of acquired companies into our business and assumption of unanticipated liabilities.

We have completed 27 acquisitions since 1993 and may pursue additional acquisitions and investment opportunities. We cannot assure, however, that we will be able to identify or complete additional acquisitions. If we do pursue acquisitions, we may not realize the anticipated benefits of such acquisitions. Acquisitions involve many risks, including risks relating to the assumption of unforeseen liabilities of an acquired business, adverse accounting charges resulting from the acquisition, and difficulties in integrating acquired companies into our business, both from a cultural perspective, as well as with respect to personnel and client retention and technological integration. Acquired liabilities may be significant and may adversely affect our financial condition and results of operations. Our inability to successfully integrate acquired businesses may lead to increased costs, failure to generate expected returns, accounting charges, or even a total loss of amounts invested, any of which could have a material adverse effect on our financial condition and results of operations.

We face competition from a number of other companies.

We face competition from various companies that may provide all or some of the services we offer. Our competitors include companies that are engaged in staffing services such as Kelly Services, Inc. and Manpower Inc., companies that are focused on co-employment, such as Insperity, Inc. and companies that primarily provide payroll processing services, such as Automatic Data Processing, Inc. and Paychex, Inc. We also face competition from information technology outsourcing firms and broad-based outsourcing and consulting firms that perform individual projects.

- 17 -

Table of Contents

Several of our existing or potential competitors have substantially greater financial, technical and marketing resources than we do, which may enable them to:

| | develop and expand their infrastructure and service offerings more quickly and achieve greater cost efficiencies; |

| | invest in new technologies; |

| | expand operations into new markets more rapidly; |

| | devote greater resources to marketing; |

| | compete for acquisitions more effectively and complete acquisitions more easily; and |

| | aggressively price products and services and increase benefits in ways that we may not be able to match financially. |

In order to compete effectively in our markets, we must target our potential clients carefully, continue to improve our efficiencies and the scope and quality of our services, and rely on our service quality, innovation, education and program clarity. If our competitive advantages are not compelling or sustainable, then we are unlikely to increase or sustain profits and our stock price could decline.

We are dependent upon certain key personnel and recruitment and retention of key employees may be difficult and expensive.

We believe that the successful operation of our business is dependent upon our retention of the services of key personnel, including our Chief Executive Officer, other executive officers and area managers. We may not be able to retain all of our executives, senior managers and key personnel in light of competition for their services. If we lose the services of one of our executive officers or a significant number of our senior managers, our operations and profitability likely would be adversely affected.

We do not have an expansive in-house sales staff and therefore rely extensively on referral partners.

We maintain a minimal internal professional sales force and we rely heavily on referral partners to provide referrals to new business, especially in California, although each area manager is expected to be an effective leader in business development, including marketing efforts and sales closures. In connection with these arrangements, we pay a fee to referral partners for new clients. As a result, we are dependent on firms and individuals that do not have an exclusive relationship with us. If we are unable to maintain these relationships, or if they increase their fees or lose confidence in our services, we could face declines in our business and additional costs and uncertainties as we attempt to hire and train an internal sales force.

We depend on attracting and retaining qualified employees; during periods of economic growth, our costs to do so increase and it becomes more difficult to attract and retain people.

The success of our staffing services depends on our ability to attract and retain qualified employees for placement with our customers. Our ability to attract and retain

- 18 -

Table of Contents

qualified personnel could be impaired by rapid improvement in economic conditions resulting in lower unemployment and increases in compensation. During periods of economic growth, we face growing competition for retaining and recruiting qualified personnel, which in turn leads to greater advertising and recruiting costs and increased salary expenses. If we cannot attract and retain qualified employees, the quality of our services may deteriorate and our reputation and results of operations could be adversely affected.

Our service agreements may be terminated on short notice, leaving us vulnerable to loss of a significant amount of customers in a short period of time, if business or regulatory conditions change or events occur that negatively affect our reputation.

Our client services agreements are generally terminable on 30 days notice by either us or the client. As a result, our clients may terminate their agreement with us at any time, making us particularly vulnerable to changing business or regulatory conditions or changes affecting our reputation or the reputation of our industry.

Our industry has at times received negative publicity that, if it were to become more prevalent, could cause our business to decline.

In the industries in which we compete, companies periodically have been tarnished by negative publicity or scandals from poor business judgment or even outright fraud. If we or our industry face negative publicity, customers confidence in the use of temporary personnel or co-employed workers may deteriorate, and they may be unwilling to enter into or continue our staffing or co-employment relationships. If a negative perception were to prevail, it would be more difficult for us to attract and retain customers.

Changes in state unemployment tax laws and regulations could adversely affect our business.

In past years, there has been significant negative publicity relating to the use of staffing or PEO companies to shield employers from poor unemployment history and high unemployment taxes. New legislation enacted at the state or federal level to try to counter this perceived problem could have a material adverse effect on our business by limiting our ability to market our services or making our services less attractive to our customers and potential customers.

We are, and in the future may be, subject to legal or administrative actions that could adversely affect our results of operations and our business.

As described in more detail in Item 3 of this Report and in Note 13 to our audited consolidated financial statements included in Item 15 of this Report, three lawsuits purporting to be class actions brought on behalf of all of BBSIs stockholders have been filed in the United States District Court for the Western District of Washington against BBSI and BBSIs Chief Executive Officer and Chief Financial Officer. The actions allege violations of the federal securities laws based on claims arising from the decline in the market price for our common stock following announcement of a charge for increased workers compensation reserves expense in the 2014 third quarter. In addition, in February 2015, we received a letter from counsel from a stockholder threatening to commence a shareholder derivative action on

- 19 -

Table of Contents

behalf of the Company based on the same facts as the three lawsuits already filed, as well as that certain officers and directors sold shares of BBSI common stock while in possession of material non-public information.

The results of legal proceedings against us, including those described above, if decided adversely to us or to our directors or officers, could result in significant monetary damages or penalties or reputational harm, and could involve significant defense or other costs. We have entered into indemnification agreements with each of our directors and our corporate charter requires us to indemnify each of our officers and directors against all liabilities, losses, judgments, penalties, fines, settlements and reasonable expenses arising out of their actions in such capacities to the fullest extent permitted by Maryland law. Although we maintain insurance coverage in amounts and with deductibles that we believe are appropriate for our operations, our insurance coverage may not cover all claims that have been or may be brought against us, or continue to be available to us at a reasonable cost. As a result, we may be exposed to substantial uninsured liabilities, including pursuant to our indemnification obligations, which could adversely affect our business, prospects, results of operations and financial condition.

Maryland law and our Charter and bylaws contain provisions that could make the takeover of the Company more difficult.

Certain provisions of Maryland law and our Charter and bylaws could have the effect of delaying or preventing a third party from acquiring the Company, even if a change in control would be beneficial to our stockholders. These provisions of our Charter and bylaws:

| | permit the Board of Directors to issue up to 500,000 shares of preferred stock with such rights and preferences, including voting rights, as the Board may establish, without further approval by the Companys stockholders, which could also adversely affect the voting power of holders of our common stock; and |

| | vest the power to adopt, alter or repeal the Companys bylaws solely in the Board of Directors; the stockholders do not have that power. |

In addition, the Company is subject to the Maryland control share act (the Control Share Act). Under the Control Share Act, a person (an Acquiring Person) who acquires voting stock in a transaction (a Control Share Acquisition) which results in its holding voting power within specified ranges cannot vote the shares it acquires in the Control Share Acquisition unless voting rights are accorded to such control shares by the holders of two-thirds of the outstanding voting shares, excluding the Acquiring Person and the Companys officers and directors who are also employees of the Company.

The Company is also subject to the provisions of Maryland law limiting the ability of certain Maryland corporations to engage in specified business combinations (the Business Combination Act). Subject to certain exceptions, the Business Combination Act prohibits a Maryland corporation from engaging in a business combination with a stockholder who, with its affiliates, owns 10% or more of the corporations voting stock. These provisions will not apply to business combinations that are approved by the Board of Directors before the stockholder became an interested stockholder.

- 20 -

Table of Contents

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

| Item 2. | PROPERTIES |

We operate through all 54 of our branch offices. The following table shows the number of locations in each state in which we operate. We also lease office space in other locations in our market areas which we use to recruit and place employees.

| Offices |

Number of Branch Locations |

|||

| California |

20 | |||

| Oregon |

11 | |||

| Utah |

5 | |||

| Washington |

5 | |||

| Idaho |

3 | |||

| Arizona |

2 | |||

| Colorado |

2 | |||

| Maryland |

2 | |||

| North Carolina |

2 | |||

| Delaware |

1 | |||

| Nevada |

1 | |||

We lease office space for our branch offices. At December 31, 2014, our leases had expiration dates ranging from less than one year to six years, with total minimum payments through 2020 of approximately $10.7 million. Our corporate headquarters office in Vancouver, Washington occupies approximately 40 percent of the 63,500 square foot building we own.

| Item 3. | LEGAL PROCEEDINGS |

On November 6, 2014, plaintiffs in Michael Arciaga, et al. v. Barrett Business Services, Inc., et al., filed an action in the United States District Court for the Western District of Washington against BBSI and Michael L. Elich and James D. Miller, BBSIs Chief Executive Officer and Chief Financial Officer, respectively. The action purports to be a class action brought on behalf of all of BBSIs stockholders alleging violations of the federal securities laws. The claims arise from the decline in the market price for BBSI common stock following announcement of a charge for increased workers compensation reserves expense. The lawsuit seeks compensatory damages (in an amount to be determined at trial), plus interest, and costs and expenses (including attorney fees and expert fees).

On November 13, 2014, a second purported shareholder class action was filed in the United States District Court for the Western District of Washington, entitled Christopher P. Carnes, et al. v. Barrett Business Services, Inc., et al. The Carnes complaint names the same defendants as the Arciaga case and asserts similar claims for relief.

Similarly, on November 17, 2014, a third purported shareholder class action was filed in the United States District Court for the Western District of Washington, entitled Shiva Stein, et al. v. Barrett Business Services, Inc., et al. The Stein complaint names the same defendants as the Arciaga and Carnes cases and asserts similar claims for relief.

- 21 -

Table of Contents

On February 25, 2015, the court ordered consolidation of the three cases, and any new or other cases involving the same subject matter, into a single action for pretrial purposes. The court also appointed the Painters & Allied Trades District Council No. 35 Pension and Annuity Funds as the lead plaintiff. Discovery has not been undertaken as it is automatically stayed under the federal Private Securities Litigation Reform Act.

On February 27, 2015, BBSI received a letter from counsel for an alleged stockholder accusing each of the Companys directors and officers with having breached his fiduciary duties of loyalty and good faith based on the same facts as those alleged in the three lawsuits described above, as well as that certain officers and directors sold shares of BBSI common stock while in possession of material non-public information. The letter asserts that the Company has sustained and continues to sustain damages, including the costs and expenses incurred in connection with the Companys reserve strengthening process, reserve study and consultants, the cost of stock repurchases in October 2014, compensation paid to the Companys officers, and costs of negotiating the Companys credit facility with its principal lender. The letter demands that BBSIs Board of Directors take action against each of the Companys officers and directors to recover these damages and the proceeds of sales of stock by the officers and directors during 2013 and 2014. The letter states that if the Board does not take these actions within a reasonable period, the stockholder will commence a shareholder derivative action on behalf of the Company

We intend to vigorously defend against the foregoing actions. We have not recorded any liabilities with respect to the claims in our audited consolidated financial statements included in Item 15 of this report. We believe that the claims are covered under our directors and officers liability insurance, and we have notified our insurance carriers of the claims. The insurers have responded by requesting additional information and by reserving their rights under the policies, including the right to deny coverage under various policy exclusions. Subject to their reservation of rights and the satisfaction of applicable deductibles, we expect to be reimbursed for substantially all legal fees relating to our defense of the claims.

| Item 4. | MINE SAFETY DISCLOSURES |

Not Applicable

EXECUTIVE OFFICERS OF THE REGISTRANT

The following table identifies, as of March 16, 2015, each executive officer of the Company. Executive officers are elected annually and serve at the discretion of the Board of Directors.

| Name |

Age |

Principal Positions and Business Experience |

Officer Since |

|||||||

| Michael L. Elich |

49 | President and Chief Executive Officer | 2005 | |||||||

| James D. Miller |

51 | Vice President-Finance, Treasurer and Secretary; Chief Financial Officer; Principal Accounting Officer | 1994 | |||||||

| Gregory R. Vaughn |

59 | Vice President and Assistant Secretary; Chief Operating Officer Corporate Operations |

1998 | |||||||

| Gerald R. Blotz |

45 | Vice President, Chief Operating Officer Field Operations | 2014 | |||||||

- 22 -

Table of Contents

Michael L. Elich joined the Company in October 2001 as Director of Business Development. He was appointed Vice President and Chief Operating Officer in May 2005. He was appointed interim President and Chief Executive Officer in January 2011 upon the death of William W. Sherertz. Effective February 17, 2011, Mr. Elich was elected to serve on the Board of Directors and was made President and Chief Executive Officer. From 1995 to 2001, Mr. Elich served as Executive Vice President and Chief Operating Officer of Skills Resource Training Center, a staffing services company with offices in Oregon, Washington and Idaho that we acquired in 2004.

James D. Miller joined the Company in January 1994 as Controller. He was promoted to Vice President-Finance, Treasurer and Secretary, and Chief Financial Officer in June 2008. From 1991 to 1994, he was the Corporate Accounting Manager for Christensen Motor Yacht Corporation. Mr. Miller, a certified public accountant on inactive status, was employed by Price Waterhouse LLP, now known as PricewaterhouseCoopers LLP, from 1987 to 1991.

Gregory R. Vaughn joined the Company in July 1997 as Operations Manager. Mr. Vaughn was appointed Vice President in January 1998 and Chief Administrative Officer in February 2012. He was promoted to Chief Operating Officer-Corporate Operations in May 2014. Prior to joining Barrett, Mr. Vaughn was Chief Executive Officer of Insource America, Inc., a privately-held human resource management company headquartered in Portland, Oregon, for approximately one year. Mr. Vaughn has also held senior management positions with Sundial Time Systems, Inc., and Continental Information Systems, Inc. Previously, Mr. Vaughn was employed as a technology consultant by Price Waterhouse LLP, now known as PricewaterhouseCoopers LLP.

Gerald R. Blotz joined the Company in May 2002 as Area Manager of the San Jose branch office. Mr. Blotz was promoted to Vice President, Chief Operating Officer-Field Operations in May 2014. Prior to joining BBSI, Gerald was President and Chief Operating Officer of Protrades Connection, where he was instrumental in building Protrades to 44 offices in four states.

- 23 -

Table of Contents

PART II

| Item 5. | MARKET FOR REGISTRANTS COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock (the Common Stock) trades on the Global Select Market segment of The Nasdaq Stock Market under the symbol BBSI. At March 2, 2015, there were 23 stockholders of record and approximately 1,550 beneficial owners of the Common Stock.

The following table presents the high and low sales prices of the Common Stock and cash dividends paid for each quarterly period during the last two fiscal years, as reported by The Nasdaq Stock Market. The Companys debt covenants permit continuation of quarterly cash dividends up to $.0.22 per share so long as there is no default by the Company and payment would not cause a default. Any future determination as to the payment of dividends will be made at the discretion of the Board and will depend upon the Companys operating results, financial condition, capital requirements, general business conditions and such other factors as the Board deems relevant.

| High | Low | Cash Dividends Declared |

||||||||||

| 2013 |

||||||||||||

| First Quarter |

$ | 53.27 | $ | 38.15 | $ | 0.13 | ||||||

| Second Quarter |

62.82 | 48.50 | 0.13 | |||||||||

| Third Quarter |

73.49 | 48.08 | 0.13 | |||||||||

| Fourth Quarter |

98.00 | 66.33 | 0.18 | |||||||||

| 2014 |

||||||||||||

| First Quarter |

$ | 102.20 | $ | 57.82 | $ | 0.18 | ||||||

| Second Quarter |

63.19 | 41.96 | 0.18 | |||||||||

| Third Quarter |

63.45 | 39.47 | 0.18 | |||||||||

| Fourth Quarter |

45.38 | 18.25 | 0.22 | |||||||||

The Company maintains a Board approved stock repurchase program which currently authorizes shares to be repurchased up to 3.0 million shares of the Companys stock from time to time in open market purchases. The following table summarizes information related to stock repurchases during the quarter ended December 31, 2014.

| Month |

Shares Repurchased |

Average Price Per Share |

Total Number of Shares Repurchased as Part of Publicly Announced Plan |

Maximum Number of Shares that May Yet Be Repurchased Under the Plan |

||||||||||||

| October |

50,799 | $ | 39.88 | 1,878,987 | 1,121,013 | |||||||||||

| November |

0 | 0 | 0 | 1,121,013 | ||||||||||||

| December |

0 | 0 | 0 | 1,121,013 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total |

50,799 | 1,878,987 | ||||||||||||||

|

|

|

|

|

|||||||||||||

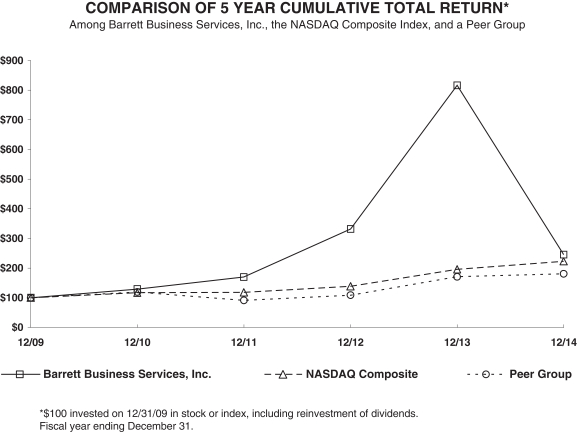

The following graph shows the cumulative total return at the dates indicated for the period from December 31, 2009, until December 31, 2014, for our Common Stock, The

- 24 -

Table of Contents

Nasdaq Composite Index, and a group of the Companys current peers in the staffing industry (the 2014 Peer Group). The 2014 Peer Group is comprised of five companies included in the peer group used to prepare the performance graph included in the Companys Form 10-K for the year ended December 31, 2014.